Sales Tax Missouri

Understanding sales tax is crucial for both businesses and consumers in Missouri. This comprehensive guide will delve into the intricacies of sales tax in the Show-Me State, covering its history, current regulations, and how it impacts various industries and daily transactions. From online sales to special tax rates, we'll explore the key aspects of Missouri's sales tax system and its implications.

A Deep Dive into Missouri Sales Tax

Sales tax in Missouri is a critical component of the state's revenue stream, with a rich history dating back to the early 20th century. The state's sales tax system has evolved over the years, adapting to changing economic landscapes and consumer behaviors. As of 2023, Missouri's sales tax landscape is a dynamic mix of state, county, and local taxes, with rates varying across the state.

The Evolution of Sales Tax in Missouri

Missouri's journey with sales tax began in the 1930s, with the primary objective of generating revenue for the state government. The initial sales tax rate was 2%, a far cry from the current rates. Over the decades, the state has seen several amendments and adjustments to its sales tax laws, with the most recent significant change occurring in 2021.

The Missouri Revised Statutes Chapter 144 outlines the state's sales tax regulations. This chapter defines taxable goods and services, provides guidelines for tax exemptions, and sets the framework for collection and remittance of sales tax. It is a crucial reference for businesses and taxpayers alike.

Key Aspects of Missouri's Sales Tax

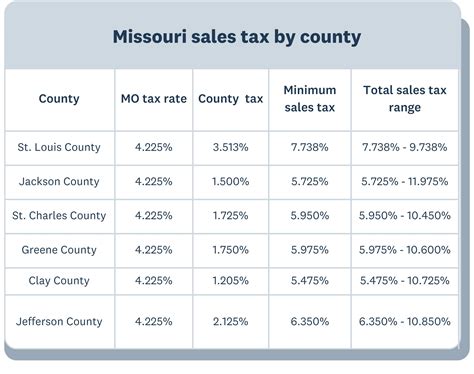

Missouri's sales tax is a combined state and local tax, with the state levying a uniform sales tax rate across the state and local jurisdictions adding their own taxes on top of it. This structure means that sales tax rates can vary significantly from one area to another.

As of 2023, the statewide sales tax rate in Missouri is 4.225%. This rate includes the state's general sales tax rate of 4.225% and a local tax rate of 0%, which is the lowest possible local tax rate in the state. However, counties and municipalities can impose additional taxes, which can increase the sales tax rate to as high as 10.475% in certain areas.

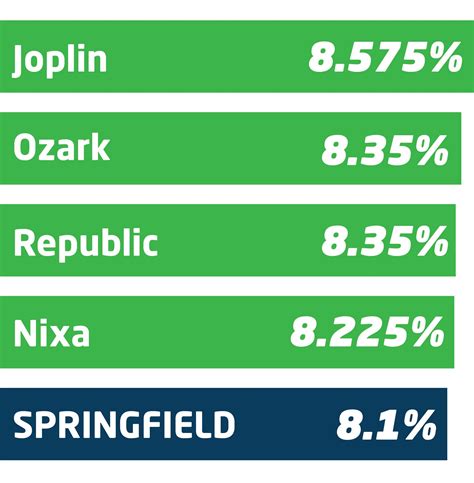

Here's a breakdown of the sales tax rates in some major cities in Missouri:

| City | Total Sales Tax Rate |

|---|---|

| Kansas City | 8.725% |

| St. Louis | 9.425% |

| Springfield | 7.725% |

| Columbia | 7.475% |

These varying rates can have a significant impact on businesses and consumers. For instance, a business located in Kansas City might have to collect and remit a higher sales tax rate than a similar business in Columbia, leading to potential pricing differences and consumer behavior shifts.

