St Johns County Property Tax

Welcome to a comprehensive guide on understanding and navigating the St. Johns County Property Tax system. This county, nestled in the northeastern part of Florida, offers a unique blend of coastal charm and historic heritage, making it an attractive location for residents and businesses alike. However, with the allure of this vibrant community comes the responsibility of understanding its property tax landscape.

In this article, we delve deep into the intricacies of St. Johns County's property tax structure, providing an expert analysis that will equip you with the knowledge needed to make informed decisions. From assessing the tax rates to exploring exemptions and understanding the assessment process, we aim to demystify the often complex world of property taxes.

The Fundamentals of St. Johns County Property Tax

St. Johns County, much like any other locality, relies on property taxes as a significant source of revenue to fund essential services such as education, public safety, and infrastructure development. These taxes are levied on both real estate and tangible personal property within the county’s jurisdiction.

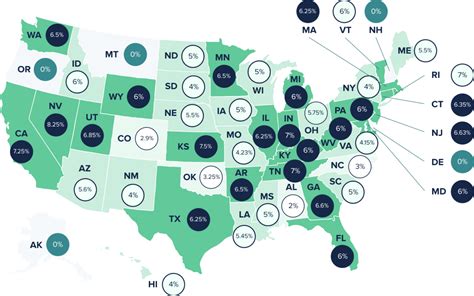

Tax Rates and Assessments

The property tax rate in St. Johns County is determined by a combination of factors, including the millage rate and the assessed value of the property. The millage rate is set annually by the Board of County Commissioners and varies based on the type of property and its intended use.

For instance, the millage rate for homestead properties is often lower than that for non-homestead or commercial properties. Additionally, the county may offer ad valorem tax exemptions for certain qualifying properties, further reducing the tax liability.

| Property Type | Millage Rate |

|---|---|

| Homestead | 5.45 mills |

| Non-Homestead | 6.83 mills |

| Commercial | 8.79 mills |

The assessed value of a property is determined through a comprehensive assessment process, which we will explore in detail later in this article.

Exemptions and Discounts

St. Johns County recognizes the importance of providing tax relief to certain segments of its population. As such, it offers a range of exemptions and discounts to eligible property owners.

One notable exemption is the Homestead Exemption, which reduces the taxable value of a property for homeowners who occupy their residence as their primary domicile. This exemption can significantly lower the property tax liability, making homeownership more affordable.

Additionally, the county provides exemptions for:

- Senior citizens

- Veterans

- Widows and widowers

- Disabled individuals

- Certain agricultural properties

Each of these exemptions has specific eligibility criteria and documentation requirements. It is advisable to consult with the St. Johns County Property Appraiser's office to determine if you qualify for any of these exemptions.

The Assessment Process

The property assessment process in St. Johns County is a meticulous procedure aimed at determining the fair market value of each property. This value, in turn, forms the basis for calculating property taxes.

The Property Appraiser's office, an independent body within the county government, is responsible for this critical task. They employ a team of certified appraisers who use a variety of methods, including sales comparison, cost approach, and income approach, to estimate property values.

Once the initial assessment is complete, property owners receive a Notice of Proposed Property Taxes, which details the assessed value, the proposed tax amount, and the deadlines for any appeals or payments.

Understanding the Tax Bill

Your St. Johns County property tax bill is a comprehensive document that provides valuable insights into your tax liability. It outlines the various components that contribute to your overall tax amount, offering transparency into the county's tax system.

Key Components of the Tax Bill

Here's a breakdown of the key elements you'll find on your tax bill:

- Assessed Value: This is the value assigned to your property by the Property Appraiser's office, as discussed earlier. It serves as the basis for calculating your property taxes.

- Taxable Value: This value is derived from the assessed value after any applicable exemptions or discounts have been applied. It represents the amount on which your taxes are calculated.

- Tax Rate: As mentioned, the tax rate is the millage rate applied to your taxable value. It varies based on the type of property and its intended use.

- Tax Amount: This is the final dollar amount you owe for the year. It is calculated by multiplying your taxable value by the tax rate.

- Due Dates: Your tax bill will clearly state the deadlines for payment. St. Johns County typically offers a discount for early payments, so it's beneficial to review these dates carefully.

By understanding these components, you can better analyze your tax bill and identify any discrepancies or potential areas for savings.

Appealing Your Assessment

If you believe your property's assessed value is inaccurate or disagree with the Property Appraiser's determination, you have the right to appeal. The appeals process in St. Johns County is designed to provide property owners with an opportunity to challenge their assessments and ensure fairness.

