Home Renovations And Tax Deductions

Home renovations can be a significant investment, and many homeowners are eager to find ways to maximize the financial benefits. One area that often sparks curiosity is the potential for tax deductions associated with home improvement projects. In this article, we will delve into the world of home renovations and explore the possibilities of tax savings, providing you with a comprehensive guide to help you navigate the tax landscape.

Maximizing Tax Benefits: An Overview

When it comes to home renovations, understanding the tax implications can make a substantial difference in your overall financial planning. Tax deductions offer a strategic opportunity to reduce your taxable income, resulting in potential savings on your tax liabilities. While not all renovation expenses qualify for deductions, there are specific categories and circumstances where you can claim these benefits.

In this comprehensive guide, we will explore the key aspects of tax deductions related to home renovations, offering insights and strategies to help you make informed decisions. From understanding the eligibility criteria to maximizing your deductions, we will cover the essential information you need to navigate the tax landscape effectively.

Eligibility and Qualifying Expenses

Not all home renovation expenses are created equal when it comes to tax deductions. To claim deductions, your expenses must meet certain criteria and fall within specific categories recognized by tax authorities. Here are the key eligibility factors to consider:

1. Primary Residence Requirement

One of the fundamental requirements for claiming tax deductions on home renovations is that the property must be your primary residence. This means you must occupy the home as your primary dwelling for a significant portion of the year. Rental properties or vacation homes typically do not qualify for these deductions.

To meet this criterion, you should be able to demonstrate that you reside in the property for the majority of the year. This can be evidenced through utility bills, mail receipts, or other documentation that ties you to the residence.

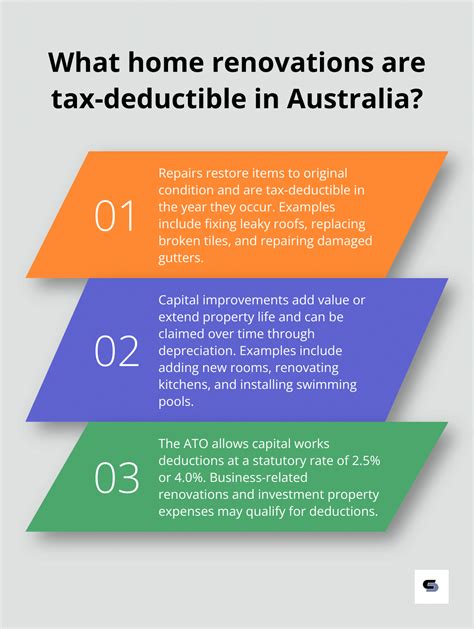

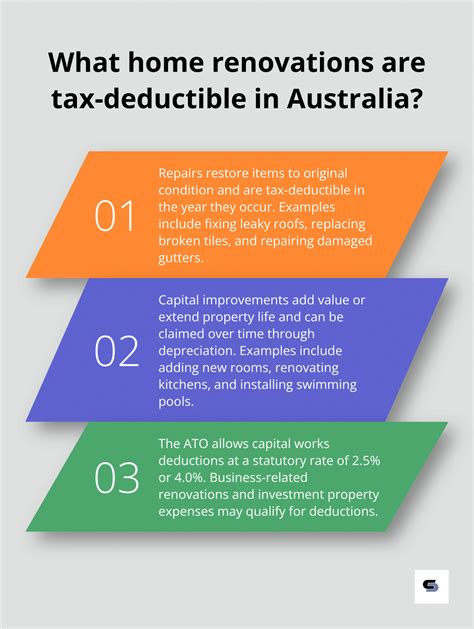

2. Capital Improvements vs. Repairs and Maintenance

Another crucial distinction when it comes to tax deductions is the difference between capital improvements and repairs or maintenance. Capital improvements are substantial renovations that increase the value of your home, prolong its useful life, or adapt it to new uses. These improvements are often permanent in nature and become part of the property itself.

On the other hand, repairs and maintenance refer to the upkeep and preservation of your home's current condition. While repairs and maintenance expenses do not typically qualify for deductions, they can be essential for maintaining the value and functionality of your property.

Some examples of capital improvements include:

- Adding a new room or expanding the existing space.

- Installing energy-efficient upgrades like solar panels or insulation.

- Upgrading plumbing, electrical systems, or roofing.

- Building a garage or converting an attic into living space.