Special Tax Rates and Exemptions

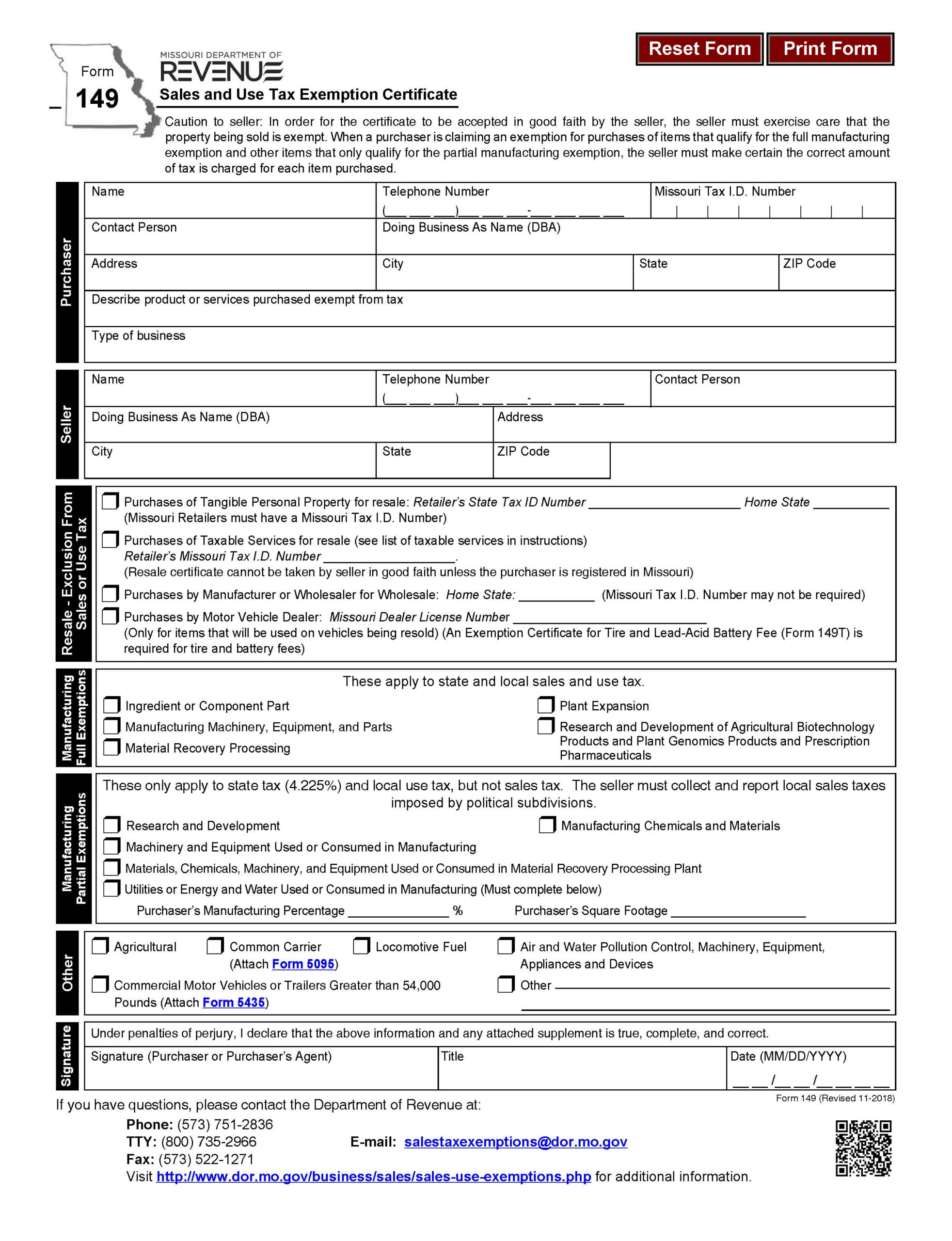

Missouri's sales tax system also includes several special tax rates and exemptions. These are designed to promote specific industries, support local economies, or provide tax relief to certain sectors.

- The state offers a reduced sales tax rate of 1.225% on qualifying food items, such as unprepared food, dairy products, and baby food. This rate does not apply to soft drinks, candy, or prepared foods.

