Wa Liquor Tax

In the state of Washington, the liquor tax is a significant aspect of the alcohol industry, influencing both businesses and consumers. Officially known as the Spirits and Wine Tax, this tax is a vital revenue source for the state government and plays a crucial role in regulating the sale and distribution of alcoholic beverages. This article aims to delve into the intricacies of the WA Liquor Tax, exploring its history, current structure, impact on the industry, and potential future developments.

History and Evolution of the WA Liquor Tax

The journey of the WA Liquor Tax began with the end of Prohibition in the United States. In 1933, the 21st Amendment to the U.S. Constitution repealed the nationwide ban on alcohol, allowing states to regulate and tax the sale of liquor. Washington State promptly enacted its liquor control laws, establishing a framework for licensing and taxing alcoholic beverages.

Initially, the WA Liquor Tax was a straightforward excise tax, levied on the manufacturers or importers of alcoholic beverages. However, over the years, the tax structure has evolved to keep pace with the changing dynamics of the industry and the state's revenue needs.

One significant milestone in the tax's history was the privatization of liquor sales in Washington. Until 2012, the state-run liquor stores were the sole retailers of spirits and wine. With the privatization, the tax structure had to adapt to accommodate a more diverse and competitive market.

Today, the WA Liquor Tax is a complex system, designed to balance the state's revenue objectives with the need to regulate and control the sale of alcoholic beverages. The tax is an essential tool for the state to maintain control over the industry, while also generating significant funds for various state programs and services.

Current Structure and Rates of the WA Liquor Tax

The WA Liquor Tax is a multi-tiered system, applying different tax rates based on the type of alcoholic beverage and the volume of sales. Here’s a breakdown of the current tax structure:

Spirits and Liqueurs

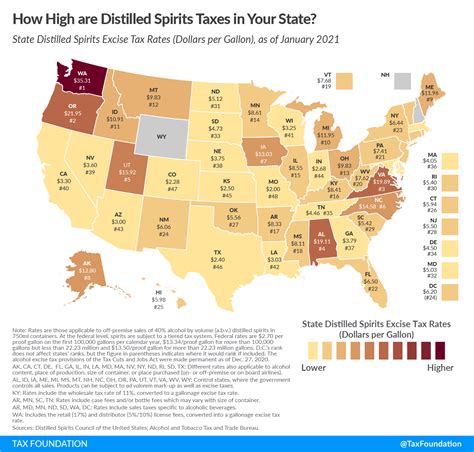

Spirits, including vodka, whiskey, gin, and rum, are subject to a tax rate of 12.95 per liter of absolute alcohol. This means that the tax is calculated based on the alcohol content of the beverage, regardless of the container size. For example, a 750 ml bottle of vodka with an alcohol content of 40% would be taxed at 11.01 ($12.95 x 0.75 x 0.40).

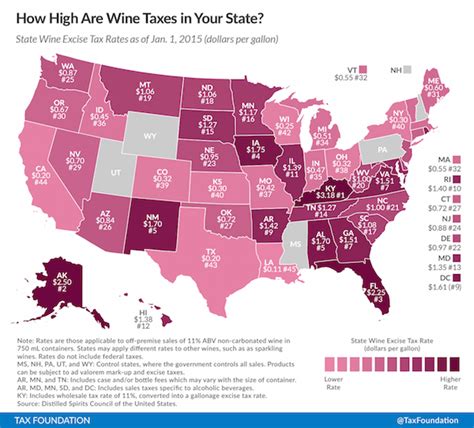

Wine

Wine, including both table wine and fortified wine, is taxed differently based on its alcohol content. Wines with an alcohol content of less than 14% are taxed at 0.37 per liter of wine. Wines with an alcohol content of 14% or more are taxed at 0.58 per liter of absolute alcohol. This means that a bottle of red wine with an alcohol content of 13.5% would be taxed at 0.34 (0.37 x 0.925 liters), while a bottle of fortified wine with an alcohol content of 18% would be taxed at 0.97 (0.58 x 0.925 x 0.18).

Specialty Beverages

Specialty beverages, such as sake, aperitifs, and vermouths, are taxed at a rate of $0.37 per liter of beverage. This tax is applied regardless of the alcohol content of the beverage.