3. Medical Expenses and Accessibility Modifications

If you or a family member have specific medical needs, certain home renovations that enhance accessibility or accommodate those needs may qualify for tax deductions. These modifications can include ramps, wheelchair lifts, widened doorways, or other adaptations that improve mobility and safety.

It's important to consult with a tax professional to ensure that your medical-related renovations meet the necessary criteria for deductions.

Tax Deduction Strategies

Now that we've covered the eligibility requirements, let's explore some strategic approaches to maximize your tax deductions on home renovations:

1. Plan Your Renovations Strategically

When considering home renovations, it's beneficial to plan your projects with tax deductions in mind. Evaluate the potential impact of different improvements on the value and functionality of your home. By prioritizing capital improvements over cosmetic upgrades, you can increase the chances of qualifying for tax deductions.

Additionally, consider spreading out your renovation expenses over multiple years. This can help you manage your tax liabilities and maximize your deductions over time.

2. Document and Track Expenses

Proper documentation is crucial when claiming tax deductions. Keep detailed records of all your renovation expenses, including receipts, invoices, and contracts. Ensure that these records clearly outline the nature of the work, the dates of the expenses, and the amounts paid.

Consider using a dedicated spreadsheet or tax software to track your expenses throughout the year. This will make it easier to organize and retrieve the necessary information when filing your taxes.

3. Consult with a Tax Professional

Navigating the complexities of tax deductions can be challenging, especially when it comes to home renovations. Consulting with a qualified tax professional or accountant can provide valuable guidance tailored to your specific circumstances.

A tax expert can help you understand the applicable tax laws, ensure you're claiming all eligible deductions, and advise you on any potential tax benefits or pitfalls associated with your renovation projects.

Case Studies: Real-World Examples

To illustrate the potential tax benefits, let's explore some real-world case studies of homeowners who successfully claimed tax deductions on their home renovations:

Case Study 1: Energy-Efficient Upgrades

Homeowner Profile: John and Sarah, a young couple living in a suburban home, decided to invest in energy-efficient upgrades to reduce their environmental impact and lower their utility costs.

Renovation Details: They installed solar panels, upgraded their insulation, and replaced old appliances with energy-efficient models.

Tax Benefits: By claiming the Residential Renewable Energy Tax Credit, they were able to deduct a significant portion of their renovation expenses, reducing their taxable income and saving them money on their taxes.

Case Study 2: Accessibility Modifications

Homeowner Profile: Emily, a homeowner with mobility challenges, wanted to make her home more accessible to accommodate her needs.

Renovation Details: She installed a wheelchair ramp, widened doorways, and modified her bathroom to include grab bars and a walk-in shower.

Tax Benefits: Through the Medical Expense Deduction, Emily was able to deduct a portion of her renovation costs, helping to offset the expenses associated with improving her home's accessibility.

Tax Deductions for Different Types of Renovations

The tax deductions available for home renovations can vary depending on the type of project and its purpose. Here's a breakdown of some common renovation categories and their associated tax benefits:

1. Energy-Efficient Upgrades

Energy-efficient renovations not only benefit the environment but can also provide tax incentives. Here are some examples:

- Solar Panels: Installing solar panels to generate clean energy can qualify for the Residential Renewable Energy Tax Credit, allowing you to deduct a percentage of the installation cost.

- Insulation: Upgrading insulation to improve energy efficiency may be eligible for the Nonbusiness Energy Property Credit, providing a tax credit for energy-saving measures.

- Energy-Efficient Appliances: Replacing old appliances with energy-efficient models may qualify for tax deductions or credits, encouraging homeowners to adopt more sustainable practices.

2. Home Office Renovations

If you work from home and have a dedicated home office, you may be able to claim deductions for certain renovation expenses related to that space. Here's what you need to know:

- Eligibility: To qualify, your home office must be used exclusively and regularly for business purposes. It should be your primary place of business or a designated area where you conduct a significant amount of business activity.

- Deductions: You can claim deductions for expenses related to the improvement, maintenance, and operation of your home office. This can include renovations such as adding built-in shelves, installing new flooring, or upgrading electrical wiring specifically for your office space.

3. Medical-Related Renovations

If you or a family member have specific medical needs, certain home renovations that enhance accessibility or accommodate those needs may qualify for tax deductions under the Medical Expense Deduction. Here are some examples:

- Ramps: Installing ramps to provide access for individuals with mobility challenges can be deducted as a medical expense.

- Doorway Modifications: Widening doorways or making other modifications to improve accessibility for individuals with disabilities may be eligible for tax deductions.

