Va State Income Tax Myths Debunked: What You Really Need to Know

In the complex labyrinth of tax policy, state-specific narratives often become muddled by misconceptions that persist despite extensive evidence to the contrary. Virginia, with its evolving economic landscape and fiscal regulations, exemplifies this phenomenon with a host of persistent myths surrounding its income tax system. For residents, policymakers, and financial advisors alike, understanding what the Virginia state income tax truly entails is crucial for making informed decisions. This article dissects prevalent myths, evaluates their origins and implications, and presents a clear, evidence-based perspective on Virginia's income tax policies—aiming to demystify a topic that influences millions annually.

Virginia State Income Tax: Myths, Misconceptions, and Reality

Virginia’s income tax has historically been a subject of debate, often depicted through a prism of misconceptions that obscure its practical realities. These myths range from exaggerated claims about tax rates to misinterpretations of tax loopholes and exemptions. As the state repositioned itself within the broader U.S. economy, particularly with initiatives aimed at attracting affluent residents and high-tech industries, the narrative surrounding its taxation system became increasingly convoluted. The fact remains that legal, policy-driven facts must be distinguished from misleading perceptions—especially in an era where misinformation can influence everything from individual financial planning to legislative reforms.

Origins of Virginia Income Tax Myths

Many misconceptions arise from misreading tax legislation, anecdotal experiences, or politicized rhetoric. For example, assertions that Virginia’s income tax is among the highest nationally have persisted despite data indicating that it ranks mid-tier within the spectrum of U.S. states. Other myths stem from confusion about tax brackets, deductions, and credits. The complexity of Virginia’s tax code, which has evolved through multiple amendments over decades, breeds misunderstandings. Add to this the influence of special interest lobbying and populist narratives, and it becomes apparent why myths continue to proliferate among residents and media commentators.

Myth 1: Virginia Has the Highest Income Tax Rates in the U.S.

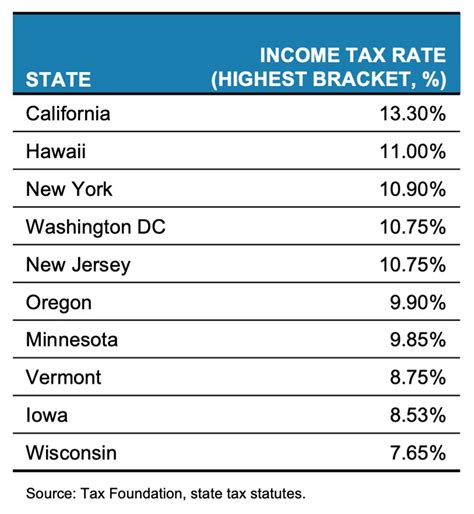

One of the most persistent misconceptions is that Virginia’s income tax rates rank among the highest nationwide. As of the latest fiscal adjustments, Virginia’s top marginal income tax rate is 5.75%, applicable to income exceeding approximately 17,000 for single filers and 34,000 for joint filings. When compared with states like California (up to 13.3%) or New York (up to 10.9%), Virginia’s rates appear modest. Nevertheless, the myth often arises from comparing the top bracket without contextualizing the actual income thresholds or considering effective tax burdens after credits and deductions.

| Relevant Category | Substantive Data |

|---|---|

| Virginia Top Marginal Tax Rate | 5.75% (for income over $17,000) |

| US State with Highest Top Marginal Rate | California at 13.3% |

| Average State Income Tax Rate (effective) | Around 4-6% |

Reassessment of the Myth

It is critical to contextualize Virginia’s tax rates within the national landscape. The top marginal rate applies only to a small percentage of high-income earners; the majority of Virginians face considerably lower effective tax rates. Furthermore, tax brackets are progressive, meaning many middle-income taxpayers pay significantly less than the top marginal rate. This nuanced understanding guards against overgeneralization and helps clarify the true tax experience in Virginia.

