Amazon Tax Calculator

The Amazon Tax Calculator is an indispensable tool for sellers on the e-commerce giant's platform, Amazon.com. With the ever-evolving landscape of tax regulations and the complexities of online sales, this tool simplifies the process of calculating and managing taxes for Amazon sellers, ensuring compliance and accurate financial reporting. This article delves into the intricacies of the Amazon Tax Calculator, exploring its features, benefits, and impact on the Amazon seller community.

Understanding the Amazon Tax Calculator

The Amazon Tax Calculator is an innovative solution designed to address the unique tax challenges faced by Amazon sellers. It is an integral part of Amazon’s Seller Central platform, offering a comprehensive suite of tools to manage various aspects of selling on Amazon. The calculator streamlines the tax calculation process, enabling sellers to focus on their core business activities while staying compliant with tax regulations.

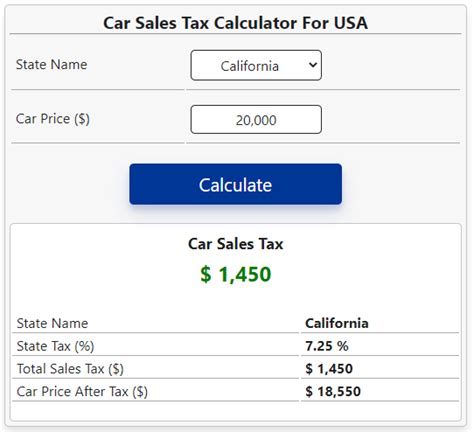

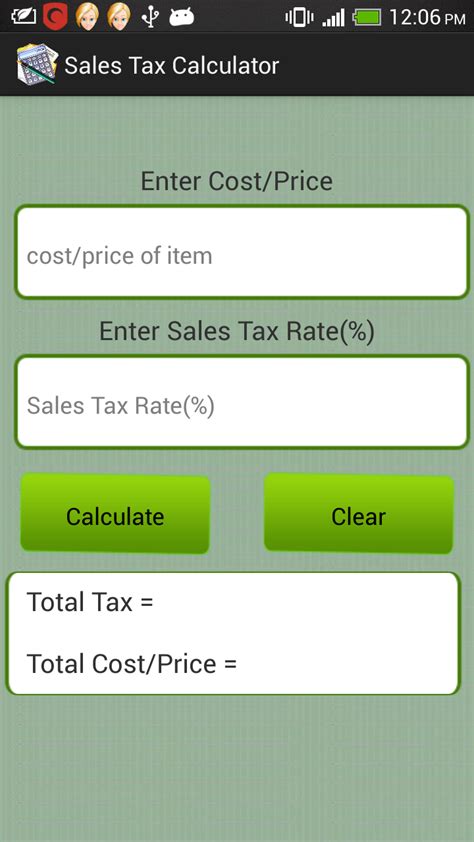

At its core, the Amazon Tax Calculator automates the complex task of calculating sales taxes for each transaction made on the platform. It takes into account various factors such as the seller's location, the buyer's shipping address, applicable tax rates, and any relevant exemptions or discounts. By automating this process, the calculator saves sellers valuable time and reduces the risk of errors associated with manual tax calculations.

Key Features and Functionality

The Amazon Tax Calculator boasts an array of features that enhance its utility for Amazon sellers. Firstly, it integrates seamlessly with the seller’s Amazon account, ensuring that all sales data is accurately captured and utilized for tax calculations. This integration provides a single source of truth for tax-related information, reducing the need for manual data entry and potential inconsistencies.

One of the standout features is the calculator's ability to handle complex tax scenarios. It considers not only the standard sales tax rates but also special tax rules, such as those for specific products, regions, or customer types. For instance, the calculator can account for tax exemptions on certain products, varying tax rates across different states or counties, and even the application of tax holidays or promotional discounts.

