Non Refundable Tax Credit

Welcome to an in-depth exploration of the Non-Refundable Tax Credit (NRTC), a complex yet vital component of many tax systems worldwide. This article aims to demystify this financial concept, offering a comprehensive understanding of its workings and implications. Through a detailed analysis, we will uncover the intricacies of NRTC, its role in tax strategies, and its impact on individual taxpayers and businesses.

Unraveling the Non-Refundable Tax Credit

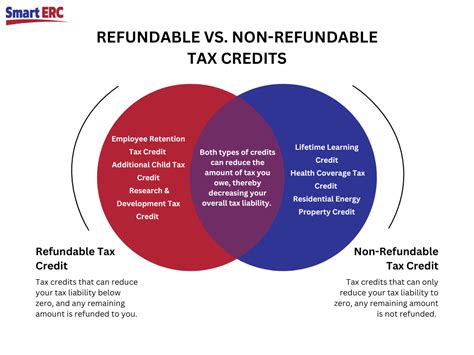

The Non-Refundable Tax Credit is a financial mechanism designed to reduce an individual’s or entity’s tax liability, providing a credit against the taxes they owe. Unlike its refundable counterpart, the NRTC cannot result in a refund if the credit exceeds the taxpayer’s liability. Instead, it serves as a direct reduction of the tax amount due, offering a strategic advantage in tax planning.

Key Features and Mechanics

NRTCs are typically tied to specific expenses, activities, or characteristics of the taxpayer. For instance, credits may be available for educational expenses, energy-efficient home improvements, or certain types of investments. Each jurisdiction may have unique credits, reflecting its priorities and policies.

The process of claiming an NRTC involves identifying applicable credits and ensuring that all eligibility criteria are met. Taxpayers must carefully review their circumstances and relevant tax laws to maximize the benefits. Some credits may require additional documentation or verification, adding a layer of complexity to the tax filing process.

| NRTC Example | Description |

|---|---|

| Child Care Credit | Provides a credit for expenses related to childcare, encouraging workforce participation and supporting families. |

| Research & Development Credit | Rewards businesses for investing in research and development activities, fostering innovation and competitiveness. |

| Energy Efficiency Credit | Encourages homeowners to adopt energy-efficient measures, reducing environmental impact and long-term costs. |

Strategic Benefits and Considerations

Non-Refundable Tax Credits offer a strategic opportunity for taxpayers to reduce their tax liability without the need for a refund. This can be particularly advantageous for individuals or businesses with consistent tax obligations, as the credits can be applied directly to offset their annual tax bills. For instance, a business investing in research and development may benefit from the associated NRTC, lowering their tax burden and freeing up resources for further innovation.

However, NRTCs also present challenges. The non-refundable nature means that taxpayers must have sufficient tax liability to utilize the credit fully. Those with lower incomes or tax obligations may find it difficult to take advantage of these credits, potentially creating an imbalance in the tax system. Additionally, the complexity of NRTCs and their varying eligibility criteria can be a hurdle for taxpayers, requiring a deep understanding of tax laws and often the assistance of tax professionals.

Real-World Applications and Impact

The influence of NRTCs extends far beyond individual tax returns, shaping economic policies and behaviors at a societal level.

Encouraging Desirable Behaviors

Many NRTCs are designed with a specific social or economic goal in mind. For example, credits for educational expenses or childcare aim to encourage personal development and workforce participation. Similarly, energy efficiency credits promote environmentally conscious practices. By offering financial incentives, these credits steer individuals and businesses toward behaviors that align with societal objectives.

Shaping Business Decisions

For businesses, NRTCs can be a significant factor in strategic decision-making. Credits related to research and development, for instance, can encourage companies to allocate more resources to innovation, potentially leading to new products, services, or processes. Similarly, credits for job creation or investment in certain industries can influence business expansion plans, shaping the economic landscape.

Community Development and Investment

NRTCs can also be a tool for community development and investment. Credits targeting specific regions or industries can encourage economic growth in underserved areas, fostering job creation and business opportunities. This targeted approach to tax incentives can have a profound impact on local economies, attracting investment and talent.

Future Implications and Trends

As tax systems evolve, the role and design of NRTCs are likely to change as well. Here are some key trends and potential future developments to watch for:

- Digitalization of Tax Systems: With the rise of digital technologies, tax systems are becoming more efficient and transparent. This trend may lead to more streamlined processes for claiming NRTCs, potentially reducing the complexity and documentation requirements.

- Sustainability Focus: As environmental concerns continue to rise, we can expect to see an increased emphasis on NRTCs related to sustainability and green practices. Governments may offer more incentives for individuals and businesses to adopt eco-friendly measures.

- Targeted Credits for Social Issues: In response to social challenges, governments may introduce new NRTCs to address specific issues. For example, credits could be introduced to support mental health initiatives, combat homelessness, or promote digital literacy.

- International Harmonization: As global trade and investment continue to grow, there may be a push for international harmonization of tax policies, including NRTCs. This could simplify tax strategies for multinational businesses and individuals with global investments.

Can NRTCs be carried forward to future tax years if not fully utilized in one year?

+Yes, some NRTCs can be carried forward to future tax years, allowing taxpayers to utilize the credit when they have sufficient tax liability. However, the rules and limitations vary by jurisdiction and credit type, so it's important to consult with tax professionals or refer to official tax guidelines.

Are NRTCs available for all taxpayers, or are they restricted to certain income levels or circumstances?

+NRTCs are typically designed to be broadly applicable, but their availability and eligibility may depend on various factors, including income level, residency status, and specific circumstances. It's essential to review the eligibility criteria for each credit to determine if you qualify.

How can taxpayers stay informed about the latest NRTCs and changes in tax laws?

+Tax laws and NRTCs can change frequently, so it's crucial to stay informed. Tax professionals and reputable tax resources can provide up-to-date information. Additionally, many tax authorities provide online resources and updates to keep taxpayers informed about new credits and changes.

The Non-Refundable Tax Credit is a powerful tool in the tax landscape, offering both opportunities and challenges for taxpayers. As we navigate the complexities of tax strategies, understanding the role and impact of NRTCs is essential for making informed financial decisions. Whether you’re an individual taxpayer, a business owner, or a policy advocate, the insights provided here can guide you toward effective tax planning and a deeper understanding of the tax system’s intricacies.