Status Of Amended Tax Return

The status of an amended tax return is an important aspect of financial management, especially for individuals or businesses that need to make adjustments to their previously filed tax documents. This article aims to provide an in-depth understanding of the process, from the initial filing to the final resolution, shedding light on the intricacies and potential outcomes.

Understanding the Amended Tax Return Process

An amended tax return is a formal document used to correct mistakes or make changes to a previously filed tax return. It is a crucial tool for taxpayers to ensure accuracy and avoid potential penalties or audits. The process involves careful consideration and precision, as any error in the amended return could lead to further complications.

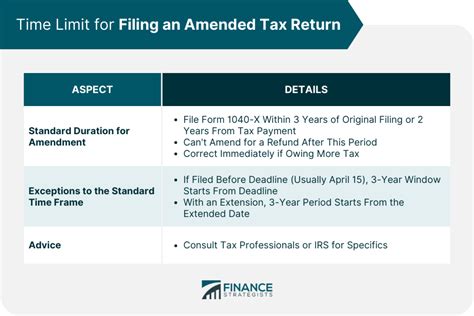

The Internal Revenue Service (IRS) in the United States, for instance, provides guidelines and forms specifically designed for amending tax returns. Taxpayers must use Form 1040X, Amended U.S. Individual Income Tax Return, to make corrections to their federal income tax returns. This form is not to be taken lightly; it requires detailed information and thorough documentation to support the changes being made.

Common Reasons for Amending Tax Returns

There are several scenarios that might prompt a taxpayer to amend their return. These include, but are not limited to:

- Correcting errors in income, deductions, or credits reported on the original return.

- Claiming additional deductions or credits that were overlooked in the initial filing.

- Filing as the surviving spouse after the death of a spouse, which may result in different tax liabilities.

- Reporting additional income that was not included in the original return.

- Adjusting figures due to changes in tax laws or regulations.

It's crucial to note that amending a tax return does not always result in a refund. In some cases, it might lead to an additional tax liability or a reduction in the refund amount originally calculated.

The Amended Return Filing Process

Filing an amended return involves a meticulous approach. Taxpayers must gather all relevant documentation, including W-2s, 1099 forms, and any other supporting documents related to the changes being made. It’s essential to keep these documents organized and easily accessible, as the IRS may request them for verification purposes.

The process typically begins with the completion of Form 1040X. This form requires the taxpayer to specify the type of return being amended (1040, 1040A, or 1040EZ), the tax year in question, and the reason for the amendment. It also involves making the necessary corrections to income, deductions, credits, or any other relevant tax components.

Once the form is completed, it must be mailed to the appropriate IRS processing center along with any supporting documentation and the payment for any additional taxes owed. The IRS provides a list of addresses on its website, which taxpayers can use to ensure their amended return is sent to the correct location.

Processing Time and Status Updates

The time it takes for the IRS to process an amended return can vary, typically ranging from 8 to 16 weeks. During this period, taxpayers may wonder about the status of their amended return and whether their corrections have been accepted.

Unfortunately, the IRS does not provide a dedicated online tool for tracking the status of amended returns. Instead, taxpayers are advised to wait for the processing time to elapse and then contact the IRS directly for an update. This can be done by calling the IRS TeleTax system at 1-800-829-4477 or by visiting a local IRS Taxpayer Assistance Center.

When contacting the IRS, taxpayers should have their tax return information handy, including their Social Security Number, filing status, and the tax year in question. This information helps IRS representatives locate the amended return and provide an accurate status update.

| Tax Return Status | Description |

|---|---|

| Accepted | The amended return has been processed, and the corrections have been accepted. |

| Pending | The IRS is still reviewing the amended return. Taxpayers should allow sufficient time for processing before inquiring about the status. |

| Rejected | The amended return was not accepted due to errors or incomplete information. Taxpayers will receive a notice explaining the reasons for the rejection and the steps needed to correct the issues. |

Potential Outcomes and Next Steps

Once the IRS has processed the amended return, taxpayers can expect one of the following outcomes:

Refund or Additional Tax Liability

If the amended return results in a larger refund or a reduction in tax liability, the IRS will process the refund or send a notice of the adjusted tax amount. In the case of a refund, taxpayers can choose to receive it as a direct deposit or as a check mailed to their address on file.

On the other hand, if the amended return leads to an additional tax liability, the IRS will send a bill for the amount owed. Taxpayers have the option to pay the full amount or explore payment plans or installment agreements if they cannot afford the full payment.

Further Review or Audit

In some cases, the IRS may require additional information or documentation to support the amendments made. This could lead to a more detailed review or even an audit. It’s important to respond promptly to any requests for information and to provide accurate and complete documentation.

Filing a Second Amended Return

If, after receiving the IRS’s response, a taxpayer believes there are additional errors or adjustments to be made, they can file a second amended return. However, it’s crucial to ensure that all necessary corrections are made in this second filing, as further amendments may become increasingly complex and time-consuming.

Conclusion: Navigating the Amended Return Process

Amending a tax return is a critical step in maintaining financial integrity and compliance with tax laws. While the process can be intricate and time-consuming, it is essential for ensuring accuracy and avoiding potential penalties. By understanding the process, taxpayers can navigate the amended return status with confidence and make informed decisions about their financial obligations.

Remember, tax laws and regulations can be complex, and it's always advisable to consult with a tax professional or a certified public accountant (CPA) for guidance specific to your situation. They can provide valuable insights and ensure your amended return is completed accurately and efficiently.

How long does it take for the IRS to process an amended return?

+

Typically, it takes 8 to 16 weeks for the IRS to process an amended return. Taxpayers should allow this time to elapse before contacting the IRS for a status update.

What if my amended return is rejected by the IRS?

+

If your amended return is rejected, the IRS will send a notice explaining the reasons for the rejection. You will need to correct the errors and resubmit the amended return. It’s important to review the notice carefully and provide all necessary information to ensure the return is accepted.

Can I check the status of my amended return online?

+

Unfortunately, the IRS does not provide an online tool for tracking the status of amended returns. Taxpayers are advised to wait for the processing time to elapse and then contact the IRS directly for an update.

What should I do if I owe additional taxes after amending my return?

+

If you owe additional taxes after amending your return, you can pay the full amount or explore payment plans or installment agreements. The IRS offers various options for taxpayers who cannot afford to pay the full amount immediately.

Is it possible to file a second amended return if I find more errors?

+

Yes, it is possible to file a second amended return if you discover additional errors or need to make further adjustments. However, it’s crucial to ensure that all necessary corrections are made in this second filing to avoid further complications.