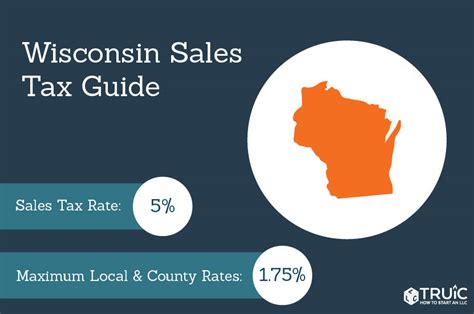

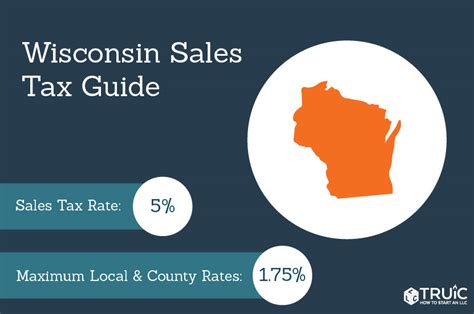

Sales Tax In Wisconsin

Welcome to an insightful exploration of the Sales Tax landscape in the state of Wisconsin, where we delve into the intricacies of this crucial revenue stream for the state government. Sales tax is an essential component of Wisconsin's fiscal policies, impacting businesses and consumers alike. Understanding its nuances is key to navigating the state's economic ecosystem successfully.

The Wisconsin Sales Tax: A Comprehensive Overview

Wisconsin’s sales tax is a state-level consumption tax levied on the sale of tangible goods and certain services. It is a vital revenue source, contributing significantly to the state’s annual budget. The sales tax is an essential component of Wisconsin’s tax structure, shaping the economic landscape and influencing business strategies and consumer behavior.

The tax is applied to a wide range of transactions, from retail sales to certain services like lodging, rental car charges, and admissions to certain entertainment events. It is a critical tool for the state to generate revenue, fund public services, and maintain infrastructure.

Tax Rates and Structures

Wisconsin’s sales tax operates on a statewide base rate of 5%, which is applied uniformly across the state. However, the state allows local governments to impose additional sales and use taxes, creating a complex multi-tiered tax structure. This means that the sales tax rate can vary significantly depending on the specific location of the transaction.

| Tax Type | Base Rate | Additional Local Taxes |

|---|---|---|

| State Sales Tax | 5% | Varies by Location |

| County Sales Tax | Up to 0.5% | Dependent on County |

| Municipal Sales Tax | Up to 0.5% | Dependent on Municipality |

| Technical College District Tax | Up to 0.15% | Varies by District |

For instance, while the state base rate is a standard 5%, counties and municipalities can levy additional taxes, with some areas having rates as high as 5.6%.

Taxable and Exempt Items

Wisconsin’s sales tax covers a broad spectrum of goods and services, but there are notable exemptions. Some essential items like groceries, prescription drugs, and medical devices are exempt from sales tax, providing a significant relief to Wisconsin’s residents. Additionally, the state offers tax holidays on specific items, reducing the tax burden for consumers during those periods.

However, certain services like legal and accounting services, as well as intangibles like software and digital subscriptions, are generally subject to sales tax. This complexity in the tax structure requires businesses to stay informed and adapt their strategies accordingly.

Compliance and Administration

The sales tax in Wisconsin is administered by the Wisconsin Department of Revenue, which provides detailed guidelines and resources for businesses to understand their tax obligations. Compliance with sales tax laws is essential for businesses to maintain their standing with the state and avoid penalties.

Businesses are required to register for a sales tax permit with the Department of Revenue, collect the appropriate tax rates based on the location of the sale, and remit the collected taxes periodically. The Department of Revenue offers online resources and tools to simplify the process and ensure accurate tax calculation and reporting.

Challenges and Best Practices

Navigating Wisconsin’s sales tax landscape can be challenging due to its complex multi-tiered structure. Businesses operating in multiple locations within the state or those with online sales that deliver to Wisconsin residents must carefully manage their tax obligations to avoid errors and penalties.

Best practices include utilizing sales tax automation tools, staying updated with tax law changes, and seeking professional advice when needed. By adopting a proactive approach to tax compliance, businesses can minimize risks and focus on their core operations.

Economic Impact and Policy Considerations

The sales tax is a critical tool for Wisconsin’s economic policy, influencing consumer spending habits and business investment decisions. The tax revenue funds essential public services, infrastructure development, and social programs, making it a vital component of the state’s economic strategy.

Policy discussions often revolve around balancing the need for revenue generation with the impact on businesses and consumers. The state's decision to exempt certain essential items from sales tax, for instance, reflects a thoughtful approach to supporting residents while maintaining a healthy tax base.

Future Implications

As Wisconsin’s economy evolves, the sales tax landscape is likely to see further changes. The state may consider adjustments to tax rates, exemptions, or collection methods to adapt to changing economic conditions and technological advancements.

For instance, with the rise of e-commerce, the state may need to revisit its tax collection methods to ensure fair taxation of online sales. This could involve implementing new laws or leveraging technology to streamline the process and enhance compliance.

Additionally, with the ongoing debate around tax fairness and simplification, Wisconsin may explore ways to streamline its tax structure, potentially reducing the complexity for businesses and consumers alike.

What is the current sales tax rate in Wisconsin?

+The current state sales tax rate in Wisconsin is 5%, but local taxes can increase this rate, with some areas having rates as high as 5.6%.

Are there any sales tax holidays in Wisconsin?

+Yes, Wisconsin offers tax holidays on specific items, providing a temporary reduction in sales tax during certain periods.

How often do sales tax rates change in Wisconsin?

+Sales tax rates can change annually, depending on legislative decisions and local government budgets.

In conclusion, Wisconsin’s sales tax is a dynamic and complex system, playing a crucial role in the state’s economic framework. Understanding its intricacies is essential for businesses and consumers alike, as it directly impacts their financial decisions and obligations.