Pa Tax Exempt Form

Welcome to this comprehensive guide on the Pennsylvania Tax Exempt Form, a critical document for entities and individuals seeking tax-exempt status in the state of Pennsylvania. This article will delve into the intricacies of the form, its purpose, and the process of obtaining tax-exempt status. By the end, you'll have a clear understanding of the requirements, benefits, and implications of the PA Tax Exempt Form, empowering you to make informed decisions regarding your tax obligations.

Understanding the PA Tax Exempt Form

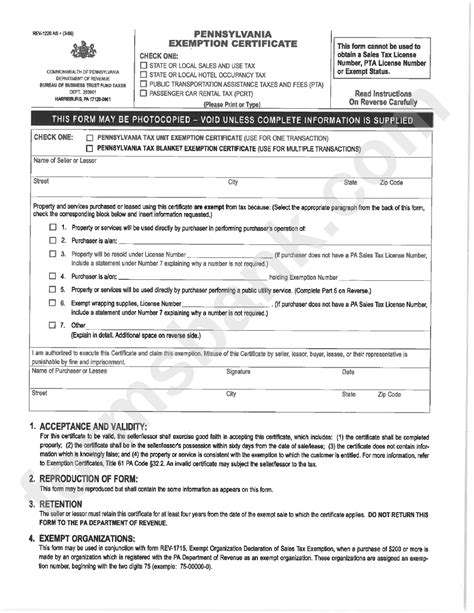

The PA Tax Exempt Form, officially known as the “Pennsylvania Tax Exemption Certificate for Entities,” is a legal document that serves as proof of an entity’s tax-exempt status. It is issued by the Pennsylvania Department of Revenue to eligible organizations and individuals, granting them exemption from certain state taxes.

This form is a crucial tool for nonprofit organizations, charitable institutions, religious entities, educational institutions, and other eligible entities to assert their tax-exempt status and claim exemption from sales and use taxes, among other potential tax benefits.

Key Benefits of Tax-Exempt Status

- Sales and Use Tax Exemption: Eligible entities can claim exemption from sales and use taxes on purchases made for their operations. This significantly reduces the financial burden on nonprofit organizations, allowing them to allocate more resources towards their core missions.

- Property Tax Exemption: Certain types of organizations, such as religious and charitable entities, may qualify for property tax exemption. This benefit can provide substantial savings and ensure that these organizations can maintain their facilities without undue financial strain.

- Income Tax Exemption: Depending on the entity’s structure and purpose, income tax exemption may be applicable. This benefit further reduces the tax obligations of nonprofit organizations, allowing them to focus on their core activities and long-term sustainability.

Eligibility and Requirements

Not all organizations and individuals are eligible for tax-exempt status in Pennsylvania. The PA Tax Exempt Form has specific criteria that entities must meet to qualify for exemption. Here are some key requirements:

- Nonprofit Status: The entity must be organized and operated exclusively for charitable, religious, educational, scientific, or other nonprofit purposes as defined by the Internal Revenue Code (IRC) Section 501(c)(3). This status is typically verified through federal tax exemption determination.

- Exemption Purpose: The primary purpose of the organization must align with the specific tax exemption category it is applying for. For example, a religious organization seeking tax exemption must demonstrate its primary purpose is religious worship, instruction, or outreach.

- Federal Tax Exemption: Many types of tax-exempt organizations in Pennsylvania are required to have federal tax exemption status from the IRS. This often involves obtaining an Employer Identification Number (EIN) and completing the necessary federal tax exemption application process.

- State Registration: Entities seeking tax exemption in Pennsylvania must also register with the state. This typically involves submitting the appropriate forms, providing organizational and financial information, and meeting other state-specific requirements.

| Tax Exemption Category | Eligibility Requirements |

|---|---|

| Charitable Organizations | Promote charitable, educational, religious, scientific, or other purposes for public benefit. |

| Religious Organizations | Primarily engaged in religious worship, instruction, or outreach. |

| Educational Institutions | Provide education, including K-12, higher education, and specialized education programs. |

| Scientific Organizations | Conduct or promote scientific research or educational activities. |

Applying for Tax-Exempt Status

The process of obtaining tax-exempt status in Pennsylvania involves several steps. Here’s a simplified overview:

- Determine Eligibility: Assess whether your organization meets the criteria for tax exemption based on its purpose, structure, and activities.

- Obtain Federal Tax Exemption: If applicable, obtain federal tax exemption status from the IRS by applying for an EIN and completing the necessary federal tax exemption application.

- Register with the State: Complete the state registration process, which typically involves submitting forms, providing organizational and financial information, and paying any applicable fees.

