Tax Code 570

Welcome to a comprehensive exploration of Tax Code 570, a vital component of the tax landscape for businesses and individuals alike. This article aims to delve into the intricacies of this code, shedding light on its purpose, application, and impact on financial strategies. As we navigate the complex world of taxation, we'll uncover the nuances that make Tax Code 570 a critical consideration for many taxpayers.

Understanding Tax Code 570: A Comprehensive Overview

Tax Code 570, an essential aspect of tax law, serves as a pivotal guide for businesses and individuals navigating their financial obligations. This code, often overlooked by those unfamiliar with intricate tax details, plays a significant role in determining tax liabilities and shaping financial strategies.

At its core, Tax Code 570 addresses the complexities of capital gains taxation. It delineates the rules and regulations governing the taxation of profits or gains arising from the sale or exchange of capital assets, such as stocks, bonds, real estate, and other investment properties. This code is a critical tool for taxpayers, offering clarity and structure in managing their capital gains tax liabilities.

The intricacies of Tax Code 570 extend beyond simple tax calculation. It involves understanding the classification of assets as capital and the determination of their holding period – short-term or long-term. The holding period is a critical factor in tax calculation, as it influences the applicable tax rates and the complexity of the tax return.

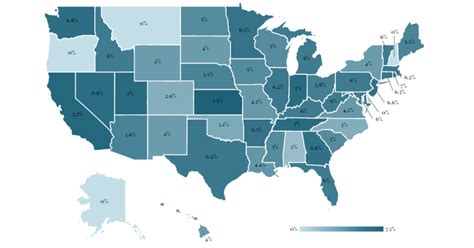

Moreover, Tax Code 570 introduces the concept of capital gains tax rates, which can vary based on the taxpayer's income level and the type of asset sold. These rates can significantly impact the overall tax liability, making it a crucial consideration in financial planning.

For businesses, Tax Code 570 is particularly relevant when dealing with corporate assets and business investments. It guides them in managing their capital gains tax obligations, ensuring compliance with the law, and optimizing their tax strategies. For individuals, this code is a roadmap for navigating the often-complex world of investment and asset management, offering a structured approach to minimize tax liabilities.

Key Considerations under Tax Code 570

Navigating Tax Code 570 requires an understanding of several key considerations. Firstly, taxpayers must grasp the tax treatment of different asset types, as each may have unique rules and rates. For instance, the tax implications of selling a piece of real estate differ significantly from those of selling stocks or bonds.

Secondly, taxpayers should be aware of the tax benefits and deductions available under this code. These benefits can offset tax liabilities, making it crucial to explore and utilize them effectively. From cost basis adjustments to carryover losses, these deductions can provide significant tax savings.

Thirdly, taxpayers should consider the tax planning strategies associated with Tax Code 570. This may involve timing asset sales to take advantage of lower tax rates or holding assets for a specific period to qualify for long-term capital gains rates. Effective tax planning under this code can result in substantial tax savings and improved financial outcomes.

Lastly, it's essential to recognize the potential tax traps and pitfalls within this code. Misunderstanding or overlooking certain aspects can lead to costly mistakes. For instance, failing to report capital gains accurately or misclassifying assets can result in audits and penalties. Staying informed and seeking professional guidance can help navigate these challenges effectively.

Real-World Application of Tax Code 570

The application of Tax Code 570 is widespread and diverse, impacting a broad range of taxpayers. For businesses, it's a critical tool for managing their capital investments and ensuring compliance with tax laws. By understanding this code, businesses can optimize their tax strategies, reduce liabilities, and improve their financial performance.

Individuals, particularly those with substantial investment portfolios, rely on Tax Code 570 to manage their capital gains tax obligations. From understanding the tax implications of selling a home to navigating the complexities of investment income, this code provides a structured approach to tax planning. By utilizing the code effectively, individuals can minimize their tax liabilities and maximize their financial returns.

Moreover, Tax Code 570 is a vital consideration for those engaging in real estate transactions. Whether it's buying, selling, or investing in real estate, understanding the tax implications is crucial. This code guides taxpayers in navigating the tax landscape, ensuring they make informed decisions and manage their tax obligations effectively.

| Asset Type | Capital Gains Tax Rate |

|---|---|

| Stocks and Bonds | Varies based on holding period and income level |

| Real Estate | Long-term capital gains rate for assets held over 1 year |

| Art and Collectibles | 28% tax rate for assets held less than a year |

In addition to its direct tax implications, Tax Code 570 influences other financial decisions. For instance, it can impact the timing of asset sales, the choice of investment strategies, and even the decision to enter certain business ventures. Understanding this code is not just about tax compliance but also about leveraging it to make informed financial choices.

Future Implications and Conclusion

As we conclude our exploration of Tax Code 570, it's evident that this code is a critical component of the tax landscape. Its influence extends far beyond simple tax calculation, shaping financial strategies and impacting a wide range of taxpayers.

Looking ahead, the future implications of Tax Code 570 are significant. With ongoing discussions around tax reform and the potential for changes in tax laws, staying informed about this code is more important than ever. Taxpayers must be vigilant in monitoring updates and amendments to ensure they remain compliant and can adapt their financial strategies accordingly.

Furthermore, as the economy and investment landscape continue to evolve, so too will the application and impact of Tax Code 570. Taxpayers and businesses must stay agile, utilizing the code's provisions to their advantage while navigating potential challenges and opportunities. This may involve adjusting investment strategies, exploring new tax-efficient approaches, or seeking professional guidance to stay ahead of the curve.

In conclusion, Tax Code 570 is a vital tool for taxpayers, offering a structured approach to managing capital gains tax liabilities. By understanding its intricacies, taxpayers can optimize their financial strategies, minimize tax obligations, and make informed decisions. As we navigate the complex world of taxation, this code serves as a guiding light, ensuring compliance, and facilitating effective financial management.

Frequently Asked Questions

What is the primary purpose of Tax Code 570?

+

Tax Code 570 primarily serves to guide taxpayers in understanding and managing their capital gains tax obligations. It provides a structured framework for calculating tax liabilities on profits or gains from the sale or exchange of capital assets, ensuring compliance with tax laws and offering opportunities for effective tax planning.

How does Tax Code 570 impact individuals with investment portfolios?

+

For individuals with investment portfolios, Tax Code 570 is a critical tool for managing their capital gains tax liabilities. It guides them in understanding the tax implications of their investment decisions, helping them minimize tax obligations and maximize financial returns. Effective utilization of this code can lead to substantial tax savings and improved portfolio performance.

What are some common tax benefits or deductions available under Tax Code 570?

+

Tax Code 570 offers several tax benefits and deductions to offset capital gains tax liabilities. These include cost basis adjustments, carryover losses, and the potential for lower tax rates on long-term capital gains. These benefits can significantly reduce tax obligations and improve financial outcomes.

How can taxpayers stay informed about changes to Tax Code 570?

+

Staying informed about changes to Tax Code 570 is crucial for effective tax planning and compliance. Taxpayers can monitor updates and amendments by subscribing to tax law newsletters, following reputable tax law blogs or websites, and consulting with tax professionals or financial advisors. Staying vigilant ensures they can adapt their strategies accordingly.