Retirement Tax Rate Calculator

Understanding your tax obligations during retirement is a crucial aspect of financial planning. As you approach this life stage, you want to ensure that you're not only maximizing your savings but also minimizing the tax burden on your retirement income. The Retirement Tax Rate Calculator is a powerful tool designed to help retirees and pre-retirees navigate this complex landscape. This article will delve into the intricacies of this calculator, exploring its features, benefits, and how it can assist individuals in making informed decisions about their retirement finances.

Demystifying Retirement Taxes: The Need for a Specialized Calculator

Retirement planning involves a delicate balance between accumulating wealth and preparing for the various financial challenges that arise during one’s golden years. Among these challenges, taxes play a significant role. The tax landscape for retirees is intricate, with various income streams, deductions, and credits that can impact overall tax liability.

Traditional tax calculators often fall short when it comes to retirement planning. They may not account for specific retirement income sources like pensions, 401(k) distributions, or Social Security benefits. Additionally, they might overlook the unique tax brackets and rules applicable to retirees, such as the provisional income calculation for Social Security benefits or the potential for Required Minimum Distributions (RMDs) from retirement accounts.

This is where the Retirement Tax Rate Calculator steps in. It's specifically designed to address the complexities of retirement taxation, providing a comprehensive analysis of an individual's tax situation and offering strategies to optimize their retirement finances.

Features and Functionality of the Retirement Tax Rate Calculator

The Retirement Tax Rate Calculator is a sophisticated tool, equipped with a range of features to cater to the diverse needs of retirees and those approaching retirement.

Comprehensive Income Analysis

At its core, the calculator begins by requesting detailed information about an individual’s income streams. This includes:

- Social Security benefits

- Pension payments

- Retirement account distributions (401(k), IRA, etc.)

- Rental income

- Investment earnings

- Any other taxable income sources

By entering these details, the calculator can provide an accurate estimate of the total taxable income for the year.

Deduction and Credit Assessment

Next, the calculator takes into account various deductions and credits that can reduce tax liability. This includes standard deductions, itemized deductions (medical expenses, charitable contributions, etc.), and tax credits like the Saver’s Credit or Retirement Savings Contributions Credit, which are specifically designed to incentivize retirement savings.

Tax Bracket Analysis

One of the calculator’s key strengths is its ability to analyze an individual’s tax bracket within the context of retirement. It considers the progressive nature of the tax system, where higher income levels are taxed at higher rates. For retirees, this can be particularly complex due to the interplay of various income sources and the potential for income to fluctuate year-over-year.

The calculator provides a detailed breakdown of the tax brackets applicable to the individual's income, helping them understand the potential tax implications of different income levels.

Social Security Benefits and Taxation

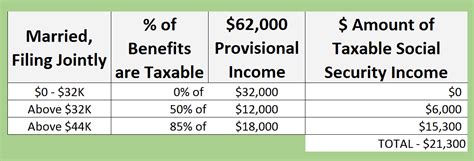

Social Security benefits are a significant income source for many retirees, but they are not entirely tax-free. The calculator accounts for the provisional income calculation, which determines the portion of Social Security benefits that may be taxable. This calculation depends on an individual’s total income, including half of their Social Security benefits, any taxable pension income, and other taxable sources.

By understanding the potential taxability of Social Security benefits, individuals can make informed decisions about their retirement income strategy.

Required Minimum Distributions (RMDs)

For those with retirement accounts, the calculator also addresses the issue of Required Minimum Distributions (RMDs). RMDs are mandatory distributions from retirement accounts once an individual reaches a certain age (typically 72 for those turning 70.5 in 2020 or later). Failure to take RMDs can result in significant penalties.

The calculator helps individuals understand their RMD obligations, ensuring they meet these requirements while also considering the tax implications of these distributions.

Tax Optimization Strategies

Beyond providing a simple tax calculation, the Retirement Tax Rate Calculator offers strategic insights to optimize an individual’s tax situation. This includes suggestions on:

- When to start taking Social Security benefits to minimize taxes

- Strategies for managing RMDs to stay in a lower tax bracket

- Potential tax-efficient ways to withdraw from retirement accounts

- Maximizing deductions and credits to reduce taxable income

These strategies are tailored to the individual's unique financial situation, helping them make the most of their retirement savings while minimizing their tax burden.

Benefits of Using the Retirement Tax Rate Calculator

The Retirement Tax Rate Calculator offers a multitude of benefits to individuals navigating the complex world of retirement finances.

Accurate Tax Projections

By inputting their specific financial details, individuals can obtain an accurate projection of their tax liability for the year. This helps in budgeting and financial planning, ensuring that retirees have sufficient funds to cover their tax obligations.

Tax Strategy Development

The calculator’s strategic insights provide a roadmap for individuals to optimize their tax situation. Whether it’s deciding when to start Social Security benefits or how to structure retirement account withdrawals, the calculator offers guidance to minimize taxes and maximize retirement income.

