Nc Tax Rebates

In the state of North Carolina, tax rebates are a significant aspect of the tax system, offering relief and incentives to both individuals and businesses. The state's tax structure and the availability of rebates play a crucial role in shaping the financial landscape and can greatly impact residents and investors.

Understanding North Carolina’s Tax Rebate System

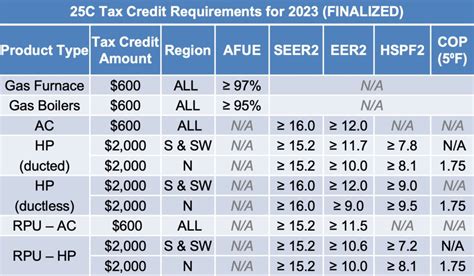

North Carolina offers a range of tax rebates and incentives to promote economic growth, attract businesses, and support its residents. These rebates are designed to offset various types of taxes, including income tax, sales tax, and property tax. The state’s tax policies are continuously evolving, and staying updated on these changes is essential for both taxpayers and investors.

One of the key aspects of North Carolina's tax rebate system is its focus on encouraging economic development. The state provides tax incentives for businesses that invest in certain sectors or create job opportunities. These incentives can take the form of tax credits, deductions, or direct rebates, depending on the specific program and the business's eligibility.

Income Tax Rebates

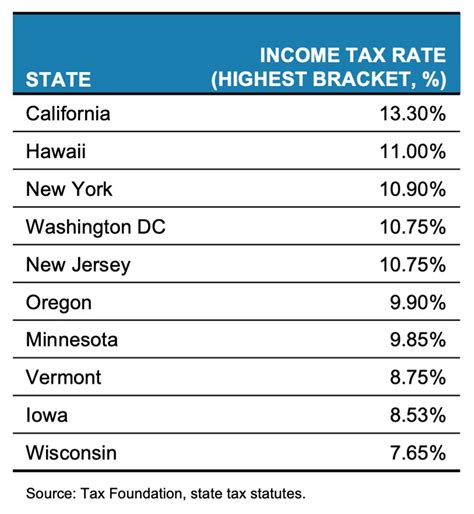

For individuals, North Carolina offers income tax rebates as a means of providing relief and supporting lower-income households. The state’s income tax structure includes brackets and rates that determine the amount of tax owed. However, eligible taxpayers can claim rebates to reduce their overall tax liability.

The income tax rebate system is designed to benefit those with lower incomes, as it aims to provide a certain level of financial support and encourage economic participation. The eligibility criteria and the amount of rebate vary based on factors such as income level, marital status, and number of dependents.

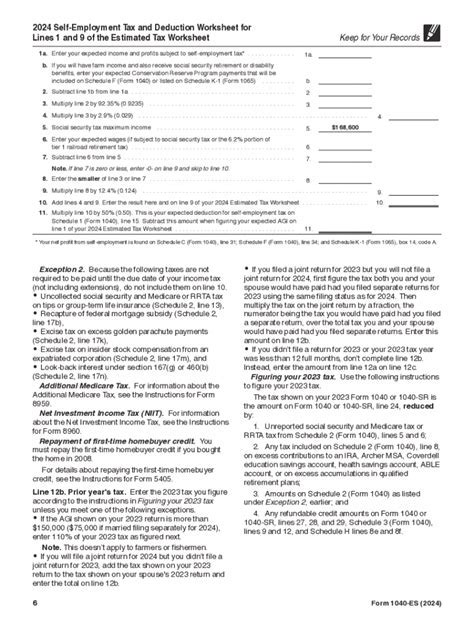

| Income Tax Rebate Program | Rebate Amount |

|---|---|

| Low-Income Tax Rebate | $150 for single filers, $300 for joint filers |

| Earned Income Tax Credit (EITC) | Varies based on income and number of qualifying children |

Additionally, North Carolina offers tax credits for specific circumstances, such as the Child and Dependent Care Tax Credit, which can further reduce the tax burden for families with childcare expenses.

Sales and Use Tax Rebates

Businesses operating in North Carolina may be eligible for sales and use tax rebates. These rebates are typically provided to promote certain economic activities or to offset the burden of taxes on specific industries. For instance, the state offers rebates for sales tax paid on certain types of equipment used in manufacturing or agriculture.

The sales and use tax rebate system is complex and varies based on the nature of the business, the products or services offered, and the tax jurisdiction. It is essential for businesses to stay informed about the latest tax regulations and rebates to ensure they are maximizing their potential savings.

