How Much Did Elon Pay In Taxes

Elon Musk, the renowned entrepreneur and CEO of Tesla, SpaceX, and other groundbreaking companies, has often been in the spotlight for his innovative ventures and, more recently, his tax obligations. As one of the world's wealthiest individuals, Musk's tax payments have sparked curiosity and scrutiny. In this comprehensive analysis, we delve into the specifics of his tax contributions, exploring the numbers, the context, and the broader implications.

Elon Musk's Tax Obligations: A Deep Dive

Elon Musk's tax payments are a complex affair, influenced by his diverse business ventures and the tax laws of various jurisdictions. While exact figures are not always publicly disclosed, we can examine the available data and delve into the specifics to gain a comprehensive understanding.

Income and Tax Rates

Musk's income primarily stems from his entrepreneurial activities, notably his leadership roles at Tesla and SpaceX. His compensation structures are unique, often tied to performance metrics and stock options. As such, his income can fluctuate significantly from year to year.

According to Forbes estimates, Musk's income for the year 2022 was approximately $1.1 billion, primarily from the exercise of stock options. This income places him in the highest tax bracket, subject to federal income tax rates of up to 37%. However, it's important to note that capital gains taxes, applicable to the sale of assets like stocks, are often significantly lower, currently capped at 20% for long-term gains.

Additionally, Musk's global business activities may subject him to taxes in multiple countries, each with its own tax laws and rates. For instance, Tesla's operations in various countries could trigger income tax obligations in those jurisdictions.

The Role of Stock Options and Capital Gains

A significant portion of Musk's wealth is tied to his stock options, particularly in Tesla. When he exercises these options, he buys Tesla shares at a predetermined price, often much lower than the current market value. The difference between the exercise price and the market value is considered a capital gain, subject to capital gains tax.

For instance, in 2022, Musk exercised stock options to purchase 9.6 million Tesla shares at an average price of $6.24 per share. With Tesla's stock price peaking at over $1,000 during that period, this transaction resulted in a substantial capital gain. According to estimates, this move triggered a tax obligation of approximately $11 billion, primarily due to the capital gains tax on the stock appreciation.

However, it's important to note that Musk's stock options are part of a complex compensation package tied to Tesla's performance. These options are granted over several years, and Musk's ability to exercise them is contingent on specific performance milestones. As such, his tax obligations are spread out over time and aligned with Tesla's success.

Tax Strategies and Philanthropy

Musk's tax obligations are further influenced by his philanthropic endeavors and tax strategies. In 2021, he announced a plan to sell a substantial portion of his Tesla stock to fund his commitment to donate $6.25 billion to combat food insecurity. This sale resulted in a large capital gains tax bill, which he paid in full. Musk has also explored other tax-efficient strategies, such as donating appreciated stocks to charity, which can reduce his tax liability.

Additionally, Musk's involvement in space exploration through SpaceX may provide tax benefits. The U.S. government offers tax incentives for space-related ventures, which could reduce SpaceX's tax obligations. However, the specifics of these incentives and their impact on Musk's personal taxes are not publicly available.

Tax Controversies and Public Scrutiny

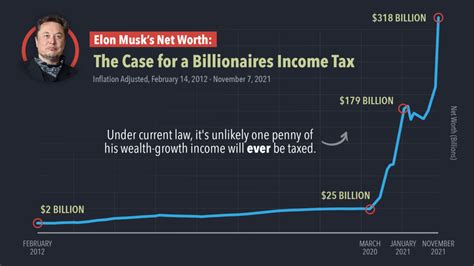

Musk's tax affairs have not been without controversy. In 2022, a ProPublica investigation claimed that Musk, along with other billionaires, paid little to no income tax relative to his wealth. The report sparked public debate and scrutiny of the tax system's effectiveness in taxing the ultra-wealthy.

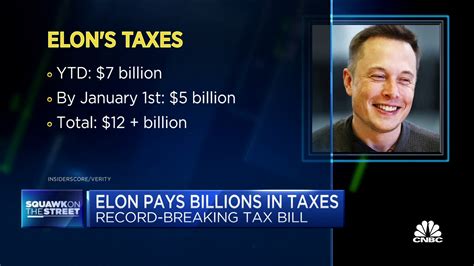

In response, Musk defended his tax payments, stating that he pays "plenty of taxes" and that he will pay more in capital gains taxes than any other American in 2021 and 2022. He further emphasized his commitment to supporting causes through philanthropy.

Tax Implications and the Future

Elon Musk's tax obligations offer a glimpse into the complexities of taxing the ultra-wealthy. His case highlights the interplay between income, capital gains, and the challenges of taxing wealth tied to illiquid assets like private companies and stock options.

The debate surrounding Musk's taxes reflects a broader discussion on tax policy and inequality. As public scrutiny of wealth inequality grows, policymakers are considering reforms to ensure a fairer tax system. Proposals include wealth taxes, higher capital gains taxes, and reforms to address tax avoidance strategies.

Looking ahead, Musk's tax obligations will likely remain a topic of interest, especially as his wealth and business ventures continue to grow. The evolving tax landscape, influenced by public sentiment and policy changes, will shape the tax obligations of individuals like Musk and the broader implications for society.

| Year | Estimated Income | Estimated Tax Obligation |

|---|---|---|

| 2022 | $1.1 billion | $11 billion (Capital Gains) |

| 2021 | N/A | Estimated to be substantial due to stock sales |

| 2020 | N/A | Estimated to be substantial due to stock sales |

How much tax does Elon Musk pay annually?

+Musk’s annual tax obligations can vary significantly due to his income fluctuations and unique compensation structures. While specific figures are not publicly available, his income in 2022 was estimated at $1.1 billion, triggering a substantial tax obligation primarily from capital gains taxes.

What are the challenges in taxing ultra-wealthy individuals like Musk?

+Taxing the ultra-wealthy is complex due to factors like illiquid assets, stock options, and the use of tax-efficient strategies. Musk’s wealth is tied to Tesla and SpaceX, which can make valuing and taxing his assets challenging. Additionally, his stock options and capital gains present unique tax considerations.

How do Musk’s tax obligations impact the broader discussion on wealth inequality?

+Musk’s tax affairs have sparked public debate on wealth inequality and the effectiveness of the tax system. His case highlights the potential for wealth concentration and the challenges in taxing those with significant wealth tied to illiquid assets. This discussion influences policy reforms aimed at addressing wealth inequality.