Master How to Reduce Your NC Car Tax Efficiently

Owning a vehicle in North Carolina often entails more than just the purchase price and maintenance costs; it involves navigating a complex web of tax obligations that can significantly impact your finances. Specifically, understanding how to effectively reduce your NC car tax isn't just about saving a few dollars—it's about employing strategic, compliant methods to optimize your vehicle-related expenditures. For many vehicle owners, the annual property tax and other associated fees can add up, creating a financial strain that might be mitigated with the right knowledge and planning. This article delves into the intricacies of North Carolina's vehicle taxation system and presents a comprehensive guide to reducing your car tax burden through legal and efficient strategies.

Understanding the Framework of North Carolina Vehicle Taxes

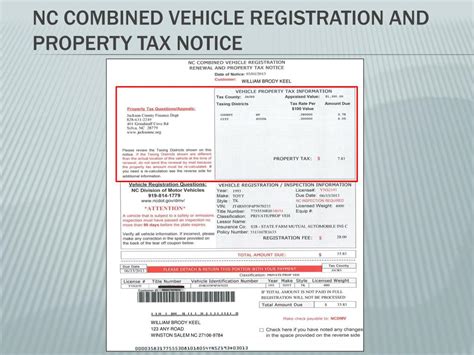

North Carolina levies several taxes and fees on vehicles, primarily focusing on property tax, registration fees, and sometimes excise taxes—especially if a vehicle is purchased out of state or through certain dealer arrangements. The North Carolina Vehicle Property Tax is assessed based on the vehicle’s value, age, and location, making it a significant consideration for owners seeking to minimize their tax obligations. The state’s motor vehicle property tax is calculated annually, which requires owners to stay proactive and informed to leverage available reductions effectively.

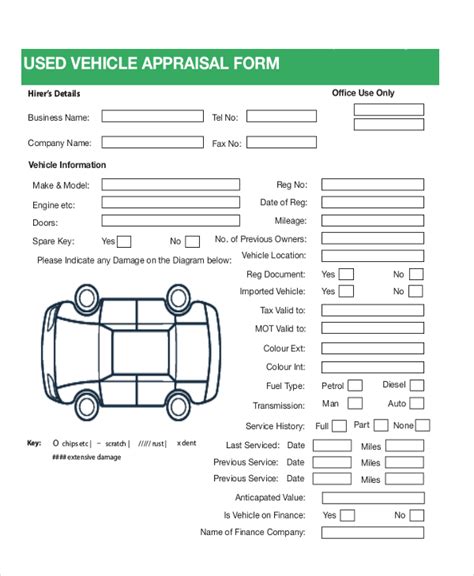

The Role of Vehicle Valuation and Assessment

The vehicle property tax in North Carolina hinges on the DMV’s assessed value of the vehicle, which is often a percentage of the vehicle’s fair market value at the time of assessment. This process, overseen by local county tax offices, assesses the vehicle value and applies a mill rate—an essential determinant in calculating the annual tax owed. Since market values fluctuate amidst factors such as vehicle age, condition, and market demand, understanding how assessments are made provides a foundation for leveraging reductions.

| Relevant Category | Substantive Data |

|---|---|

| Average Vehicle Appraisal | $20,000 for new cars, depreciating approximately 15-20% annually |

| Typical Mill Rate | 0.4% to 1.25% depending on county |

| Average Annual Tax | $400–$1,000+ based on assessed value and local rate |

Strategies to Legally Reduce Your North Carolina Car Tax

Reducing vehicle taxes in North Carolina requires an informed approach, rooted in compliance with state laws but aimed at minimizing taxable value or leveraging exemptions. Here are the primary strategies that vehicle owners can thoughtfully employ to achieve this goal:

1. Claim Applicable Exemptions and Special Classifications

North Carolina offers various vehicle exemptions that significantly reduce tax liability. For example, vehicles classified as neighborhood electric vehicles (NEVs), modified vehicles, or veterans’ vehicles may qualify for full or partial exemptions if owners meet specific criteria. Additionally, disabled persons with approved documentation can often apply for exemption or tax reductions, which require submitting appropriate proof to local tax authorities.

