Is The Tax Id The Same As Ein

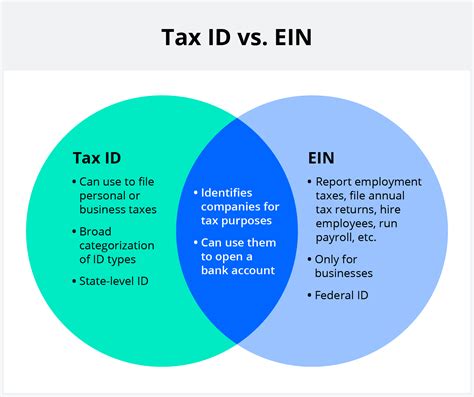

The Employer Identification Number (EIN) and the Taxpayer Identification Number (TIN) are two crucial concepts in the realm of business taxation and compliance, often used interchangeably, but they serve distinct purposes and have different applications. Understanding the differences and similarities between an EIN and a TIN is essential for business owners and accountants alike to ensure proper tax filing and legal compliance.

Unraveling the EIN: A Unique Business Identifier

An Employer Identification Number (EIN), often referred to as a Federal Tax Identification Number, is a unique nine-digit number assigned to businesses by the Internal Revenue Service (IRS) in the United States. Its primary purpose is to identify a business entity for tax purposes. An EIN is required for various reasons, primarily when a business needs to:

- File taxes for its employees.

- Open a business bank account.

- Apply for business licenses and permits.

- Establish a retirement plan for employees.

- Enter into certain business transactions.

An EIN is structured similarly to a Social Security Number (SSN), consisting of five digits, a dash, and four additional digits. However, it’s important to note that an EIN is not a SSN and is solely used for business identification.

EIN Eligibility and Application

Any business entity, including sole proprietorships, partnerships, corporations, and non-profit organizations, may be eligible for an EIN. The IRS offers a simple online application process for obtaining an EIN. The application typically requires information about the business owner, the business itself, and its operations. It’s important to keep the EIN secure and confidential, much like any other sensitive business information.

| EIN Application Considerations |

|---|

|

EIN vs. SSN for Business Tax Filing

When it comes to tax filing, the distinction between an EIN and an SSN becomes crucial. While an SSN is used for personal tax filing, an EIN is specifically designed for business tax purposes. For example, a sole proprietor who opts to use their SSN for tax filing might find it simpler to report their business income and expenses on their personal tax return using Schedule C. However, if the business grows and hires employees, an EIN becomes mandatory for payroll tax reporting.

The TIN: A Broader Taxpayer Identifier

A Taxpayer Identification Number (TIN) is a more comprehensive term that encompasses various types of identification numbers used by the IRS to track taxpayer information. The TIN includes several types of identifiers, such as:

- Social Security Number (SSN) - Issued by the Social Security Administration for personal tax filing.

- Individual Taxpayer Identification Number (ITIN) - Granted to individuals who are not eligible for an SSN but need to file U.S. tax returns.

- Employer Identification Number (EIN) - As discussed earlier, this is assigned to businesses for tax purposes.

- Adoption Taxpayer Identification Number (ATIN) - Temporary TIN assigned to children in the adoption process for tax-related purposes.

In essence, the TIN is an umbrella term that covers all forms of identification numbers used by the IRS to identify taxpayers, whether they are individuals or businesses.

Key Differences between EIN and TIN

While the EIN is a specific type of TIN assigned to businesses, the TIN encompasses a broader range of identification numbers. Here are some key distinctions:

- Scope: The EIN is solely for business identification, whereas the TIN covers identification numbers for both individuals and businesses.

- Usage: EINs are primarily used for business tax filing and reporting, while TINs have a wider application, including personal tax filing and various other tax-related purposes.

- Eligibility: Any business entity can apply for an EIN, but individuals may not need an EIN if they are sole proprietors and choose to use their SSN for tax filing.

FAQs: Unlocking Common EIN and TIN Queries

Can I use my Social Security Number instead of an EIN for my business taxes?

+Yes, as a sole proprietor, you have the option to use your Social Security Number (SSN) for tax filing purposes instead of an Employer Identification Number (EIN). However, if your business grows and you hire employees, an EIN becomes mandatory for payroll tax reporting.

Do I need a separate EIN for each business entity within my organization?

+Yes, in certain cases, multiple EINs may be required for different business entities within a single organization. For instance, if you have a parent company and several subsidiary companies, each may need its own EIN for tax and legal purposes.

How do I obtain an ITIN if I’m not eligible for an SSN but need to file U.S. tax returns?

+To obtain an Individual Taxpayer Identification Number (ITIN), you’ll need to complete and submit IRS Form W-7 along with supporting documentation to the IRS. The process typically involves providing proof of identity and foreign status, such as a valid passport or national ID card.

Is an EIN necessary for a sole proprietorship that doesn’t have employees or payroll taxes to report?

+No, a sole proprietorship that doesn’t have employees or payroll taxes to report may not require an EIN. In such cases, the owner can use their Social Security Number (SSN) for tax filing purposes. However, it’s advisable to consult with a tax professional to ensure compliance with specific circumstances.