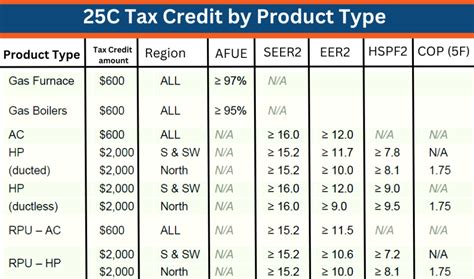

25C Tax Credit

The 25C Tax Credit, officially known as the Nonbusiness Energy Property Tax Credit, is a valuable incentive aimed at promoting energy efficiency and reducing carbon footprints. This tax credit, established by the Internal Revenue Service (IRS), offers a financial incentive to individuals who invest in energy-efficient home improvements and renewable energy systems. In this comprehensive article, we will delve into the intricacies of the 25C Tax Credit, exploring its history, eligibility criteria, eligible expenses, and the potential benefits it brings to homeowners across the United States.

The History and Purpose of the 25C Tax Credit

The origins of the 25C Tax Credit can be traced back to the Energy Policy Act of 2005, where it was first introduced as a measure to encourage homeowners to adopt energy-efficient practices. Over the years, this tax credit has undergone several revisions and extensions, with the most recent changes taking effect in 2023. The primary objective of the 25C Tax Credit is to stimulate the adoption of energy-efficient technologies and practices, ultimately reducing energy consumption and greenhouse gas emissions.

By offering a financial incentive, the IRS aims to make energy-efficient upgrades more accessible and attractive to homeowners. This not only benefits individual households by reducing energy costs but also contributes to the broader goal of creating a more sustainable and environmentally conscious society.

Eligibility Criteria for the 25C Tax Credit

Understanding the eligibility criteria for the 25C Tax Credit is crucial for homeowners looking to take advantage of this incentive. Here are the key requirements:

Taxpayer Eligibility

To qualify for the 25C Tax Credit, the taxpayer must meet the following conditions:

- Be a U.S. citizen or resident alien.

- Have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- File a federal income tax return for the year in which the energy-efficient improvements were made.

- Have a taxable income that falls within the defined limits, which may vary based on filing status and the year of the tax credit claim.

Property Eligibility

The property for which the tax credit is claimed must also meet certain criteria:

- The property must be located in the United States, including the District of Columbia and U.S. possessions.

- It should be the taxpayer’s principal residence, which is defined as the primary place of abode for most of the year.

- Rental properties and second homes do not qualify for the 25C Tax Credit.

Eligible Expenses and Improvements

The 25C Tax Credit covers a wide range of energy-efficient improvements and technologies. Here are some of the key eligible expenses:

Residential Energy Efficiency Upgrades

- Insulation: Upgrading insulation in the home’s walls, attics, or basements to improve thermal efficiency.

- Windows and Doors: Installing energy-efficient windows and doors with a U-Factor and Solar Heat Gain Coefficient (SHGC) meeting specific requirements.

- Roofing Materials: Using metal or asphalt roofs with high solar reflectance.

- HVAC Systems: Upgrading to energy-efficient heating and cooling systems, including air conditioners, furnaces, and heat pumps.

Renewable Energy Systems

- Solar Energy Systems: Installing solar electric panels, solar water heaters, or solar space heating systems.

- Small Wind Energy Systems: Investing in small wind turbines to generate electricity.

- Fuel Cell Property: Acquiring and installing fuel cell property with a capacity of at least 0.5 kilowatts.

Other Eligible Improvements

- Water Heaters: Replacing traditional water heaters with energy-efficient models, including heat pump water heaters.

- Energy-Efficient Appliances: Purchasing new appliances with an Energy Star label, such as refrigerators, dishwashers, and clothes washers.

- Residential Biomass Fuel Property: Investing in a stove, furnace, or boiler that burns biomass fuel.

Claiming the 25C Tax Credit: A Step-by-Step Guide

Claiming the 25C Tax Credit involves a straightforward process, but it’s essential to follow the correct steps to ensure a successful claim. Here’s a step-by-step guide:

- Gather Documentation: Collect all the necessary documentation, including receipts, invoices, and manufacturer certifications for the eligible improvements.

- Calculate the Credit Amount: Determine the eligible expenses and calculate the tax credit amount based on the specific improvements made. The credit is typically 10% of the eligible expenses, up to a maximum credit amount.

