Automobile Sales Tax Virginia

Welcome to this comprehensive guide on the intricacies of Automobile Sales Tax in Virginia, a crucial aspect of the state's automotive industry and an essential consideration for car buyers and sellers alike. Virginia, known for its rich history and diverse landscapes, also boasts a robust vehicle market, making an understanding of its sales tax policies imperative.

Understanding the Virginia Sales Tax Landscape

Virginia operates under a progressive sales tax system, where the tax rate varies depending on the type of transaction and the location of the sale. This means that understanding the sales tax for automobiles requires a nuanced approach, taking into account not just the vehicle’s price but also its specific characteristics and the location of the dealership or seller.

The Role of Locality in Sales Tax

One unique aspect of Virginia’s sales tax is its locality-based approach. The state’s Department of Taxation allows individual localities to set their own sales tax rates, in addition to the standard state sales tax. This results in a diverse range of tax rates across the state, with some localities imposing higher taxes than others.

For instance, while the state sales tax for vehicles is set at 4.3%, localities can add a local tax rate, which can increase the total sales tax to as high as 10.3% in certain areas. This variability makes it essential for car buyers to be aware of the sales tax rates in their specific locality, ensuring they budget appropriately.

| Locality | Sales Tax Rate |

|---|---|

| Arlington County | 5.3% |

| Fairfax County | 4.7% |

| Richmond City | 5.8% |

| Norfolk City | 7.0% |

| Virginia Beach | 5.3% |

Exemptions and Special Considerations

Virginia offers several exemptions and special provisions within its sales tax framework. For instance, the state provides a trade-in exemption, where the value of a traded-in vehicle can reduce the taxable base of the new vehicle purchase. This can significantly lower the overall sales tax liability for buyers.

Additionally, Virginia has specific provisions for electric vehicles (EVs) and hybrid vehicles. These vehicles often qualify for a reduced sales tax rate or even a complete exemption, as the state encourages the adoption of eco-friendly transportation options. This can make purchasing an EV or hybrid in Virginia a more cost-effective choice.

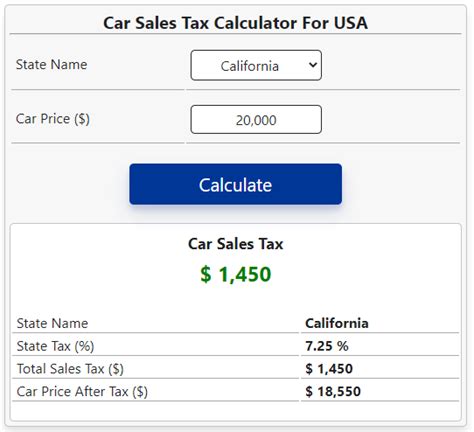

Calculating Automobile Sales Tax in Virginia

Calculating the sales tax on an automobile in Virginia involves a multi-step process. Firstly, determine the applicable sales tax rate for your locality. Then, calculate the taxable value of the vehicle, which can include the vehicle’s price, applicable fees, and any trade-in value. Finally, apply the sales tax rate to this taxable value to arrive at the sales tax amount.

Example Calculation

Let’s consider an example. Suppose you’re purchasing a new car in Fairfax County, Virginia, for a price of 30,000</strong>. You also trade in your old car, which has a value of <strong>5,000. The applicable sales tax rate in Fairfax County is 4.7%.

| Vehicle Price | $30,000 |

|---|---|

| Trade-in Value | $5,000 |

| Total Taxable Value | $25,000 |

| Sales Tax Rate | 4.7% |

| Sales Tax Amount | $1,175 |

In this scenario, the sales tax amount would be $1,175, calculated as 4.7% of the total taxable value of $25,000 (after deducting the trade-in value). This example illustrates how the sales tax calculation can vary based on the specific details of the transaction.

Comparative Analysis with Other States

When compared to other states, Virginia’s sales tax rates for automobiles are relatively moderate. For instance, neighboring states like Maryland have a higher state sales tax rate of 6%, while Washington, D.C., imposes a 10% sales tax on vehicles. This makes Virginia a more attractive option for car buyers, especially those seeking to minimize their tax liabilities.

Regional Variations and Their Impact

However, as mentioned earlier, the regional variations within Virginia can create significant differences. While some localities like Arlington County have a sales tax rate close to the state average, others like Norfolk City have much higher rates. This means that car buyers in certain parts of the state could face substantially higher tax burdens.

This variability also has implications for the automotive industry in Virginia. Dealerships in areas with lower sales tax rates may attract more buyers, potentially leading to increased competition and pricing strategies. On the other hand, dealerships in higher tax rate areas might need to adapt their business models to remain competitive.

Future Implications and Industry Insights

The landscape of automobile sales tax in Virginia is likely to evolve in response to various factors, including economic conditions, political decisions, and technological advancements. For instance, the growing popularity of online car sales platforms could prompt the state to reconsider its sales tax policies, especially if these transactions are currently falling through the tax collection net.

Industry Trends and Strategies

From an industry perspective, automotive businesses in Virginia must stay abreast of these tax variations and trends. This knowledge can inform their pricing strategies, with dealerships in high-tax areas potentially offering more competitive pricing or additional incentives to offset the higher tax burden.

Furthermore, the varying tax rates can influence consumer behavior. Buyers may strategically choose to purchase vehicles in lower tax rate areas, leading to a redistribution of sales across the state. This shift could have significant implications for the distribution of tax revenues and the planning of public services.

Conclusion

In conclusion, understanding the intricacies of automobile sales tax in Virginia is crucial for both consumers and businesses in the automotive industry. The state’s progressive sales tax system, coupled with locality-based rates, creates a complex but manageable landscape. By staying informed about these tax policies, car buyers can make more informed decisions, while dealerships can adapt their strategies to stay competitive.

Frequently Asked Questions

How often do sales tax rates change in Virginia?

+Sales tax rates in Virginia can change annually, typically based on legislative decisions and local budgetary requirements. It’s essential to check for updates at the beginning of each year.

Are there any online resources to find the latest sales tax rates for my locality in Virginia?

+Yes, the Virginia Department of Taxation provides an online tool where you can enter your locality to find the current sales tax rate. This resource is regularly updated to reflect any changes.

What happens if I purchase a vehicle from a private seller in Virginia? Do I still pay sales tax?

+Yes, even when purchasing from a private seller, you are still required to pay sales tax in Virginia. The process involves registering the vehicle and paying the applicable sales tax based on your locality’s rate.