- Certain prescription drugs and medical devices are exempt from sales tax, providing a significant benefit to individuals with medical needs.

- There is a temporary sales tax holiday in Missouri, typically occurring in August. During this period, specific items like school supplies, clothing, and computers are exempt from sales tax, offering a boost to back-to-school shopping.

These special rates and exemptions can be a boon for both consumers and businesses, encouraging spending and supporting specific industries.

Online Sales and Remote Sellers

With the rise of e-commerce, the sales tax landscape has become increasingly complex. Missouri, like many other states, has laws in place to address the collection of sales tax from online and remote sellers.

The Missouri Use Tax comes into play when goods are purchased from out-of-state vendors and brought into Missouri. This tax ensures that even online purchases are subject to the state's sales tax regulations. Remote sellers with substantial nexus in Missouri are required to register with the state and collect and remit sales tax on their Missouri sales.

Missouri also has a Marketplace Facilitator Law, which requires online marketplaces and third-party sellers to collect and remit sales tax on their transactions. This law ensures that even sellers without a physical presence in the state contribute to the state's revenue.

Compliance and Enforcement

Ensuring compliance with Missouri's sales tax regulations is a critical aspect for businesses. The Missouri Department of Revenue is responsible for enforcing sales tax laws and regulations. They provide guidance and resources to help businesses understand their sales tax obligations and ensure they are compliant.

The Department of Revenue conducts audits to verify that businesses are correctly calculating and remitting sales tax. These audits can be complex and time-consuming, so it's essential for businesses to maintain accurate records and have a clear understanding of their sales tax responsibilities.

The Impact on Businesses and Consumers

Missouri's sales tax system has a significant impact on both businesses and consumers. For businesses, sales tax can be a complex and time-consuming aspect of operations. From calculating the correct tax rate to remitting taxes to the appropriate jurisdictions, sales tax compliance requires dedicated resources and attention.

For consumers, sales tax adds to the cost of goods and services. The varying rates across the state can lead to price differences, influencing shopping behaviors and preferences. Additionally, the special tax rates and exemptions can provide financial benefits to certain groups, such as those purchasing food or medical supplies.

Frequently Asked Questions

How often does Missouri update its sales tax rates and regulations?

+Missouri's sales tax rates and regulations are not updated frequently. Major changes typically occur every few years, with the last significant amendment happening in 2021. However, it's essential to stay updated on any minor adjustments or special provisions that might impact your business or transactions.

Are there any plans to simplify Missouri's sales tax system?

+Simplifying Missouri's sales tax system is a topic of ongoing discussion among lawmakers and tax professionals. While there are no immediate plans for a major overhaul, efforts are being made to improve clarity and consistency in the system, particularly for online sellers and remote transactions.

How can I stay updated on Missouri's sales tax changes and news?

+The best way to stay informed is by regularly checking the Missouri Department of Revenue's website, which provides the latest news, updates, and resources related to sales tax. You can also subscribe to their email updates or follow them on social media for timely notifications.

Are there any resources available to help businesses calculate and remit sales tax in Missouri?

+Absolutely! The Missouri Department of Revenue offers a range of resources, including guides, calculators, and webinars, to assist businesses in understanding and complying with sales tax regulations. These resources can be particularly helpful for new businesses or those expanding into new jurisdictions within Missouri.

What happens if a business fails to collect or remit sales tax in Missouri?

+Failing to collect or remit sales tax in Missouri can result in penalties and interest charges. The Missouri Department of Revenue has a strict enforcement process, and businesses found in violation may face significant financial consequences. It's crucial for businesses to prioritize sales tax compliance to avoid these issues.

Missouri’s sales tax system is a vital component of the state’s economy, impacting businesses and consumers alike. By understanding the intricacies of this system, businesses can ensure compliance and consumers can make informed purchasing decisions. As the state’s economy evolves, so too will its sales tax regulations, making it essential to stay informed and adaptable.