- Complete IRS Form 5695: Fill out IRS Form 5695, "Residential Energy Credits," accurately, including all the required information about the eligible improvements.

- Attach Form 5695 to Your Tax Return: Attach the completed Form 5695 to your federal income tax return (Form 1040 or 1040-SR) for the tax year in which the improvements were made.

- Claim the Credit: When filing your tax return, ensure that you claim the 25C Tax Credit by entering the amount from Form 5695 into the appropriate line on your tax form.

Maximizing the Benefits: Tips and Strategies

To make the most of the 25C Tax Credit, homeowners can employ several strategies. Here are some tips:

- Plan Your Improvements: Research and plan your energy-efficient upgrades carefully. Consider the long-term energy savings and the potential tax credit benefits to make informed decisions.

- Stay Informed: Keep up-to-date with the latest changes and eligibility criteria for the 25C Tax Credit. The IRS and energy efficiency organizations often provide valuable resources and updates.

- Combine Credits: Explore the possibility of combining the 25C Tax Credit with other available energy-related tax incentives. Some states and localities offer additional credits or rebates for energy-efficient improvements.

- Seek Professional Advice: Consult with tax professionals or energy efficiency experts to ensure you are maximizing your tax benefits and meeting all the necessary requirements.

Real-World Impact and Success Stories

The 25C Tax Credit has had a significant impact on homeowners across the country, encouraging them to invest in energy-efficient upgrades. Here are a few real-world success stories:

The Smith Family's Solar Journey

The Smith family, residents of California, decided to install solar panels on their rooftop. With the help of the 25C Tax Credit, they were able to offset a substantial portion of the installation costs. The solar panels not only reduced their electricity bills but also provided a reliable source of clean energy, contributing to their sustainability goals.

Green Renovations in Chicago

In Chicago, Illinois, several homeowners took advantage of the 25C Tax Credit to upgrade their homes with energy-efficient windows and insulation. The improved energy efficiency not only reduced their heating and cooling costs but also increased the overall comfort and value of their properties.

Future Implications and Sustainability

The 25C Tax Credit plays a crucial role in promoting a more sustainable future. By incentivizing energy-efficient practices, it encourages homeowners to reduce their carbon footprint and contribute to a greener environment. As the world shifts towards a more environmentally conscious mindset, the 25C Tax Credit continues to be a powerful tool in driving the adoption of sustainable technologies and practices.

| Year | Maximum Credit Amount |

|---|---|

| 2023 | $500 |

Conclusion

The 25C Tax Credit is a valuable incentive for homeowners looking to make their homes more energy-efficient and environmentally friendly. By understanding the eligibility criteria, eligible expenses, and the claiming process, individuals can take advantage of this tax credit to reduce their energy costs and contribute to a sustainable future. With its positive impact on both individual households and the environment, the 25C Tax Credit is a powerful tool in the journey towards a greener and more energy-conscious society.

Can I claim the 25C Tax Credit for multiple improvements in the same year?

+

Yes, you can claim the 25C Tax Credit for multiple eligible improvements made in the same tax year. However, there is an annual cap on the credit amount, so it’s important to prioritize the improvements that offer the most energy savings and tax benefits.

Are there any income restrictions for claiming the 25C Tax Credit?

+

While there are income limitations for certain tax credits, the 25C Tax Credit does not have specific income restrictions. However, it’s important to ensure that your taxable income falls within the defined limits for the tax year in which you claim the credit.

Can I claim the 25C Tax Credit for improvements made in previous years?

+

No, the 25C Tax Credit can only be claimed for improvements made in the current tax year or in a carryover year if you have remaining eligible expenses. It’s important to claim the credit in the appropriate tax year to maximize your benefits.

Are there any state-specific variations of the 25C Tax Credit?

+

Yes, some states offer their own energy-related tax credits or incentives in addition to the federal 25C Tax Credit. It’s advisable to research state-specific programs to explore potential additional savings and benefits.

How long does it typically take to receive the tax credit after filing my return?

+

The time it takes to receive your tax refund, which includes any claimed tax credits, can vary. The IRS aims to process returns within 21 days, but processing times may fluctuate due to various factors. It’s advisable to check the IRS website for the latest processing timelines.