Pay New York State Taxes Online

For New York State residents and businesses, staying on top of tax obligations is an important aspect of financial responsibility and compliance with state regulations. One of the most convenient and efficient ways to manage your tax payments is through the state's online tax payment system. In this article, we will delve into the process of paying New York State taxes online, exploring the various options, benefits, and considerations to ensure a smooth and timely tax payment experience.

Understanding the Online Tax Payment System

The New York State Department of Taxation and Finance offers a user-friendly online platform that allows taxpayers to manage their tax obligations digitally. This system, accessible via the official website, provides a secure and efficient way to make tax payments, file returns, and access important tax-related information.

The online tax payment system is designed to cater to both individual taxpayers and businesses, offering tailored features and functionalities to meet diverse needs. Whether you are an individual filing your annual income tax return or a business managing sales tax obligations, the platform provides a centralized and convenient solution.

Benefits of Paying Taxes Online

Opting to pay your New York State taxes online offers several advantages that can streamline your financial management and enhance overall efficiency.

Convenience and Accessibility

The online tax payment system provides 24/7 accessibility, allowing you to manage your tax obligations from the comfort of your home or office. Whether it's filing your return or making a payment, you can access the platform at your convenience without the need for in-person visits to tax offices.

This accessibility extends to mobile devices as well, with the option to use the NYS Tax App for iOS and Android devices. The app provides a convenient way to stay on top of your tax responsibilities while on the go.

Real-Time Payment Confirmation

When paying taxes online, you receive immediate confirmation of your payment. This real-time feedback ensures that you can quickly verify the successful submission of your payment, providing peace of mind and eliminating the uncertainty often associated with traditional mail-in payments.

Secure and Encrypted Transactions

The online tax payment system utilizes advanced security measures to protect your personal and financial information. All transactions are encrypted, ensuring that your data remains confidential and secure during the payment process. This level of security is crucial for safeguarding your sensitive tax-related details.

Payment Flexibility and Options

The online platform offers a range of payment options to accommodate different financial circumstances. You can choose to pay your taxes in full or opt for installment plans, depending on your preferences and needs. This flexibility ensures that you can manage your tax obligations in a way that aligns with your financial situation.

Reduced Administrative Burden

By paying taxes online, you eliminate the need for manual paperwork and the associated administrative tasks. The online system automates various processes, reducing the time and effort required to manage your tax obligations. This streamlining of administrative tasks can free up valuable time for other financial planning and management activities.

Step-by-Step Guide to Paying Taxes Online

To assist you in navigating the online tax payment system, here is a detailed guide to help you through the process:

Step 1: Access the Online Platform

Begin by visiting the official New York State tax payment website. This is the secure portal where you will manage your tax obligations. Ensure you are using a secure internet connection to protect your data during the process.

Step 2: Register or Log In

If you are a first-time user, you will need to register an account. The registration process typically involves providing basic personal information and creating a secure password. Once registered, you can log in using your credentials for future tax-related activities.

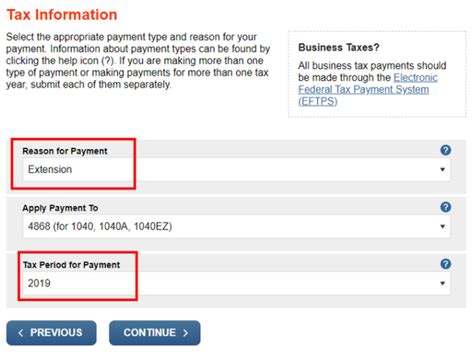

Step 3: Select Your Tax Type

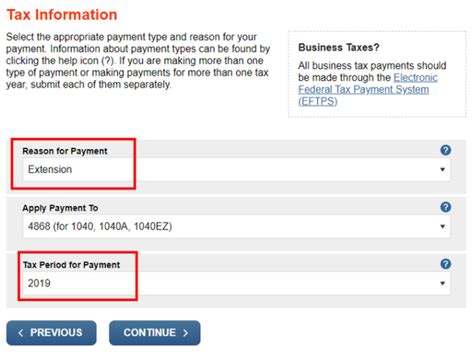

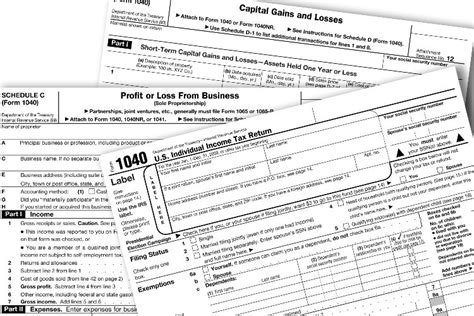

The online platform caters to various tax types, including income tax, sales tax, corporate tax, and more. Select the specific tax for which you are making a payment. This step ensures that your payment is directed to the correct tax category.

Step 4: Enter Taxpayer Information

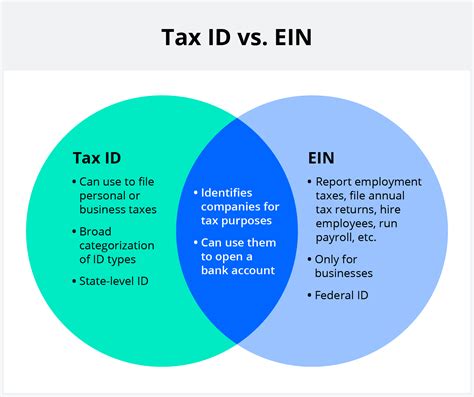

Provide the necessary taxpayer information, including your tax identification number (e.g., Social Security Number or Employer Identification Number), name, and other relevant details. Accurate information is crucial to ensure that your payment is properly attributed to your tax account.