Myth 2: Virginia Offers Massive Tax Deductions and Loopholes

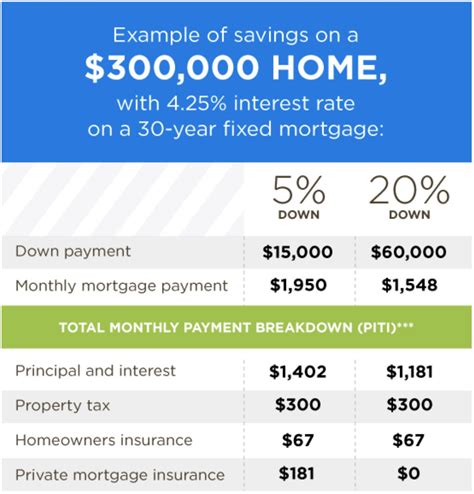

This myth suggests that Virginia residents benefit from extensive deductions and loopholes that significantly reduce their tax liabilities. While it is true that various deductions—such as those for mortgage interest, charitable contributions, and retirement savings—are available, the idea of widespread loopholes that drastically lower tax burdens is overstated. Virginia’s tax code aligns with federal standards, and many deductions mirror those available at the national level, with some state-specific adjustments.

The Reality of Deductions and Credits

Virginia provides several notable tax credits and deductions, but they are calibrated to encourage responsible fiscal behavior rather than offer endless loopholes. For example, the state offers credits for certain disabled veterans, renewable energy investments, and efforts aimed at local economic development. Table 1 summarizes some of these provisions:

| Relevant Category | Substantive Data |

|---|---|

| Major Virginia Tax Deductions | Mortgage interest, student loan interest, charitable contributions |

| Popular Virginia Tax Credits | Solar energy, veteran-related credits, local enterprise zone credits |

| Limitations | Caps on itemized deductions, income phase-outs for some credits |

Implication for Taxpayers

By emphasizing responsible use of available deductions and credits, Virginians can legitimately optimize their tax liabilities. Overstating loopholes not only distorts reality but can also discourage compliance and foster mistrust in the tax system.

Myth 3: The Virginia Income Tax Is a Bad Deal for Low and Middle-Income Earners

This myth suggests that the tax structure disproportionately burdens lower and middle-income households, pushing them into economic hardship. Yet, Virginia’s phased tax brackets and broad exemptions demonstrate a progressive structure designed to mitigate such concerns. For instance, the standard deduction—roughly 8,000 for single filers and 16,000 for joint filers—significantly reduces taxable income for the majority of middle-income households. Moreover, the state’s credits for earned income and qualified dependents aim to alleviate tax burdens on these groups.

Analyzing the Actual Burden

Data from the Virginia Department of Taxation indicates that the effective tax rate for middle-income earners hovers below 3%, significantly lower than the rates faced at higher income levels. Furthermore, policy adjustments over the years have focused on fairness, including expanded credits and exemptions. Understanding actual tax liabilities through detailed, data-driven analysis dispels the myth that Virginia disproportionately penalizes lower-income residents.

| Relevant Category | Substantive Data |

|---|---|

| Median Household Income in Virginia | $76,000 (2022) |

| Effective Tax Rate for Middle Income | Approximately 2-3% |

| Progressivity of Virginia Tax System | Gradual brackets from 2% to 5.75% |

Final Perspective on the Myth

Far from being an oppressive system, Virginia’s income tax structure incorporates checks and balances aimed at fairness. The myth of undue burden on lower or middle-income families diminishes once the actual data is scrutinized, underscoring the importance of nuanced tax literacy for residents and policymakers alike.

Concluding Synthesis: Navigating Virginia’s Income Tax Landscape

The array of myths surrounding Virginia’s income tax system illustrates a broader challenge facing many states: translating complex legislation into accessible, accurate public understanding. While myths about high rates, widespread loopholes, and disproportionate burdens persist, empirical data from the Virginia Department of Taxation and comparative national analysis underscore a more nuanced reality—a system that is progressively structured, with targeted credits and manageable rates designed to balance revenue needs with fairness.

In a climate where tax policy continually evolves due to economic shifts and political priorities, staying informed is the best strategy. Understanding the true nature of Virginia’s income tax—its rates, credits, and structure—equips citizens not just to comply but to advocate for policies that reflect their economic reality and societal values. Dispelling myths with credible data and analysis is a step toward a more transparent and equitable tax system, ensuring that everyone from individuals to policymakers navigates its complexities with clarity and confidence.