- Bathroom Adaptations: Renovating a bathroom to include grab bars, walk-in showers, or other features that enhance safety and mobility for individuals with medical conditions can be claimed as a medical expense.

Performance Analysis: Tracking the Impact of Renovations

To fully understand the financial benefits of your home renovations, it's essential to track and analyze their performance over time. Here's how you can assess the impact of your renovation projects:

1. Monitor Energy Savings

If you've invested in energy-efficient upgrades, keep track of your utility bills before and after the renovations. Calculate the difference in energy consumption and cost savings to determine the real-world impact of your improvements.

2. Property Value Appreciation

Capital improvements can increase the value of your home, making it a valuable asset. Consider getting an appraisal or comparing your property's value with similar homes in your area to gauge the impact of your renovations on its market value.

3. Long-Term Cost Savings

Renovations that improve the durability and longevity of your home can lead to long-term cost savings. For example, upgrading your roofing or replacing outdated plumbing can reduce the frequency and cost of future repairs.

| Renovation Type | Potential Cost Savings |

|---|---|

| Energy-Efficient Upgrades | Lower utility bills and tax deductions |

| Durable Improvements (e.g., roofing, plumbing) | Reduced maintenance and repair costs over time |

| Accessibility Modifications | Enhanced safety and improved quality of life |

Future Implications: Long-Term Financial Planning

When planning home renovations, it's crucial to consider the long-term financial implications. While tax deductions can provide immediate savings, there are other factors to keep in mind for sustainable financial management:

1. Budgeting and Financing

Renovations can be costly, so it's essential to create a detailed budget and explore financing options. Consider your financial goals and timeline to determine the most suitable approach for funding your projects.

2. Resale Value and Return on Investment

Some renovations can significantly increase your home's resale value, making it an attractive investment. However, it's important to strike a balance between personal preferences and market demand to ensure a positive return on your renovation investments.

3. Long-Term Maintenance

While renovations can enhance your home's value and functionality, they also come with ongoing maintenance responsibilities. Factor in the costs and time required for regular upkeep to maintain the quality and longevity of your renovations.

4. Tax Implications Over Time

Tax deductions for home renovations are typically claimed in the year the expenses are incurred. However, it's crucial to understand the long-term tax implications. Some renovations may affect your property taxes or capital gains taxes when selling your home.

Consult with tax professionals to ensure you're aware of any potential tax consequences and plan accordingly.

FAQs: Common Questions About Home Renovation Tax Deductions

Can I claim tax deductions for cosmetic renovations, such as painting or landscaping?

+Cosmetic renovations generally do not qualify for tax deductions. These types of improvements are considered personal expenses and are not typically deductible. Focus on capital improvements that add value to your home and meet the eligibility criteria for deductions.

Are there any tax benefits for homeowners who install energy-efficient appliances or make energy-saving upgrades?

+Yes, there are tax incentives available for energy-efficient upgrades. The Residential Renewable Energy Tax Credit and the Nonbusiness Energy Property Credit are two examples of tax benefits that encourage homeowners to adopt energy-saving measures. These credits can provide significant savings on your tax liabilities.

Can I claim tax deductions for renovations related to my home office space?

+Yes, if you have a dedicated home office that meets certain criteria, you may be eligible for tax deductions. These deductions can cover expenses related to the improvement, maintenance, and operation of your home office space. However, it's important to ensure that your home office is used exclusively and regularly for business purposes to qualify.

What if I'm a renter? Are there any tax benefits for renters who make improvements to their rental property?

+Unfortunately, tax deductions for home renovations are generally limited to homeowners. Renters typically cannot claim deductions for improvements made to their rental properties. However, it's important to note that renters may be able to negotiate with their landlords to have some renovation costs included in their rental agreement.

Are there any tax deductions available for homeowners who install solar panels or other renewable energy systems?

+Yes, installing solar panels or other renewable energy systems can qualify for tax deductions or credits. The Residential Renewable Energy Tax Credit provides a tax credit for a percentage of the installation costs, making it an attractive option for homeowners looking to go green and save on taxes.

Home renovations offer an opportunity to enhance your living space and potentially reduce your tax liabilities. By understanding the eligibility criteria, planning strategically, and consulting with tax professionals, you can navigate the tax landscape effectively and make the most of the available deductions. Remember, proper documentation and staying updated with tax regulations are key to maximizing your tax benefits.