Georgia Tax Rebate Date

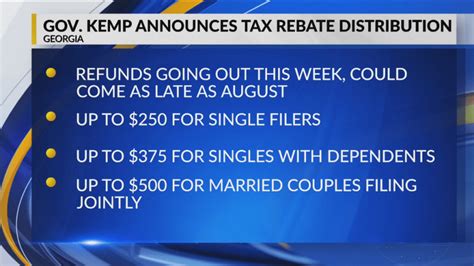

For residents of Georgia, the state's tax rebate program is a highly anticipated event, offering a much-needed financial boost. In this article, we delve into the specifics of the Georgia Tax Rebate program, its significance, and the crucial date residents eagerly await each year.

Understanding the Georgia Tax Rebate Program

The Georgia Tax Rebate program, officially known as the Individual Income Tax Refund, is an initiative by the Georgia Department of Revenue to provide tax relief to eligible state residents. This program aims to return a portion of the state income tax paid by individuals, offering a financial incentive and supporting local economies.

Eligible residents can receive a refund, which varies based on their income tax payments and personal circumstances. The rebate amount is calculated using a formula that considers various factors, including the taxpayer's filing status, income level, and any applicable deductions or credits.

Program Eligibility and Criteria

To be eligible for the Georgia Tax Rebate, individuals must meet specific criteria. First and foremost, they must be residents of Georgia and have filed their state income tax returns for the relevant tax year. The income threshold for eligibility is $75,000 or less for single filers and $150,000 or less for joint filers.

Additionally, individuals must have a valid Social Security number and cannot be claimed as a dependent on another person's tax return. The program also has certain age restrictions, requiring individuals to be at least 18 years old to claim the rebate for themselves.

| Eligibility Criteria | Details |

|---|---|

| Residency | Must be a Georgia resident |

| Income Level | Single filers: $75,000 or less Joint filers: $150,000 or less |

| Social Security Number | Must have a valid SSN |

| Age | At least 18 years old |

The Anticipated Tax Rebate Date

The date when the Georgia Tax Rebates are issued is a highly anticipated event for eligible residents. While the exact date can vary slightly from year to year, the state aims to distribute the rebates as promptly as possible after the conclusion of the tax filing season.

Historically, the tax rebate date has been set for early to mid-summer, typically falling within June or July. This timeframe allows the Department of Revenue sufficient time to process tax returns, verify eligibility, and calculate the precise rebate amounts for each taxpayer.

Tax Rebate Processing Timeline

The process of issuing tax rebates involves several stages, each with its own timeline. Once the tax filing season concludes, usually by the end of April, the Department of Revenue begins processing the returns and identifying eligible taxpayers.

The initial stage involves a thorough review of each tax return to ensure accuracy and compliance with state tax laws. This process can take several weeks, especially given the volume of returns received. Once the returns are deemed accurate, the department moves on to the next step: calculating the rebate amount for each eligible taxpayer.

The rebate calculation is a complex process that takes into account the taxpayer's income, deductions, credits, and other relevant factors. This step can add a few more weeks to the overall timeline. Once the rebate amounts are determined, the Department of Revenue issues the rebates, typically via direct deposit or check, depending on the taxpayer's preference.

| Tax Rebate Processing Timeline | Estimated Duration |

|---|---|

| Tax Return Review | 4–6 weeks |

| Rebate Amount Calculation | 2–4 weeks |

| Rebate Issuance | Varies; typically within 1–2 weeks |

Maximizing Your Tax Rebate

While the Georgia Tax Rebate program provides a significant financial benefit, there are strategies individuals can employ to maximize their rebate amount.

Filing Your Taxes Early

One of the most effective ways to ensure you receive the maximum tax rebate is by filing your state income tax returns early. By submitting your return promptly, you allow the Department of Revenue ample time to process your return and calculate your rebate accurately.

Additionally, filing early reduces the risk of errors or discrepancies in your tax return, which could lead to delays or adjustments in your rebate amount. Early filers also benefit from reduced processing times, often receiving their rebates sooner than those who file later in the tax season.

Maximizing Deductions and Credits

Understanding and utilizing the various deductions and credits available under Georgia's tax laws can significantly impact your rebate amount. Deductions reduce the taxable income, which in turn reduces the amount of tax owed and increases the potential rebate.