The first step is to carefully review your Notice of Proposed Property Taxes and identify any discrepancies. Common reasons for appealing an assessment include:

- Inaccurate property characteristics (e.g., square footage, number of rooms)

- Recent property damage or improvements not reflected in the assessment

- Overvaluation compared to similar properties in the area

To initiate an appeal, you'll need to file a Petition for Administrative Review with the Property Appraiser's office within a specified timeframe. It's essential to gather supporting documentation, such as recent sales data or appraisals, to strengthen your case.

Property Tax Relief Programs

St. Johns County recognizes the financial burden that property taxes can impose on certain individuals and households. As such, it offers a range of tax relief programs to provide assistance and ensure fairness.

Senior Exemption Program

Eligible senior citizens in St. Johns County may qualify for a substantial exemption on their property taxes. To be eligible, you must:

- Be at least 65 years old

- Have resided in Florida for at least 10 years

- Have owned and occupied the property as your primary residence for at least 25 years

This exemption can significantly reduce your tax liability, making it an attractive benefit for long-term residents.

Low-Income Tax Assistance

The county also provides assistance to low-income homeowners who struggle to meet their property tax obligations. The Low-Income Senior Homestead Exemption and the Low-Income Non-Homestead Tax Relief Program offer reduced tax rates or even complete exemption from certain taxes for qualifying individuals.

To be eligible, applicants must meet specific income and asset thresholds, as defined by the county. These programs aim to ensure that financial constraints do not prevent residents from owning a home or maintaining their property.

Other Relief Programs

St. Johns County offers a variety of other tax relief programs, each with its own eligibility criteria and benefits. These include:

- Disability Exemption

- Widow/Widower Exemption

- Veteran's Exemption

- Agricultural Classification

Each of these programs provides unique benefits to specific segments of the population, contributing to the county's commitment to fairness and equity in taxation.

Navigating the Online Property Tax Portal

In today's digital age, St. Johns County has embraced technology to enhance the property tax experience for its residents. The Online Property Tax Portal is a user-friendly platform that allows property owners to access a wealth of information and manage their tax obligations conveniently.

Key Features of the Portal

- Property Search: Quickly locate your property's details, including assessment history, tax records, and exemptions.

- Tax Bill Payment: Pay your property taxes online securely, with the option to set up automatic payments or receive email reminders.

- Appeal Status: Track the progress of your assessment appeal and receive updates on the decision.

- Exemption Applications: Submit and manage applications for various exemptions, ensuring you don't miss out on any potential savings.

- Tax Rate Information: Stay informed about the current and proposed tax rates, providing transparency into the county's budgeting process.

By leveraging the Online Property Tax Portal, St. Johns County residents can take control of their property tax management, making it a convenient and efficient process.

The Future of St. Johns County Property Taxes

As St. Johns County continues to thrive and grow, its property tax landscape is expected to evolve as well. The county’s commitment to maintaining a fair and transparent tax system is evident in its ongoing efforts to improve the assessment process, enhance taxpayer services, and explore innovative solutions.

Potential Future Developments

- Technology Integration: The county may further leverage technology to streamline the assessment process, improve data accuracy, and provide more efficient taxpayer services.

- Exemption Expansion: As the county's demographics change, there may be a push to expand or create new exemptions to better support its diverse population.

- Community Engagement: St. Johns County may increase its focus on engaging with residents to gather feedback and ensure that the tax system remains aligned with the community's needs and values.

By staying proactive and responsive to the needs of its residents, St. Johns County can continue to foster a vibrant and thriving community while maintaining a sustainable and fair property tax system.

How often are property taxes assessed in St. Johns County?

+

Property taxes are assessed annually in St. Johns County. The Property Appraiser’s office conducts a comprehensive assessment of all properties within the county each year to determine their fair market value.

What is the deadline for paying property taxes in St. Johns County?

+

Property taxes in St. Johns County are due in two installments. The first installment is typically due by March 31st, and the second installment is due by September 30th. However, it’s advisable to check the exact dates each year, as they may vary slightly.

Can I appeal my property’s assessed value if I disagree with it?

+

Yes, you have the right to appeal your property’s assessed value if you believe it is inaccurate. The appeals process in St. Johns County is designed to ensure fairness and accuracy. You’ll need to file a Petition for Administrative Review within a specified timeframe and provide supporting evidence for your appeal.

Are there any tax relief programs available for low-income homeowners in St. Johns County?

+

Absolutely! St. Johns County offers several tax relief programs for low-income homeowners. These include the Low-Income Senior Homestead Exemption and the Low-Income Non-Homestead Tax Relief Program. To determine your eligibility, it’s best to consult with the Property Appraiser’s office.

How can I stay updated on changes to property tax rates and exemptions in St. Johns County?

+

The best way to stay informed is to regularly visit the St. Johns County Property Appraiser’s website or follow their official social media channels. They often provide updates and announcements regarding changes to tax rates, exemptions, and other important information.