Tax Exemptions and Credits

It’s important to note that there are certain exemptions and credits available under the WA Liquor Tax. For instance, manufacturers or distributors who produce or sell low-alcohol beverages, such as beer and cider, are not subject to the liquor tax. Additionally, there are tax credits available for certain types of wine, such as those produced from Washington-grown grapes or those sold in certain qualifying regions.

| Alcohol Type | Tax Rate |

|---|---|

| Spirits and Liqueurs | $12.95 per liter of absolute alcohol |

| Wine (less than 14% alcohol) | $0.37 per liter of wine |

| Wine (14% alcohol or more) | $0.58 per liter of absolute alcohol |

| Specialty Beverages | $0.37 per liter of beverage |

Impact on the Alcohol Industry and Consumers

The WA Liquor Tax has a significant impact on both the alcohol industry and consumers in Washington State. For businesses, the tax adds to the cost of doing business, influencing pricing strategies and profit margins. It also creates a complex regulatory environment, with businesses needing to navigate various tax laws and reporting requirements.

From a consumer perspective, the WA Liquor Tax directly affects the price of alcoholic beverages. The tax is typically passed on to the consumer, influencing the final price of the product. This can lead to variations in prices across different retailers and even different regions within the state.

Furthermore, the tax structure can also impact consumer behavior. For instance, the different tax rates for wine based on alcohol content may encourage consumers to opt for wines with lower alcohol content, leading to a potential shift in market trends.

Case Study: Impact on Craft Distilleries

The WA Liquor Tax has had a notable impact on the burgeoning craft distillery industry in Washington. These small-scale distilleries, which produce unique and high-quality spirits, often face challenges due to the tax structure. The high tax rate on spirits can significantly impact their profit margins, especially when compared to the tax rates for beer and cider, which are exempt from the liquor tax.

As a result, many craft distilleries have had to innovate and diversify their product offerings. Some have started producing lower-alcohol beverages, such as liqueurs and aperitifs, which are taxed at a lower rate. Others have focused on developing unique and high-end spirits, targeting a niche market willing to pay a premium for their products.

Future Implications and Potential Changes

The WA Liquor Tax is subject to ongoing review and potential changes, influenced by various factors such as economic conditions, industry trends, and state revenue needs. Here are some potential future developments:

Tax Reform and Simplification

There have been discussions about simplifying the tax structure to make it more transparent and easier for businesses to comply with. This could involve consolidating the various tax rates into a more straightforward system, or even considering a flat tax rate for all alcoholic beverages.

Increased Revenue Needs

As the state’s revenue needs evolve, there may be pressure to increase the liquor tax rates. This could be particularly relevant in times of economic downturn or when the state is facing budget constraints. However, any increase in tax rates would need to be carefully balanced to avoid negatively impacting the industry and consumers.

Industry Innovations and Consumer Trends

The alcohol industry is dynamic, with constant innovations in product offerings and consumer preferences. As new beverage categories emerge, such as hard seltzers or ready-to-drink cocktails, the tax structure may need to adapt to accommodate these changes. Additionally, consumer trends, such as the growing popularity of low-alcohol or non-alcoholic beverages, could influence future tax policies.

Regional Differences

Currently, the WA Liquor Tax is uniform across the state. However, there have been discussions about allowing local governments to set their own liquor tax rates, similar to the sales tax structure. This could lead to variations in tax rates and prices across different regions of Washington, potentially influencing consumer behavior and business strategies.

Environmental Considerations

With a growing focus on sustainability and environmental concerns, there may be future opportunities to incorporate environmental considerations into the liquor tax structure. For instance, incentives or reduced tax rates could be offered for producers using sustainable practices or for products with lower environmental impacts.

Conclusion

The WA Liquor Tax is a complex and ever-evolving aspect of the alcohol industry in Washington State. From its historical roots to its current structure and potential future developments, the tax plays a critical role in shaping the industry and influencing consumer choices. As the state and the industry navigate changing landscapes, the tax will continue to be a key tool for regulation and revenue generation, requiring ongoing attention and adaptation.

How often are liquor tax rates reviewed and adjusted in Washington State?

+Liquor tax rates are typically reviewed annually as part of the state’s budget process. However, adjustments can be made at any time if there are legislative changes or if the state’s revenue needs evolve significantly.

Are there any plans to simplify the WA Liquor Tax structure in the near future?

+There have been ongoing discussions about simplifying the tax structure, but no concrete plans have been announced yet. Any changes would likely involve a comprehensive review and consultation with industry stakeholders.

How does the WA Liquor Tax compare to other states in the U.S.?

+The WA Liquor Tax is relatively high compared to some other states, especially for spirits. However, it’s important to note that tax rates vary significantly across states, and each state has its own unique tax structure and revenue objectives.