Monongalia County Tax Records

Welcome to this comprehensive guide exploring the intricacies of Monongalia County's tax records. In this article, we will delve into the specific details, historical context, and practical implications of the tax system in this region. By understanding the unique characteristics of Monongalia County's tax records, we can gain valuable insights into the financial landscape and its impact on the local community.

Unveiling the Tax Landscape of Monongalia County

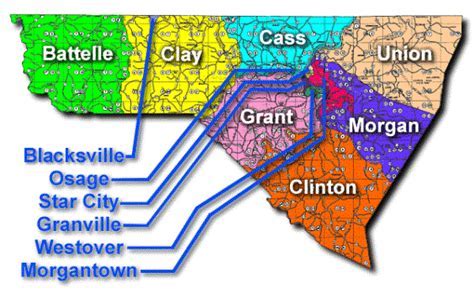

Monongalia County, nestled in the heart of West Virginia, boasts a rich history and a vibrant community. The tax records of this county hold a wealth of information, offering a glimpse into the economic dynamics and the unique challenges faced by its residents. Let’s explore the key aspects and uncover the stories hidden within these records.

A Historical Perspective on Tax Records

The history of taxation in Monongalia County dates back to the early 19th century when the region was still a part of Virginia. Over the years, the tax system has evolved, adapting to the changing needs and demographics of the county. Understanding the historical context provides a foundation for analyzing the current tax landscape and its impact on the community’s development.

One notable event in the county's tax history was the Great Depression, which left a profound mark on the financial well-being of its residents. During this period, tax records reflect the struggles faced by landowners and businesses, with many properties going into foreclosure. It is through these historical records that we can appreciate the resilience and adaptation of the community in the face of economic adversity.

Tax Assessment and Valuation Methods

The process of tax assessment in Monongalia County involves a meticulous evaluation of properties to determine their fair market value. The county utilizes a combination of appraisal techniques and market data to ensure accurate assessments. This approach takes into account factors such as location, size, improvements, and recent sales in the area.

For instance, consider the case of residential properties in the historic district of Morgantown. These homes, with their unique architectural styles, are assessed based on their historical significance and potential for restoration. The county's tax records capture the detailed information needed to fairly value these properties, ensuring a balanced tax burden for the homeowners.

