Georgia Tax Calculator Car

The Georgia Tax Calculator for cars is an essential tool for residents and prospective vehicle owners in the state of Georgia. This calculator plays a crucial role in helping individuals understand and estimate the various taxes and fees associated with purchasing and registering a vehicle. By providing accurate and up-to-date information, it ensures that car buyers can make informed decisions and plan their finances effectively.

Understanding the Georgia Tax Calculator for Cars

The Georgia Tax Calculator for cars is a comprehensive online tool that calculates the total tax liability for purchasing a vehicle in the state. It takes into account several factors, including the vehicle’s make, model, year, and purchase price, to provide an accurate estimate of the taxes and fees involved. This calculator is designed to assist individuals in budgeting for their vehicle purchase and understanding the financial implications.

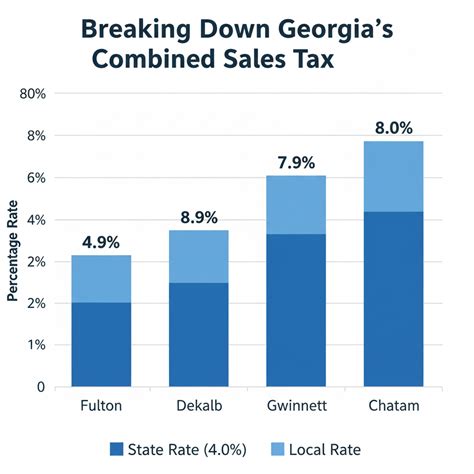

One of the key advantages of using this calculator is its ability to provide a clear breakdown of the different tax components. It not only calculates the standard sales tax but also considers additional fees such as the Title Ad Valorem Tax (TAVT), which is specific to Georgia. By offering a detailed analysis, the calculator ensures that car buyers are well-informed about the entire tax process.

Key Features and Benefits

- Precision in Tax Estimation: The calculator employs advanced algorithms and regularly updated tax rates to ensure precise calculations. This accuracy is vital for individuals who want to avoid any surprises when it comes to tax liabilities.

- Convenience and Accessibility: Available online, the Georgia Tax Calculator for cars can be accessed from anywhere, making it a convenient tool for potential car buyers. It eliminates the need for manual calculations and provides quick results.

- Educational Tool: Beyond just providing estimates, the calculator serves as an educational resource. It offers insights into the different tax components, helping users understand the tax structure in Georgia and make informed financial choices.

Tax Components and Calculations

The Georgia Tax Calculator for cars takes into account several tax components, each with its own calculation methodology. Let’s explore these components in detail:

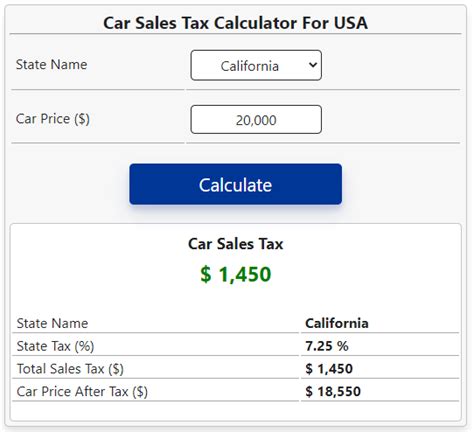

Sales Tax

The sales tax in Georgia is a percentage-based tax applied to the purchase price of a vehicle. The calculator uses the current sales tax rate, which is set by the state, to compute the sales tax liability. This rate is subject to change, so the calculator ensures it remains updated to provide accurate estimates.

