Tax On Food In Virginia

In the state of Virginia, the tax landscape for food and beverages is an intricate system that plays a significant role in the state's economy and impacts the daily lives of its residents. Understanding the nuances of these taxes is essential for businesses and individuals alike. This comprehensive guide aims to unravel the complexities surrounding the tax on food in Virginia, providing a detailed analysis of the regulations, rates, and their implications.

The Virginia Tax Structure for Food and Beverages

Virginia employs a multi-faceted approach when it comes to taxing food and beverages. This involves a combination of state and local taxes, each with its own set of rules and rates. The primary tax levied on food in Virginia is the Meals Tax, which is a sales tax applied specifically to prepared food and beverages consumed on-site at restaurants, cafes, and similar establishments.

Meals Tax: An Overview

The Meals Tax in Virginia is a consumption tax, meaning it is charged to the end consumer. It is an additional percentage added to the total bill, which varies depending on the jurisdiction. This tax is not applicable to groceries or items purchased for off-site consumption, but it is crucial to note that it covers a wide range of food and beverage services, including:

- Restaurant meals

- Catering services

- Takeout food

- Prepared food from grocery stores

- Vending machine purchases

The Meals Tax is a significant source of revenue for local governments, with the proceeds often used to fund essential services and infrastructure projects within the community.

Tax Rates and Jurisdictional Differences

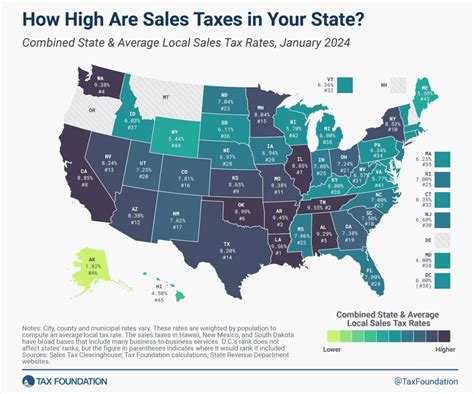

One of the most notable aspects of the Meals Tax in Virginia is its variability across the state. While the state itself does not impose a sales tax on food, local jurisdictions have the authority to implement their own rates. This means that the tax rate can differ significantly depending on the location, creating a complex landscape for businesses and consumers alike.

| Jurisdiction | Meals Tax Rate |

|---|---|

| Arlington County | 6% |

| City of Alexandria | 4% |

| City of Richmond | 6% |

| Fairfax County | 4% |

| City of Norfolk | 5% |

As illustrated in the table above, the Meals Tax rates can range from 4% to 6%, depending on the specific location. These rates are subject to change, and it is crucial for businesses to stay updated on the latest tax regulations to ensure compliance.

Exemptions and Special Cases

While the Meals Tax is a standard component of the Virginia tax system, there are certain exemptions and special cases to consider. For instance, some jurisdictions offer reduced tax rates or exemptions for specific types of food or beverage services. These may include:

- Tax-free days for certain food items

- Reduced rates for non-profit organizations

- Exemptions for religious or educational institutions

- Special considerations for food banks or charitable events

It is essential to consult the specific regulations of each jurisdiction to understand these exemptions fully.

The Impact on Businesses and Consumers

The Meals Tax in Virginia has a direct and significant impact on both businesses and consumers. For businesses, especially those in the food and beverage industry, understanding and managing these taxes is crucial for financial planning and strategy.

Business Implications

From a business perspective, the Meals Tax can affect profitability and operational strategies. Businesses must factor in the tax when pricing their products to ensure competitiveness while maintaining profitability. Additionally, the varying tax rates across jurisdictions can pose challenges for businesses with multiple locations, requiring careful planning and coordination.

Furthermore, businesses must stay informed about any changes in tax regulations to avoid penalties and maintain compliance. This includes staying updated on tax holidays, special events, or any legislative amendments that may impact their operations.

Consumer Perspective

For consumers, the Meals Tax is a noticeable aspect of their dining experience. It adds an additional cost to their meals, influencing their dining choices and preferences. Consumers often consider the tax when deciding where to dine, especially when comparing prices across different establishments.

The varying tax rates can also create a sense of confusion for consumers, especially when dining in different parts of the state. However, understanding the tax structure can empower consumers to make more informed choices and potentially save money by opting for restaurants with lower tax rates.

Compliance and Enforcement

Ensuring compliance with the Meals Tax regulations is a shared responsibility between businesses and the Virginia Department of Taxation. Businesses are required to collect and remit the appropriate taxes to the state, while the Department of Taxation oversees enforcement and ensures businesses are adhering to the law.

Business Compliance

Businesses must accurately calculate and collect the Meals Tax from their customers. This involves understanding the applicable tax rates, keeping detailed records, and submitting regular tax returns to the Department of Taxation. Failure to comply with these regulations can result in penalties, fines, or even legal action.

To assist businesses in compliance, the Department of Taxation provides resources and guidance, including tax rate lookup tools and educational materials. Businesses can also consult tax professionals to ensure they are meeting their obligations accurately.

Enforcement and Penalties

The Virginia Department of Taxation has a robust system in place to enforce tax compliance. This includes regular audits, investigations, and penalty assessments for non-compliance. The penalties can range from monetary fines to the revocation of business licenses, depending on the severity and nature of the violation.

However, the Department of Taxation also recognizes the challenges businesses face and offers amnesty programs periodically, allowing businesses to come forward and rectify their tax obligations without facing penalties.

The Future of Food Taxation in Virginia

The landscape of food taxation in Virginia is constantly evolving, influenced by various factors such as economic trends, legislative changes, and societal demands. While the current system has served the state well, there are ongoing discussions and proposals for reform.

Proposed Changes and Reforms

One of the key areas of discussion is the potential for a state-wide Meals Tax. Currently, the decision to implement a Meals Tax is left to local jurisdictions, resulting in the patchwork of rates seen across the state. Some argue that a state-wide tax could simplify the system and provide a more consistent experience for businesses and consumers.

Additionally, there are proposals to expand the scope of the Meals Tax to include certain food items that are currently exempt, such as grocery store prepared foods. This could generate additional revenue for the state but may also face resistance from consumers and businesses alike.

The Role of Technology

In the digital age, technology is playing an increasingly significant role in tax compliance and enforcement. The Virginia Department of Taxation is exploring the use of advanced technologies, such as data analytics and AI, to enhance its enforcement capabilities and improve tax collection efficiency.

For businesses, technology can also be a valuable tool. Point-of-sale systems and accounting software can automate tax calculations, ensuring accuracy and reducing the risk of errors. Additionally, these systems can provide valuable insights into tax obligations and performance, aiding in strategic decision-making.

What is the purpose of the Meals Tax in Virginia?

+The Meals Tax is a consumption tax designed to generate revenue for local governments. The proceeds are used to fund essential services and infrastructure projects within the community.

Are there any exemptions or special cases for the Meals Tax?

+Yes, certain jurisdictions offer reduced tax rates or exemptions for specific types of food or beverage services, including tax-free days, reduced rates for non-profits, and exemptions for religious or educational institutions.

How often do tax rates change in Virginia?

+Tax rates can change periodically, usually as a result of legislative amendments or local government decisions. It is crucial for businesses and consumers to stay updated on these changes to ensure compliance and make informed choices.