Capital Gains Tax Florida

When it comes to managing your finances and investments, understanding the tax implications is crucial, especially in a state like Florida, which offers unique opportunities and considerations. One of the key aspects that investors and homeowners often navigate is Capital Gains Tax. In this comprehensive guide, we will delve into the specifics of Capital Gains Tax in Florida, providing you with the knowledge and insights needed to make informed decisions regarding your financial strategies.

Unraveling Capital Gains Tax in Florida

Capital Gains Tax is a critical component of the tax system, impacting individuals and businesses alike. It is levied on the profits or gains derived from the sale of capital assets, such as real estate, stocks, bonds, and other investments. Florida, with its vibrant economy and diverse investment opportunities, presents a unique landscape for understanding and managing capital gains.

The Basics of Capital Gains Tax

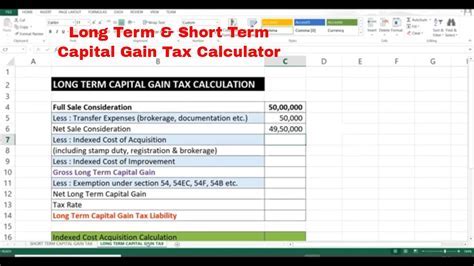

Capital gains are generally classified into two categories: short-term and long-term. Short-term capital gains refer to profits earned from assets held for less than a year, while long-term capital gains apply to assets held for a year or more. The distinction is significant, as tax rates and treatment vary based on this classification.

In Florida, like in many other jurisdictions, capital gains are subject to both federal and state taxes. The federal government imposes a progressive tax rate structure, with higher rates for higher income brackets. On the other hand, Florida has its own tax regulations, which we will explore in detail.

Florida’s Unique Tax Landscape

Florida boasts a unique tax environment, known for its absence of a state income tax. This makes it an attractive destination for individuals seeking tax-efficient investment opportunities. However, it is important to note that while there is no state income tax, capital gains are still subject to federal taxation.

The state of Florida recognizes the importance of fostering a business-friendly environment and has implemented measures to encourage investment. As a result, capital gains taxes in Florida are relatively straightforward and favorable compared to many other states.

| Capital Gains Type | Tax Rate |

|---|---|

| Short-Term Capital Gains | Same as Ordinary Income Tax Rates |

| Long-Term Capital Gains | 0% for certain income brackets 15% for higher income brackets |

The table above provides a simplified overview of the tax rates applicable to capital gains in Florida. It's important to consult with tax professionals for precise calculations based on individual circumstances.

Strategies for Minimizing Capital Gains Tax

For those looking to optimize their financial strategies, there are several strategies to consider when it comes to capital gains tax in Florida:

- Hold Periods: Understanding the distinction between short-term and long-term capital gains is crucial. Holding an asset for a year or more can result in more favorable tax treatment.

- Cost Basis Adjustments: Keep accurate records of the cost basis of your assets. Adjusting the cost basis for improvements or other relevant factors can impact your capital gains calculation.

- Tax-Efficient Investing: Explore investment options that offer tax advantages, such as retirement accounts or tax-efficient mutual funds. These can help minimize the impact of capital gains tax.

- Capital Losses: If you incur capital losses, they can be used to offset capital gains. This strategy can help reduce your overall tax liability.

Real-World Examples and Case Studies

To illustrate the practical implications of capital gains tax in Florida, let’s examine a few real-world scenarios:

- Real Estate Investment: Consider an individual who purchases a rental property in Florida. After holding it for several years, they decide to sell it for a profit. The long-term capital gains tax rate of 0% or 15% would apply, depending on their income bracket.

- Stock Market Trading: An active trader in Florida may frequently engage in short-term stock trades. The profits from these trades would be taxed at their ordinary income tax rate, which can be higher than long-term capital gains rates.

- Business Sale: A Florida-based business owner decides to sell their successful company. The capital gains tax on the sale proceeds would be subject to federal taxation, with rates varying based on the business’s structure and the owner’s income.

Expert Insights and Recommendations

💡 As a tax professional specializing in Florida’s unique tax landscape, I highly recommend consulting with a qualified accountant or tax advisor. They can provide personalized guidance based on your specific circumstances and help you navigate the intricacies of capital gains tax. Additionally, staying updated on any changes to tax laws and regulations is essential to ensure compliance and optimize your financial strategies.

Conclusion

Understanding the nuances of Capital Gains Tax in Florida is a vital aspect of financial planning and investment strategies. By familiarizing yourself with the tax rates, classifications, and potential strategies, you can make informed decisions to optimize your financial outcomes. Remember, while Florida offers a favorable tax environment, it is always prudent to seek professional advice to ensure compliance and maximize the benefits of your investments.

FAQ

How are capital gains calculated in Florida?

+Capital gains are calculated by subtracting the cost basis of the asset from the sale price. The resulting amount is then subject to the applicable tax rate, which depends on whether it’s a short-term or long-term capital gain.

Are there any exemptions or deductions for capital gains in Florida?

+Florida does not offer specific exemptions or deductions for capital gains. However, certain costs associated with the asset, such as improvements or legal fees, can be deducted from the cost basis, reducing the capital gains amount.

Can I offset capital gains with capital losses in Florida?

+Yes, you can offset capital gains with capital losses in Florida. This strategy allows you to reduce your overall tax liability by deducting capital losses from capital gains.