Is Life Insurance Tax Deductible

In the complex landscape of personal finance and taxation, understanding the deductibility of life insurance premiums is crucial for individuals seeking to optimize their financial strategies. This comprehensive guide delves into the intricacies of life insurance tax deductibility, offering a nuanced analysis of applicable laws and practical considerations.

Unraveling the Complexity: Life Insurance and Taxes

The question of whether life insurance premiums are tax deductible is a nuanced one, and the answer hinges on the specific type of life insurance policy and the purpose for which it is held. In the United States, the tax treatment of life insurance premiums varies, with different rules applying to different types of policies.

For individuals holding a personal life insurance policy, the premium payments are generally not tax deductible. This means that when you pay your life insurance premiums, you cannot claim them as a deduction on your federal income tax return. The Internal Revenue Service (IRS) considers these payments as a personal expense, much like paying for health insurance or other types of insurance.

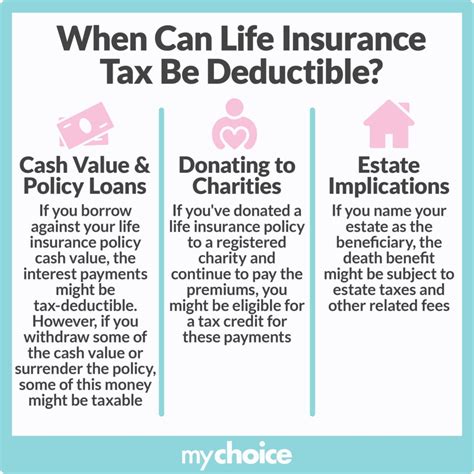

However, it's important to note that there are certain exceptions to this rule. If your life insurance policy is part of a qualified retirement plan, such as a 401(k) or an Individual Retirement Account (IRA), the premiums might be tax deductible. In these cases, the policy is often viewed as a retirement savings tool, and the premiums are considered a contribution to your retirement fund.

The Business Perspective: Tax Benefits for Employers

From a business perspective, the tax treatment of life insurance premiums can be more favorable. If an employer provides life insurance coverage as an employee benefit, the premiums paid by the company are generally tax deductible as a business expense. This means that businesses can claim these payments as a deduction on their corporate tax returns.

Furthermore, if an employer offers a group term life insurance policy to its employees, the first $50,000 of coverage per employee is tax-exempt. This means that the employer does not have to include the cost of this coverage in the employees' taxable income. This provision, outlined in Internal Revenue Code Section 79, is a significant benefit for both employers and employees.

Taxation of Life Insurance Proceeds

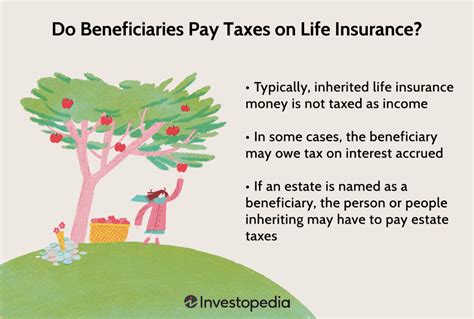

While the tax treatment of life insurance premiums is important, it’s also crucial to understand the taxation of life insurance proceeds, which are the death benefits paid out when the insured passes away.

In most cases, life insurance proceeds are tax-free for the beneficiaries. This means that the money received by the beneficiaries upon the insured's death is not considered taxable income and does not need to be reported on their income tax returns. This is a significant benefit of life insurance, as it provides a tax-efficient way to transfer wealth to loved ones.

However, there are certain exceptions to this rule as well. If the life insurance policy is part of an estate that exceeds the federal estate tax exemption amount, the proceeds might be subject to estate taxes. Additionally, if the policy is held in a trust, the tax treatment can become more complex, and the proceeds might be taxable depending on the trust's structure and purpose.

Life Insurance and Tax Planning Strategies

Understanding the tax implications of life insurance can open up opportunities for effective tax planning. Here are some strategies to consider:

Utilizing Life Insurance for Retirement Savings

For individuals, one strategy is to explore life insurance policies that offer a cash value component, such as whole life insurance or universal life insurance. These policies can be used as a tax-efficient retirement savings vehicle, especially for those who have already maximized their contributions to traditional retirement accounts.

Employer-Provided Life Insurance Benefits

Employers can leverage life insurance as an attractive employee benefit, offering a tax-deductible expense while providing valuable coverage to their workforce. This can enhance employee retention and satisfaction, particularly when coupled with other financial benefits.

Estate Planning and Life Insurance

Life insurance can be a crucial component of estate planning, helping to minimize estate taxes and ensure a smooth transfer of wealth to beneficiaries. By carefully structuring life insurance policies within an estate plan, individuals can protect their assets and provide for their loved ones in a tax-efficient manner.

Conclusion: Navigating the Complexities

The tax treatment of life insurance premiums and proceeds is a complex topic, with many nuances and exceptions. Whether you’re an individual, a business owner, or an estate planner, understanding these intricacies is essential for making informed financial decisions. By staying informed about the latest tax laws and consulting with financial advisors, you can navigate these complexities and make the most of the tax benefits offered by life insurance.

Can I Deduct Life Insurance Premiums as a Business Expense?

+Yes, if you’re an employer providing life insurance benefits to your employees, the premiums you pay are generally tax deductible as a business expense.

Are Life Insurance Proceeds Taxable for Beneficiaries?

+In most cases, life insurance proceeds are tax-free for beneficiaries. However, there are exceptions, such as when the policy is part of an estate exceeding the federal estate tax exemption amount.

What Are the Benefits of Life Insurance for Retirement Savings?

+Life insurance policies with a cash value component can be used as tax-efficient retirement savings vehicles, offering a way to save for retirement while potentially reducing taxable income.