Peace of Mind

Retirement is a time to enjoy the fruits of one’s labor, and the last thing retirees want to worry about is taxes. By using this calculator, individuals can have peace of mind, knowing they’ve taken steps to understand and manage their tax obligations effectively.

Long-Term Financial Planning

The calculator’s ability to analyze tax brackets and provide strategic insights enables individuals to make informed decisions about their long-term financial plans. This includes understanding the potential tax implications of different retirement scenarios, such as part-time work or investing strategies.

Performance and Real-World Examples

The Retirement Tax Rate Calculator has been met with widespread acclaim from financial experts and retirees alike. Its accuracy and comprehensive approach to retirement taxation have made it a trusted tool for those seeking to navigate the complexities of retirement finances.

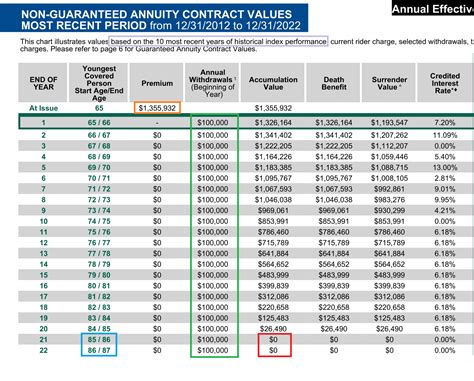

One retiree, John, used the calculator to understand the tax implications of his retirement income, which included Social Security benefits, a pension, and distributions from his 401(k). By entering his specific details, he was able to see a clear breakdown of his taxable income and the potential tax liability. This helped him make informed decisions about when to start his Social Security benefits and how to structure his retirement account withdrawals to stay in a lower tax bracket.

Another user, Sarah, found the calculator's strategic insights particularly valuable. She was able to use the calculator's suggestions to optimize her tax situation, including timing her RMDs to align with years when her taxable income was lower due to fluctuations in investment earnings. This not only reduced her tax burden but also provided her with a more stable retirement income stream.

Future Implications and Updates

As the tax landscape evolves, the Retirement Tax Rate Calculator remains committed to staying up-to-date with the latest tax laws and regulations. The calculator’s developers continuously monitor legislative changes and tax code revisions, ensuring that the tool remains accurate and relevant for retirees.

In the future, the calculator aims to integrate even more advanced features, such as:

- Advanced tax planning simulations to account for various retirement scenarios

- Real-time tax bracket updates to reflect changes in tax laws

- Integration with investment platforms to provide a holistic view of an individual's financial portfolio and potential tax implications

By staying at the forefront of retirement tax planning, the calculator aims to provide retirees with the most comprehensive and accurate tool available.

| Retirement Tax Rate Calculator Features | Description |

|---|---|

| Comprehensive Income Analysis | Accurately calculates taxable income from various sources, including Social Security, pensions, and retirement accounts. |

| Deduction and Credit Assessment | Takes into account standard and itemized deductions, as well as tax credits like the Saver's Credit, to reduce tax liability. |

| Tax Bracket Analysis | Provides a detailed breakdown of applicable tax brackets, helping individuals understand the potential tax implications of different income levels. |

| Social Security Benefits and Taxation | Calculates the potential taxability of Social Security benefits using the provisional income method, considering total income and other taxable sources. |

| Required Minimum Distributions (RMDs) | Assists individuals in understanding their RMD obligations and the tax implications of these distributions. |

| Tax Optimization Strategies | Offers tailored suggestions to minimize taxes, including timing of Social Security benefits and strategies for managing RMDs and retirement account withdrawals. |

How accurate are the tax projections provided by the Retirement Tax Rate Calculator?

+

The tax projections provided by the calculator are highly accurate, as they are based on the latest tax laws and regulations. The calculator takes into account an individual’s specific financial details, including income sources, deductions, and credits, to provide a precise estimate of their tax liability.

Can the calculator help me understand the tax implications of different retirement scenarios?

+

Absolutely! The calculator is designed to offer strategic insights and simulations to help individuals understand the tax implications of various retirement scenarios. This includes decisions such as when to start Social Security benefits, how to manage RMDs, and the tax-efficient ways to withdraw from retirement accounts.

Is the calculator regularly updated to reflect changes in tax laws and regulations?

+

Yes, the calculator is continuously updated to ensure it remains current with the latest tax laws and regulations. The developers monitor legislative changes and tax code revisions to maintain the calculator’s accuracy and relevance for retirees.

How can I access the Retirement Tax Rate Calculator?

+

You can access the Retirement Tax Rate Calculator through reputable financial planning platforms or websites. Ensure you choose a trusted source to ensure the calculator’s accuracy and reliability.

Are there any limitations to the calculator’s functionality?

+

While the calculator is highly sophisticated, it may have certain limitations, such as not accounting for specific state or local tax laws. It’s important to consult with a tax professional for a comprehensive understanding of your unique tax situation.