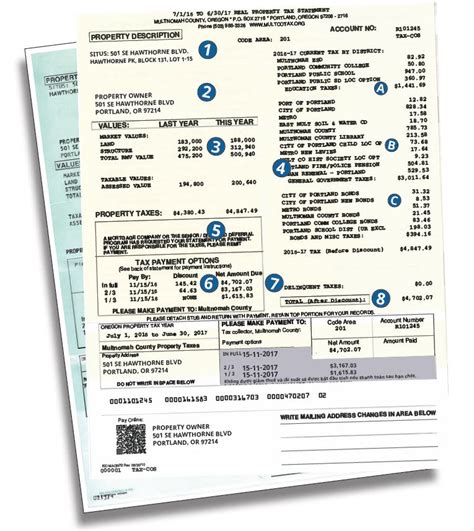

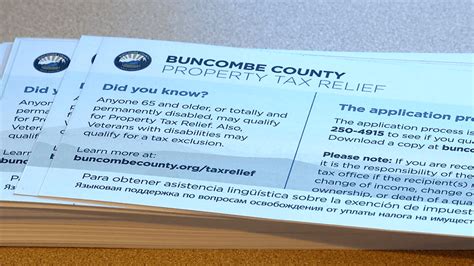

Property Tax Relief

North Carolina provides property tax relief to certain groups, primarily homeowners and farmers. The state offers various programs to reduce the property tax burden, such as the Homestead Exclusion, which excludes a portion of a homeowner’s property value from taxation. This exclusion varies by county and is based on factors like age and income.

Additionally, the state offers tax relief for agricultural lands, encouraging the preservation of farmland and supporting the agricultural industry. This relief can significantly reduce the property tax liability for farmers and promote sustainable land use practices.

Eligibility and Application Process

The eligibility criteria for tax rebates in North Carolina vary depending on the type of rebate and the individual or business’s circumstances. Generally, income-based rebates require taxpayers to meet specific income thresholds and provide documentation to support their eligibility.

Businesses applying for sales and use tax rebates must demonstrate that they meet the criteria outlined in the relevant tax statutes. This often involves providing detailed records of purchases, sales, and tax payments. The application process may also require businesses to demonstrate how the rebate will benefit their operations and the state's economy.

For property tax relief, homeowners and farmers must apply to their respective county tax offices. The application process typically involves providing documentation of ownership, income, and other relevant factors. The relief amounts and eligibility criteria can vary by county, so it is essential to consult with the local tax authority.

Maximizing Benefits and Future Implications

Staying informed about the latest tax rebates and incentives is crucial for individuals and businesses operating in North Carolina. By understanding the eligibility criteria and application processes, taxpayers can maximize their potential savings and benefit from the state’s tax relief programs.

For individuals, keeping track of income thresholds and applying for the appropriate rebates can significantly reduce their tax burden. Similarly, businesses can strategically plan their investments and operations to take advantage of the available tax incentives, promoting growth and financial stability.

As the state's tax landscape continues to evolve, staying updated on policy changes and new rebate programs becomes increasingly important. By actively engaging with the tax system and seeking professional advice when needed, taxpayers can ensure they are making the most of the opportunities available to them.

Conclusion

North Carolina’s tax rebate system offers a range of benefits to its residents and businesses. From income tax rebates for individuals to sales and use tax incentives for businesses, the state provides opportunities for financial relief and economic growth. By understanding the eligibility criteria and staying informed about the latest developments, taxpayers can navigate the system effectively and maximize their potential savings.

What are the key income tax rebates offered by North Carolina?

+North Carolina offers income tax rebates such as the Low-Income Tax Rebate and the Earned Income Tax Credit (EITC). These rebates provide financial relief to eligible taxpayers based on their income level and family status.

How do businesses qualify for sales and use tax rebates in North Carolina?

+Businesses in North Carolina can qualify for sales and use tax rebates by meeting specific criteria outlined in the state’s tax statutes. This often involves demonstrating that their operations align with the rebate program’s objectives and providing detailed tax records.

What is the Homestead Exclusion, and how does it benefit homeowners in North Carolina?

+The Homestead Exclusion is a property tax relief program in North Carolina that excludes a portion of a homeowner’s property value from taxation. This exclusion varies by county and provides financial relief to homeowners, reducing their overall property tax liability.