- Complete the PA Tax Exempt Form: Download and fill out the official form provided by the Pennsylvania Department of Revenue. Ensure all required information is accurate and complete.

- Submit the Form: Submit the completed form to the Department of Revenue, either electronically or by mail, depending on the preferred method.

- Await Approval: The Department of Revenue will review your application and determine your eligibility for tax-exempt status. This process may take several weeks.

- Renewal: Tax-exempt status is typically valid for a set period. Organizations must renew their status periodically by completing the renewal process, which often involves submitting updated information and documentation.

Technical Specifications and Performance

The PA Tax Exempt Form is a comprehensive document that requires careful attention to detail. Here are some technical specifications and performance considerations:

Form Components

- Applicant Information: This section requires accurate and complete information about the organization, including its legal name, address, contact details, and EIN (if applicable).

- Exemption Category: The form includes a selection of tax exemption categories, such as charitable, religious, educational, and scientific. Organizations must choose the category that best aligns with their purpose and activities.

- Description of Activities: A detailed description of the organization’s activities and purpose is required. This section allows organizations to demonstrate how their work aligns with the exemption criteria.

- Supporting Documents: Depending on the exemption category, additional supporting documents may be required. These could include articles of incorporation, bylaws, financial statements, or other relevant documentation.

Performance Analysis

The performance of the PA Tax Exempt Form is critical to ensuring organizations receive the tax benefits they are entitled to. Here are some key performance considerations:

- Accuracy: Providing accurate and truthful information is essential. Inaccurate or misleading information can lead to denial of tax-exempt status or legal consequences.

- Timeliness: Submitting the form promptly and within the required timeframe is crucial. Delayed submissions may result in missed opportunities for tax exemption or unnecessary financial obligations.

- Compliance: Organizations must adhere to all state and federal regulations related to tax exemption. Failure to comply with these regulations can result in revocation of tax-exempt status or other legal penalties.

- Renewal Process: Tax-exempt status is not permanent. Organizations must renew their status periodically to maintain their exemption benefits. Staying informed about renewal deadlines and requirements is essential.

Future Implications and Trends

The landscape of tax exemption in Pennsylvania is subject to change and evolution. Here are some future implications and trends to consider:

Legislative Changes

Tax laws and regulations are subject to legislative changes. Stay informed about any updates to state and federal tax codes that may impact tax-exempt organizations. This includes changes to eligibility criteria, tax rates, and reporting requirements.

Enhanced Transparency and Accountability

As tax-exempt organizations continue to play a vital role in society, there is a growing emphasis on transparency and accountability. This may lead to increased scrutiny and reporting requirements for tax-exempt entities. Organizations should be prepared to demonstrate their financial integrity and adherence to their stated purposes.

Digital Transformation

The Pennsylvania Department of Revenue is continually working to improve its digital services and streamline the tax exemption process. Keep an eye out for online portals, digital submission options, and other technological advancements that can simplify the application and renewal processes.

FAQs

Can individuals apply for tax-exempt status in Pennsylvania?

+While individuals may qualify for certain tax exemptions, the PA Tax Exempt Form is primarily designed for organizations. Individuals seeking tax benefits should explore other avenues, such as personal tax credits or deductions, based on their specific circumstances.

How long does it take to receive tax-exempt status after submitting the form?

+The processing time for tax-exempt applications can vary. Typically, it takes several weeks to a few months for the Department of Revenue to review and determine eligibility. Factors such as the completeness of the application and the complexity of the organization’s structure can influence the processing time.

Are there any fees associated with applying for tax-exempt status in Pennsylvania?

+Yes, there may be fees associated with the application process. These fees can vary depending on the type of organization and the specific requirements. It’s essential to check the current fee schedule and budget accordingly when applying for tax-exempt status.

Can a tax-exempt organization lose its status?

+Yes, tax-exempt status is not permanent. Organizations can lose their exemption if they fail to comply with state and federal regulations, engage in activities inconsistent with their stated purposes, or fail to meet the renewal requirements. It’s crucial to maintain proper documentation and adhere to all applicable laws.

How often do tax-exempt organizations need to renew their status?

+The renewal frequency can vary depending on the organization’s type and the specific tax exemption category. Some organizations may need to renew annually, while others may have a longer renewal period. It’s essential to stay informed about the renewal requirements and deadlines to maintain uninterrupted tax-exempt status.

The PA Tax Exempt Form is a powerful tool for organizations seeking tax-exempt status in Pennsylvania. By understanding the requirements, completing the form accurately, and staying informed about future developments, entities can leverage the benefits of tax exemption to further their missions and positively impact their communities.