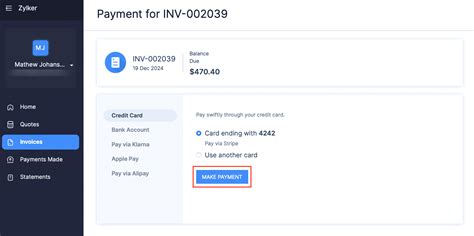

Step 5: Choose Your Payment Method

The online platform offers a range of payment options, including credit cards, debit cards, electronic checks (e-checks), and bank transfers. Select the method that best suits your financial preferences and capabilities. Each option has its own set of advantages and considerations, so choose the one that aligns with your needs.

| Payment Method | Description |

|---|---|

| Credit Card | Convenient and widely accepted, offering instant payment processing. May incur processing fees. |

| Debit Card | Directly deducts funds from your bank account, providing a secure and efficient payment method. |

| Electronic Check (e-check) | A secure and cost-effective option that draws funds directly from your bank account. Typically free of additional fees. |

| Bank Transfer | Allows for direct transfer of funds from your bank account to the tax authority. Offers convenience and security. |

Step 6: Review and Confirm Payment Details

Carefully review the payment details, including the tax type, amount, and payment method. Ensure that all information is accurate and reflects your intended payment. This step is crucial to prevent errors and ensure that your payment is processed correctly.

Step 7: Submit Payment

Once you have verified the payment details, proceed to submit your payment. The online system will guide you through the final steps, providing confirmation messages and, in some cases, transaction numbers for reference.

Step 8: Receive Payment Confirmation

After submitting your payment, you will receive immediate confirmation of the transaction. This confirmation typically includes a transaction ID or reference number, which you can use for future reference and verification. Keep this information for your records.

Step 9: Access Payment History

The online platform allows you to access your payment history, providing a record of all your tax payments made through the system. This feature is useful for tracking and managing your tax obligations over time, ensuring that you stay up to date with your payments.

Additional Considerations and Tips

To ensure a seamless experience when paying your New York State taxes online, consider the following tips and considerations:

1. Understand Payment Processing Times

Different payment methods may have varying processing times. For instance, credit card payments are typically processed instantly, while electronic checks and bank transfers may take a few business days to clear. Understanding these timelines can help you plan your payments accordingly.

2. Keep Records and Receipts

Maintain a record of all your tax payments, including the payment date, amount, and any transaction IDs or reference numbers. These records can be valuable for future reference and tax planning. Consider creating a dedicated folder or digital file to store your tax-related documents.

3. Stay Informed About Payment Deadlines

Be aware of the specific payment deadlines for your tax obligations. Late payments may incur penalties and interest, so it is crucial to stay informed and plan your payments accordingly. The online platform often provides reminders and notifications to help you stay on track.

4. Explore Payment Plans

If you anticipate difficulty paying your taxes in full, consider exploring the option of payment plans. New York State offers various payment plan options, including installment agreements and deferred payment arrangements. These plans can provide flexibility and help manage your tax obligations over time.

5. Utilize Online Resources and Support

The New York State Department of Taxation and Finance provides extensive online resources and support materials to assist taxpayers. These resources include detailed guides, FAQs, and contact information for further assistance. Take advantage of these resources to enhance your understanding of the online tax payment system and address any concerns you may have.

Conclusion

Paying your New York State taxes online offers a convenient, secure, and efficient way to manage your tax obligations. By utilizing the state's online tax payment system, you can streamline your financial management, access real-time payment confirmation, and explore various payment options to suit your needs. With the guidance provided in this article, you can navigate the process with confidence, ensuring timely and accurate tax payments.

Frequently Asked Questions

Can I pay my taxes online if I don’t have a credit card or bank account?

+Yes, you have alternative payment options available. The online tax payment system accepts electronic checks (e-checks), which allow you to make payments directly from your bank account without a credit or debit card. This method is secure and cost-effective, providing a convenient alternative for those without a credit card or bank account.

Are there any fees associated with online tax payments?

+The fees for online tax payments vary depending on the payment method you choose. Credit card payments may incur processing fees, while electronic checks and bank transfers are typically free of additional charges. It’s important to review the fee structure for each payment method before finalizing your payment to understand any potential costs.

Can I pay my taxes online if I’m not a resident of New York State?

+The online tax payment system is primarily designed for New York State residents and businesses with tax obligations in the state. However, if you have specific tax obligations in New York State, such as income tax for non-residents or sales tax for out-of-state businesses, you may be able to utilize the online system. It’s recommended to check the eligibility criteria and guidelines provided by the New York State Department of Taxation and Finance to determine if the online payment option is available for your specific situation.

How do I access my tax records and payment history online?

+To access your tax records and payment history, log in to your account on the New York State tax payment website. Once logged in, navigate to the “My Account” or “Taxpayer Services” section. Here, you will find options to view and download your tax records, including payment history, returns, and other relevant information. This feature provides a convenient way to keep track of your tax obligations and payments over time.

Is it safe to provide my personal and financial information online for tax payments?

+The online tax payment system employs advanced security measures to protect your personal and financial information. All data transmitted through the platform is encrypted, ensuring that your sensitive details remain confidential and secure. However, it’s important to use a secure internet connection and follow best practices for online security, such as using strong passwords and avoiding public Wi-Fi for sensitive transactions.