| Assessment Category | Evaluation Criteria |

|---|---|

| Residential | Size, condition, location, and recent sales |

| Commercial | Income potential, location, and comparable rentals |

| Agricultural | Soil quality, irrigation, and productivity |

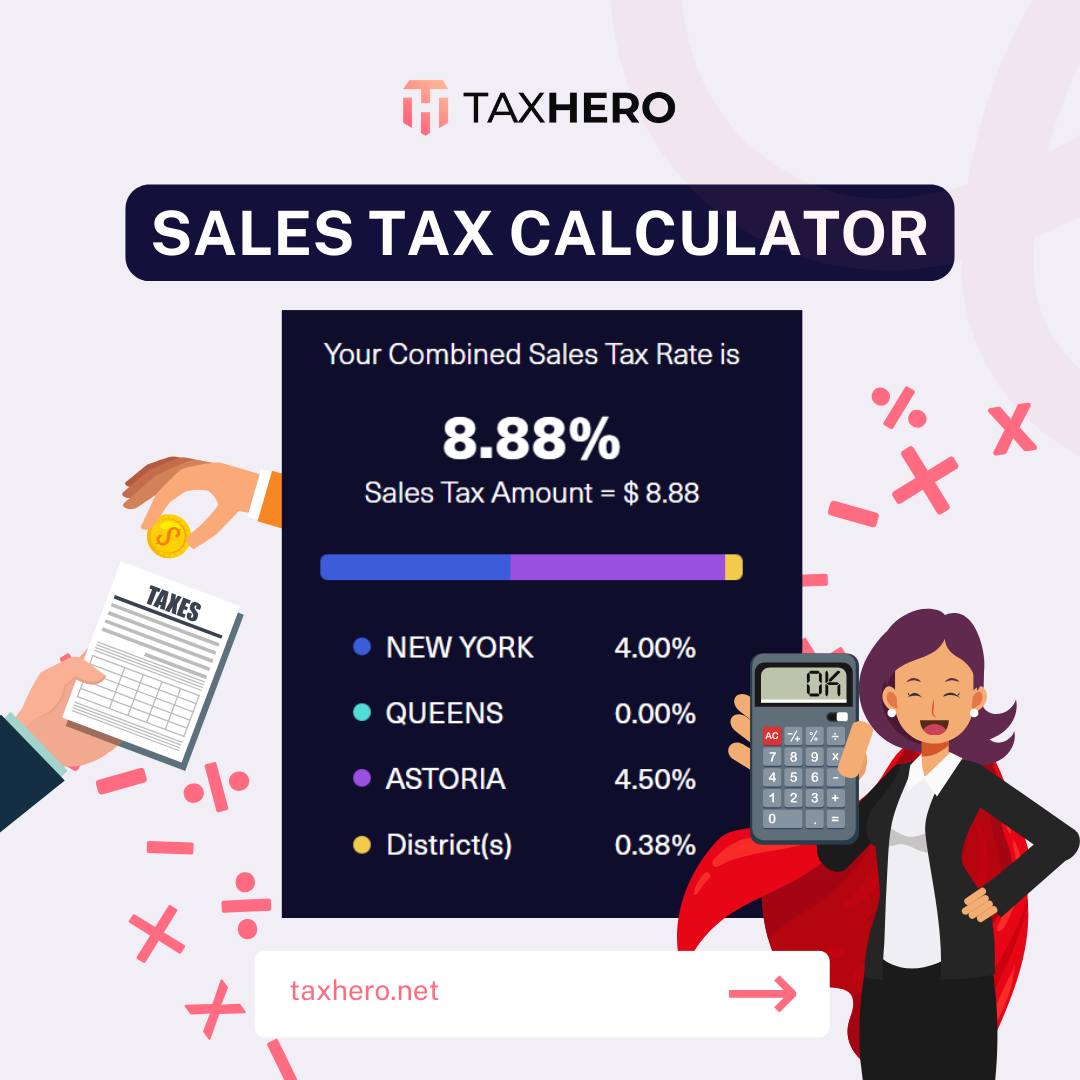

Tax Rates and Revenue Distribution

The tax rates in Monongalia County are determined by a combination of factors, including the needs of the local government and the community’s priorities. These rates are applied to the assessed values of properties, generating revenue for essential services such as education, infrastructure, and public safety.

A significant portion of the tax revenue is allocated to the Monongalia County School District, ensuring the education of the county's youth. The tax records reflect this allocation, showcasing the direct impact of tax dollars on the educational system and the overall development of the community's future generations.

Property Tax Exemptions and Incentives

Monongalia County offers various tax exemptions and incentives to promote economic growth and support specific sectors. These incentives aim to attract businesses, encourage property development, and foster community engagement.

- Homestead Exemption: Residents who meet certain criteria can apply for a homestead exemption, reducing their property tax burden and providing financial relief.

- Industrial Tax Abatements: The county may offer tax abatements to new businesses or those expanding their operations, providing a temporary reduction in taxes to stimulate economic activity.

- Historic Preservation Grants: To preserve the county's rich history, tax incentives are provided for the restoration and maintenance of historic properties, encouraging the preservation of architectural heritage.

Impact of Tax Records on Community Development

The tax records of Monongalia County play a crucial role in shaping the community’s future. By analyzing these records, stakeholders can identify trends, assess the effectiveness of tax policies, and make informed decisions to promote sustainable development.

For instance, a thorough examination of tax records can reveal the impact of tax incentives on business growth. By tracking the number of new businesses, job creation, and economic contributions, policymakers can refine their strategies to attract and retain businesses, ultimately benefiting the entire community.

Online Access and Transparency

In an effort to enhance transparency and accessibility, Monongalia County has implemented an online platform for tax records. Residents, businesses, and interested parties can now easily access property information, tax assessments, and payment details through a user-friendly interface.

This digital transformation not only improves efficiency but also empowers individuals to stay informed about their tax obligations and explore potential opportunities. The online platform also provides a historical record of tax transactions, offering a comprehensive view of the county's financial landscape.

FAQs about Monongalia County Tax Records

How often are property tax assessments conducted in Monongalia County?

+

Property tax assessments are typically conducted every three years in Monongalia County. However, certain circumstances, such as significant improvements or changes in property value, may trigger an interim assessment.

Can I appeal my property tax assessment if I disagree with the valuation?

+

Yes, Monongalia County provides a formal appeal process for property owners who wish to challenge their tax assessments. It is important to review the guidelines and deadlines for submitting an appeal.

Are there any tax incentives for renewable energy projects in the county?

+

Absolutely! Monongalia County supports the development of renewable energy by offering tax incentives for projects such as solar installations and wind farms. These incentives aim to promote sustainability and reduce the carbon footprint of the community.

How can I access my tax records and payment history online?

+

You can access your tax records and payment history through the Monongalia County website. Simply navigate to the “Tax Records” section, enter your property details, and you will be able to view your information securely.

By delving into the specifics of Monongalia County’s tax records, we have uncovered the intricate relationship between taxation and community development. These records serve as a window into the financial health and potential of the county, guiding stakeholders in their decision-making processes. Stay informed, explore the records, and understand the vital role taxation plays in shaping the future of Monongalia County.