Title Ad Valorem Tax (TAVT)

The Title Ad Valorem Tax is a unique tax in Georgia that is calculated based on the value of the vehicle. It is a one-time tax that must be paid when registering a vehicle in the state. The TAVT calculator employs a specific formula that considers the vehicle’s age, make, and value to determine the tax amount. This tax ensures that older vehicles are taxed at a lower rate compared to newer ones.

| Vehicle Age | TAVT Rate |

|---|---|

| 0-5 years | 6.75% |

| 6-10 years | 5.50% |

| 11+ years | 3.00% |

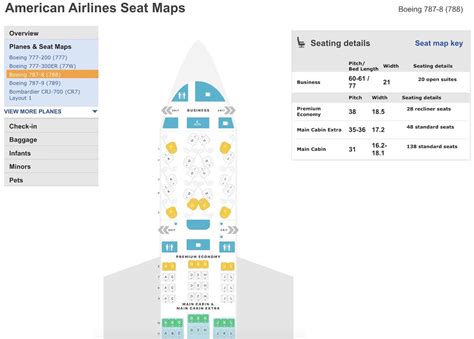

Registration Fees

Registration fees in Georgia are calculated based on the vehicle’s weight and type. The calculator takes into account the vehicle’s gross weight and determines the applicable registration fee. These fees are crucial for maintaining vehicle records and ensuring compliance with state regulations.

Title Transfer Fees

When purchasing a used vehicle, a title transfer is required. The calculator includes the cost of transferring the vehicle title, which involves a fee paid to the Georgia Department of Revenue. This fee varies depending on the vehicle’s purchase price.

| Vehicle Purchase Price | Title Transfer Fee |

|---|---|

| $10,000 and below | $18 |

| $10,001 - $25,000 | $21 |

| $25,001 and above | $24 |

Real-World Examples and Case Studies

To better illustrate the functionality of the Georgia Tax Calculator for cars, let’s explore some real-world scenarios and how the calculator can assist in these situations:

Scenario 1: New Car Purchase

John is planning to buy a new Toyota Camry with a purchase price of $30,000. Using the tax calculator, he can estimate his total tax liability. The calculator takes into account the sales tax, TAVT, registration fees, and title transfer fees, providing John with a clear breakdown.

| Tax Component | Amount |

|---|---|

| Sales Tax | $1,800 (6% of $30,000) |

| TAVT | $2,025 (6.75% of $30,000) |

| Registration Fees | $35 (Estimated) |

| Title Transfer Fee | $24 |

| Total Tax Liability | $3,884 |

Scenario 2: Used Car Purchase

Sarah is considering buying a used Honda Civic, 5 years old, with a purchase price of $15,000. The tax calculator helps her estimate her tax obligations, including the reduced TAVT rate for older vehicles.

| Tax Component | Amount |

|---|---|

| Sales Tax | $900 (6% of $15,000) |

| TAVT | $975 (6.75% of $15,000) |

| Registration Fees | $25 (Estimated) |

| Title Transfer Fee | $18 |

| Total Tax Liability | $2,018 |

Future Implications and Considerations

As tax rates and regulations are subject to change, it is crucial for individuals to stay updated with the latest information. The Georgia Tax Calculator for cars plays a vital role in ensuring that car buyers have access to accurate and current tax estimates. Here are some key considerations for the future:

- Tax Rate Updates: The calculator must be regularly updated to reflect any changes in tax rates, ensuring that users receive precise estimates.

- Vehicle Value Calculation: As vehicle values can fluctuate, the calculator should incorporate real-time data to provide accurate assessments of TAVT and other value-based taxes.

- Regulatory Changes: Keeping up with any changes in state regulations and fee structures is essential to maintain the calculator's relevance and accuracy.

How often are the tax rates updated on the calculator?

+The tax rates on the calculator are updated quarterly to ensure they reflect the latest changes implemented by the state government. This allows users to receive accurate estimates based on the current tax environment.

Are there any additional fees besides the taxes calculated by the tool?

+Yes, there might be additional fees such as emissions testing, environmental fees, or optional add-ons like personalized license plates. These fees are not included in the calculator’s estimate but can be obtained from the Department of Motor Vehicles (DMV) for a comprehensive understanding of the total costs.

Can the calculator estimate taxes for leased vehicles as well?

+While the calculator primarily focuses on calculating taxes for purchased vehicles, it can provide estimates for leased vehicles by considering the monthly payment and lease term. However, it’s important to note that the specific tax implications for leased vehicles may vary, and consulting a tax professional is recommended for accurate guidance.