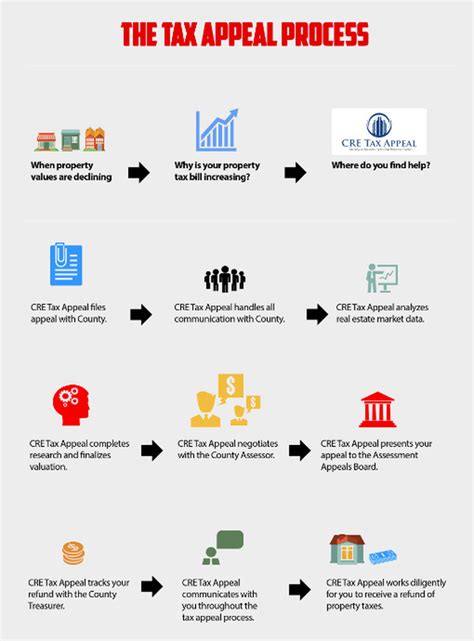

2. Engage in Formal Assessment Appeals

If you believe your vehicle’s assessed value exceeds its fair market value, filing an appeal with the county assessor’s office can be effective. This process involves providing evidence such as independent appraisals, recent sales data, or comparative vehicle evaluations. Successful appeals can significantly lower your assessed value, thus reducing the property tax owed annually—a practice regularly employed by savvy owners who stay vigilant about valuation updates and deadlines.

| Relevant Category | Substantive Data |

|---|---|

| Appeal Success Rate | Approximately 25-40% depending on county and documentation quality |

| Required Documentation | Independent vehicle appraisal, recent sale records, detailed photographs |

| Typical Reduction | 10–30% decrease in assessed value, translating into similar tax savings |

3. Leverage Tax-Deferred or Tax-Exempt Vehicles

Some vehicle classifications, such as certain electric or hybrid models and historic vehicles, qualify for tax deferrals or exemptions based on state policies aiming to promote eco-friendly transportation or preserve historical assets. For electric vehicle owners, North Carolina offers incentives like rebates and tax credits, but also specific property tax exemptions in some counties, particularly for low-emission vehicles. Ensuring your vehicle qualifies requires alignment with current state and local policies, which evolve periodically.

4. Optimize Vehicle Usage and Registration Choices

Registering your vehicle in a county with a lower mill rate directly affects your annual tax obligation. If feasible, relocating your vehicle’s registration to such jurisdictions—while maintaining compliance with residency requirements—can have a long-term impact. Moreover, selecting a vehicle with a lower assessed value or purchasing used vehicles with inherently lower market value can also be strategic in managing assessed tax base.

5. Regular Maintenance and Updates to Documentation

Keeping detailed records of any modifications, repairs, or upgrades that potentially lower the vehicle’s value can support accurate assessments and appeals. Additionally, annual review of assessment notices allows prompt responses to erroneous valuations—taking advantage of procedural deadlines to appeal or request reassessment.

Key Points

- Engaging in annual assessment appeals can yield significant reductions in property tax.

- Claiming available exemptions—especially for disabled owners or electric vehicles—can substantially lower costs.

- Understanding local mill rates and evaluating registration options across counties provides strategic leverage.

- Maintaining up-to-date documentation supports appeals and justifies valuation adjustments.

- Regularly reviewing changes in policy and law ensures compliance and maximizes benefits.

Legal and Practical Considerations in Reducing Your NC Car Tax

While these strategies are effective, it’s crucial to approach reductions within legal boundaries. Engaging in fraudulent valuation suppression or misrepresenting vehicle classifications can lead to penalties, fines, or revocation of exemptions. The aim should always be to leverage transparent, documented processes designed to reflect an honest valuation and legitimate exemptions.

Potential Limitations and Risks

Tax reductions via appeals are inherently dependent on available evidence and local administrative discretion. Not all disputes result in favorable outcomes, and some counties impose caps on reductions or have strict criteria for exemptions. Overreliance on outdated or insufficient support can delay appeals or result in denial, emphasizing the importance of expert consultation and thorough preparation.

Conclusion: A Holistic Approach to Car Tax Efficiency

Reducing your North Carolina car tax efficiently necessitates a multifaceted, informed approach rooted in legal compliance and strategic planning. From leveraging exemption opportunities and engaging in appeals to optimizing registration options and maintaining meticulous documentation, vehicle owners can significantly curtail their annual tax burdens. Navigating this landscape calls for ongoing vigilance and a proactive stance—transforming a potentially burdensome obligation into a manageable component of vehicle ownership.

How often can I appeal my vehicle’s assessed value in North Carolina?

+You can generally appeal once per assessment cycle, typically annually or biennially, depending on your county’s policies. Timely submission of evidence before deadlines is crucial for success.

What documentation is needed to claim a vehicle exemption for disabled persons?

+Official certification of disability from a qualified medical provider along with proof of vehicle registration and residency in the applicable county are typically required to process exemption claims.

Can moving my vehicle registration to a different county reduce my taxes?

+Yes, if the new county has a lower mill rate and you meet residency requirements, relocating registration can lower your annual property tax. However, ensure compliance with all legal requirements to avoid penalties.