Tax Calculator Mn

In the state of Minnesota, understanding the tax landscape is crucial for individuals and businesses alike. The Tax Calculator Mn tool is a valuable resource that simplifies the process of estimating tax obligations, ensuring compliance with state regulations, and aiding in financial planning. This comprehensive guide delves into the features, benefits, and applications of the Tax Calculator Mn, providing an in-depth analysis for those seeking clarity in their tax computations.

Navigating the Tax Calculator Mn Interface

The Tax Calculator Mn boasts an intuitive design, making it accessible to users with varying levels of tax expertise. Upon accessing the tool, users are greeted with a straightforward interface, requiring basic input fields such as income brackets, deductions, and applicable tax rates. The calculator then performs complex calculations, generating an accurate estimate of the user’s tax liability.

One notable feature is the calculator's ability to handle different tax scenarios. Whether it's estimating federal, state, or local taxes, the Tax Calculator Mn provides a comprehensive overview. Users can input specific details like marital status, number of dependents, and business income to obtain a personalized tax estimate.

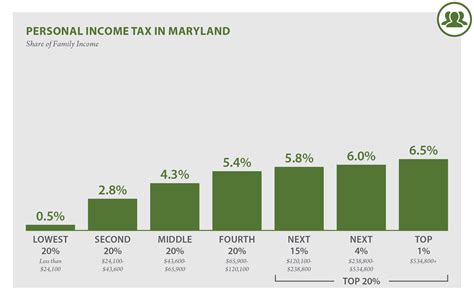

Moreover, the tool offers a visual representation of tax brackets, allowing users to understand how their income is distributed across different tax rates. This feature is particularly beneficial for those aiming to optimize their financial strategies and minimize tax liabilities.

Step-by-Step Guide to Using Tax Calculator Mn

- Access the Calculator: Begin by visiting the official website or downloading the Tax Calculator Mn app on your preferred device.

- Input Basic Information: Start by entering your annual income, including wages, salaries, and any additional sources of income.

- Select Deductions: Choose the applicable deductions you qualify for, such as standard deductions, personal exemptions, or specific itemized deductions.

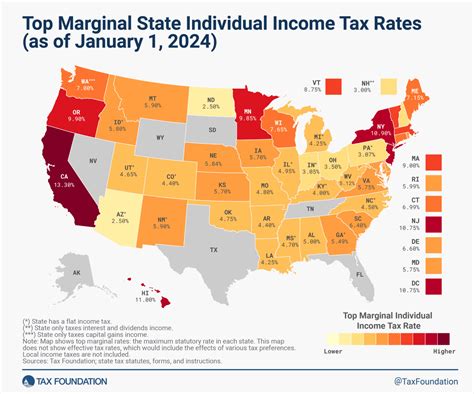

- Specify Tax Rates: Input the relevant tax rates for your income bracket, ensuring accuracy by referencing official tax tables.

- Calculate: Once all information is entered, click the calculate button to generate an estimate of your tax liability.

- Review Results: The calculator will display the estimated tax amount, providing a breakdown of how your income is taxed across different brackets.

- Adjust and Compare: You can experiment with different scenarios by adjusting income, deductions, or tax rates to understand the impact on your tax liability.

| Feature | Description |

|---|---|

| Customizable Deductions | Users can input specific deductions, ensuring an accurate representation of their financial situation. |

| Real-Time Calculations | The calculator provides instant results, allowing users to make informed decisions quickly. |

| Tax Bracket Visualization | A visual representation of tax brackets helps users understand their position and potential strategies. |

Benefits of Utilizing Tax Calculator Mn

The Tax Calculator Mn offers a range of advantages to users, making it an indispensable tool for tax management.

Accurate Tax Estimation

By inputting relevant data, users can obtain precise estimates of their tax liabilities. This accuracy is vital for financial planning, helping individuals and businesses allocate funds appropriately.

Simplified Tax Compliance

Understanding tax obligations is essential for compliance. The Tax Calculator Mn simplifies this process, ensuring users are aware of their tax responsibilities and potential penalties for non-compliance.

Financial Strategy Development

With accurate tax estimates, users can develop effective financial strategies. This includes optimizing deductions, adjusting income sources, and planning for future tax obligations.

Time and Cost Efficiency

The calculator saves time and resources by automating complex tax calculations. This efficiency is particularly beneficial for small businesses and individuals managing their finances independently.

Peace of Mind

Having a reliable tool to estimate tax liabilities provides peace of mind. Users can rest assured that their tax obligations are accurately calculated, reducing the stress associated with tax season.

Applications of Tax Calculator Mn

The Tax Calculator Mn finds utility in various scenarios, catering to the diverse needs of individuals and businesses.

Personal Tax Planning

Individuals can use the calculator to estimate their annual tax liabilities, helping them plan their finances accordingly. By understanding tax obligations, individuals can make informed decisions about savings, investments, and overall financial health.

Business Tax Management

For businesses, the Tax Calculator Mn is an invaluable tool for managing tax obligations. Whether it’s estimating payroll taxes, sales taxes, or corporate income taxes, the calculator provides accurate estimates, aiding in financial forecasting and tax compliance.

Tax Strategy Development

Tax professionals and financial advisors can leverage the Tax Calculator Mn to develop comprehensive tax strategies for their clients. By analyzing different scenarios, they can optimize tax liabilities and provide expert guidance.

Educational Resource

The calculator serves as an educational tool, helping users understand the intricacies of the tax system. By experimenting with different inputs, users can gain insights into the impact of various factors on their tax obligations.

Comparison and Analysis

The Tax Calculator Mn allows users to compare tax liabilities across different scenarios. This feature is particularly useful for businesses considering expansion, relocation, or changes in operational structure.

Future Implications and Updates

As tax regulations evolve, the Tax Calculator Mn remains committed to providing accurate and up-to-date calculations. The development team continuously monitors changes in tax laws, ensuring the calculator remains a reliable resource.

Future updates may include enhancements to the user interface, additional features for specific tax scenarios, and integration with other financial tools for a more holistic financial management experience.

Conclusion

The Tax Calculator Mn is a powerful tool that empowers individuals and businesses to navigate the complex world of taxation with confidence. By offering accurate estimates, simplifying compliance, and aiding in financial strategy development, the calculator proves its value as an essential resource for tax management.

Can I use the Tax Calculator Mn for federal taxes only?

+Absolutely! While the Tax Calculator Mn is designed for Minnesota taxes, it also provides estimates for federal taxes. Simply input your federal income and deductions to obtain an accurate estimate.

Is the Tax Calculator Mn suitable for small businesses?

+Yes, the calculator is an excellent resource for small businesses. It helps estimate payroll taxes, sales taxes, and business income taxes, ensuring compliance and financial planning.

How often should I update my tax information in the calculator?

+It’s recommended to update your tax information annually, especially if there are significant changes in your income, deductions, or tax rates. This ensures accurate estimates throughout the year.

Can I save my tax calculations for future reference?

+Yes, the Tax Calculator Mn offers a feature to save your calculations. This allows you to review past estimates, compare different scenarios, and track your tax obligations over time.