Some common deductions include those for medical expenses, state and local taxes, mortgage interest, and charitable contributions. Additionally, Georgia offers several credits, such as the HOPE Scholarship Credit, the Education Expense Credit, and the Angel Investor Tax Credit, which can further reduce your tax liability and boost your rebate.

| Deductions and Credits to Consider | Description |

|---|---|

| Medical Expenses | Deduction for unreimbursed medical expenses exceeding 7.5% of your adjusted gross income. |

| State and Local Taxes | Deduction for state and local income taxes, sales taxes, and property taxes. |

| Mortgage Interest | Deduction for interest paid on your mortgage loan. |

| Charitable Contributions | Deduction for donations made to qualified charities. |

| HOPE Scholarship Credit | Credit for Georgia residents attending eligible post-secondary institutions. |

| Education Expense Credit | Credit for certain educational expenses, including tuition and fees. |

| Angel Investor Tax Credit | Credit for investments in qualifying Georgia-based startups. |

The Impact of the Tax Rebate on Georgia's Economy

The Georgia Tax Rebate program has a significant impact on the state's economy, stimulating spending and contributing to economic growth. The rebate amounts distributed to eligible residents serve as a form of economic stimulus, encouraging consumers to spend and invest in their local communities.

Stimulating Local Businesses

When residents receive their tax rebates, they often use this additional income to support local businesses. Whether it's dining out at local restaurants, shopping at neighborhood stores, or investing in home improvements, the tax rebate boosts spending across various sectors of the economy.

This increased spending has a ripple effect, benefiting not only the businesses themselves but also their employees and suppliers. As businesses thrive, they can expand their operations, hire more staff, and invest in their communities, further strengthening the local economy.

Supporting Economic Growth and Development

The Georgia Tax Rebate program plays a crucial role in supporting the state's overall economic growth and development. By providing financial relief to residents, especially those with lower to moderate incomes, the program helps to reduce income inequality and promote economic stability.

The rebate amounts can help residents catch up on bills, save for the future, or invest in their education and skills development. This, in turn, leads to a more skilled and productive workforce, benefiting both individuals and the state's economy as a whole. Additionally, the increased spending stimulated by the tax rebate can attract new businesses and investments to Georgia, further boosting its economic potential.

FAQs about the Georgia Tax Rebate

How do I know if I'm eligible for the Georgia Tax Rebate?

+To be eligible for the Georgia Tax Rebate, you must meet certain criteria, including being a Georgia resident, filing a state income tax return, and having an income level below the specified threshold ($75,000 for single filers and $150,000 for joint filers). You must also have a valid Social Security number and cannot be claimed as a dependent on another person's tax return. Additionally, you must be at least 18 years old to claim the rebate for yourself.

When can I expect to receive my Georgia Tax Rebate?

+The exact date of the Georgia Tax Rebate can vary each year, but it typically falls within June or July. The state aims to distribute the rebates as promptly as possible after the tax filing season concludes. The processing timeline involves several stages, including reviewing tax returns, calculating rebate amounts, and issuing the rebates. You can expect to receive your rebate within a few weeks to a couple of months after the tax filing deadline.

How can I maximize my Georgia Tax Rebate amount?

+To maximize your Georgia Tax Rebate, file your state income tax return early in the tax season. This allows the Department of Revenue sufficient time to process your return and calculate your rebate accurately. Additionally, take advantage of the various deductions and credits available under Georgia's tax laws. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. Credits like the HOPE Scholarship Credit, Education Expense Credit, and Angel Investor Tax Credit can further reduce your tax liability and boost your rebate.

What if I haven't received my Georgia Tax Rebate by the expected date?

+If you haven't received your Georgia Tax Rebate by the expected date, it's important to remain patient. The processing timeline can vary, and delays may occur due to various factors. However, if you have concerns or believe there may be an issue with your rebate, you can contact the Georgia Department of Revenue for assistance. They can provide updates on the status of your rebate and guide you through any necessary steps to resolve any potential issues.

Can I track the status of my Georgia Tax Rebate online?

+Yes, you can track the status of your Georgia Tax Rebate online through the Georgia Department of Revenue's website. By accessing your online account or using the department's online tools, you can check the progress of your rebate processing and receive updates on when to expect your rebate. This convenient feature allows you to stay informed and plan your finances accordingly.

The Georgia Tax Rebate program is a valuable initiative that provides financial relief to eligible residents and stimulates the state’s economy. By understanding the program’s eligibility criteria, maximizing deductions and credits, and staying informed about the rebate date, Georgia residents can make the most of this beneficial program.