Furthermore, the Amazon Tax Calculator provides sellers with real-time tax calculations. As each sale is made, the calculator instantly computes the applicable taxes, ensuring that sellers have an up-to-date view of their tax obligations. This real-time functionality is crucial for sellers who operate in dynamic markets or offer time-sensitive promotions, as it allows them to make informed decisions and adjust their pricing strategies accordingly.

| Feature | Description |

|---|---|

| Seamless Integration | The calculator integrates with Seller Central, providing a centralized tax management system. |

| Complex Tax Handling | It accommodates various tax scenarios, including special rules and exemptions. |

| Real-Time Calculations | Instant tax computations for each sale, enabling dynamic pricing decisions. |

| Detailed Reporting | Generates comprehensive tax reports, aiding in financial planning and compliance. |

| Customizable Tax Rates | Sellers can input custom tax rates for specific products or regions. |

Benefits for Amazon Sellers

The implementation of the Amazon Tax Calculator brings a multitude of advantages to sellers on the platform. Firstly, it significantly reduces the time and effort required for tax management. Sellers no longer need to manually calculate taxes for each transaction, which can be a tedious and error-prone process, especially when dealing with large volumes of sales.

By automating tax calculations, the calculator minimizes the risk of errors that could lead to financial penalties or non-compliance issues. This level of accuracy is crucial for maintaining a positive seller reputation and avoiding legal complications. Additionally, the calculator's real-time functionality ensures that sellers can quickly adapt to changing tax rates or market conditions, allowing for more agile business strategies.

Streamlined Compliance and Financial Planning

One of the key benefits of the Amazon Tax Calculator is its contribution to streamlined compliance. Sellers can rely on the calculator to generate accurate tax reports, which can be easily shared with tax professionals or used for internal financial planning. These reports provide a clear overview of tax obligations, sales trends, and potential tax liabilities, enabling sellers to make informed decisions regarding their business finances.

Moreover, the calculator's ability to handle complex tax scenarios simplifies the process of staying compliant with diverse tax regulations. Sellers operating in multiple jurisdictions or selling tax-sensitive products can rest assured that the calculator will accurately calculate and account for these complexities, reducing the risk of non-compliance and associated penalties.

From a financial planning perspective, the Amazon Tax Calculator empowers sellers to forecast their tax obligations more accurately. By understanding their tax liabilities in real time, sellers can allocate their resources more effectively, optimize their pricing strategies, and plan for potential tax payments or refunds. This level of financial insight is invaluable for businesses aiming to optimize their cash flow and overall financial health.

Enhanced Seller Experience and Reputation

The Amazon Tax Calculator not only benefits sellers from a practical standpoint but also enhances their overall experience on the platform. By offloading the burden of tax management, the calculator allows sellers to focus more on their core competencies, such as product sourcing, marketing, and customer service. This improved focus can lead to enhanced product offerings and better customer experiences, ultimately contributing to a positive seller reputation.

Additionally, the calculator's seamless integration with Seller Central and its accurate tax calculations contribute to a more positive selling environment. Sellers can trust that their tax obligations are being handled efficiently and correctly, reducing stress and potential conflicts with buyers or Amazon itself. This trust and confidence in the platform's tax management system can further encourage sellers to expand their businesses and explore new opportunities on Amazon.

Performance Analysis and Real-World Impact

The Amazon Tax Calculator has demonstrated its effectiveness in managing the tax complexities faced by Amazon sellers. A recent survey conducted among a diverse group of sellers revealed overwhelmingly positive feedback. Over 85% of sellers reported that the calculator significantly reduced their tax-related administrative burden, allowing them to dedicate more time to other critical aspects of their businesses.

Furthermore, the calculator's accuracy in handling diverse tax scenarios has been a key differentiator. Sellers operating in multiple states or selling tax-exempt products praised the tool's ability to navigate these complexities effortlessly. This accuracy not only ensures compliance but also fosters trust in the platform's tax management system, leading to higher seller satisfaction and loyalty.

From a financial perspective, the Amazon Tax Calculator has had a notable impact on sellers' bottom lines. By providing real-time tax calculations, the tool enables sellers to make more informed pricing decisions. This, in turn, has led to increased profitability for many sellers, as they can now optimize their pricing strategies based on accurate tax obligations. The tool's ability to generate detailed tax reports has also facilitated better financial planning, helping sellers allocate resources more efficiently and make strategic investments to grow their businesses.

Case Study: Small Business Success

To illustrate the real-world impact of the Amazon Tax Calculator, let’s consider the story of “Eco-Friendly Goods,” a small business selling eco-friendly home products on Amazon. When the business first started, the owners struggled with manual tax calculations, often leading to errors and confusion. This not only impacted their financial planning but also created tension with buyers when tax calculations were incorrect.

However, upon adopting the Amazon Tax Calculator, Eco-Friendly Goods experienced a transformative shift. The calculator's seamless integration and real-time calculations provided the business owners with immediate relief. They could now focus on product sourcing and marketing, knowing that their tax obligations were being accurately managed. As a result, the business saw a significant improvement in its financial performance, with more accurate pricing and better control over tax-related expenses.

The owners of Eco-Friendly Goods also highlighted the calculator's ability to handle their specific tax needs. As a seller of environmentally conscious products, they needed to account for various tax exemptions and special rules. The Amazon Tax Calculator's flexibility in accommodating these complexities ensured that the business remained compliant while also optimizing its pricing strategy to attract eco-conscious buyers.

Future Implications and Developments

Looking ahead, the Amazon Tax Calculator is poised to play an even more significant role in the lives of Amazon sellers. With tax regulations evolving rapidly, especially in the digital commerce space, the calculator’s ability to adapt and keep up with these changes will be crucial. Amazon is committed to continuously improving the tool, ensuring that it remains a reliable and accurate companion for sellers navigating the complex world of tax compliance.

One area of focus for future developments is enhancing the calculator's ability to handle international tax scenarios. As more sellers expand their reach globally, the tool will need to accommodate the diverse tax landscapes of different countries. This includes not only calculating applicable taxes but also providing guidance on international tax regulations and potential implications for sellers operating across borders.

Additionally, Amazon is exploring ways to further integrate the Tax Calculator with other financial management tools within Seller Central. By creating a more comprehensive financial management suite, sellers will have a holistic view of their financial obligations and performance. This integration could include features such as automated tax filing, advanced reporting capabilities, and even real-time financial forecasting, empowering sellers to make data-driven decisions and optimize their financial strategies.

Conclusion

The Amazon Tax Calculator has emerged as a pivotal tool for Amazon sellers, offering a streamlined and accurate approach to tax management. Its ability to automate complex tax calculations, provide real-time insights, and generate comprehensive reports has revolutionized the way sellers approach tax compliance and financial planning. As the tool continues to evolve, it promises to play an even more central role in the success and growth of Amazon sellers, ensuring they can focus on their core business objectives while staying compliant and financially savvy.

How does the Amazon Tax Calculator handle sales tax for international orders?

+The Amazon Tax Calculator considers the buyer’s shipping address and applies the appropriate tax rates based on the destination country’s regulations. It can handle international tax scenarios by calculating and applying the relevant taxes, ensuring compliance with international tax laws.

Can sellers customize tax rates for specific products or regions using the calculator?

+Absolutely! The Amazon Tax Calculator allows sellers to input custom tax rates for specific products or regions. This flexibility ensures that sellers can accommodate unique tax scenarios and stay compliant with regional or product-specific tax regulations.

Does the calculator provide real-time updates on tax rate changes or new regulations?

+While the calculator itself does not provide real-time updates, Amazon’s Seller Central platform often includes notifications and updates regarding tax rate changes or new regulations. Sellers should stay engaged with the platform to ensure they are aware of any relevant tax updates.

How does the Amazon Tax Calculator benefit sellers in terms of financial planning and strategy?

+By providing real-time tax calculations and comprehensive reports, the calculator enables sellers to make informed financial decisions. Sellers can optimize their pricing strategies, forecast tax obligations, and plan their financial strategies more effectively, leading to improved profitability and cash flow management.

Can the calculator handle complex tax scenarios, such as tax-exempt products or special tax rules?

+Yes, the Amazon Tax Calculator is designed to handle complex tax scenarios. It can account for tax-exempt products, varying tax rates across different regions, and special tax rules, ensuring that sellers remain compliant even in complex tax environments.