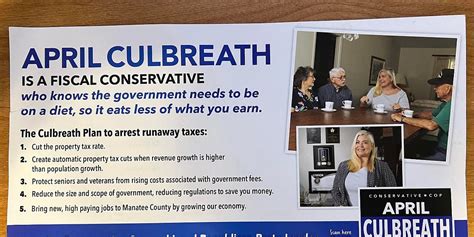

Manatee Property Tax

Welcome to an in-depth exploration of the Manatee Property Tax, a critical component of the local government's revenue system in Florida. This article aims to demystify the often complex world of property taxes, specifically tailored to the unique context of Manatee County, Florida. Through this guide, we will unravel the intricacies of the tax assessment process, understand the various exemptions and discounts available, and explore the potential implications for both residential and commercial property owners.

The Manatee Property Tax: An Overview

The Manatee Property Tax is an essential revenue source for the local government, funding vital services and infrastructure projects. This tax is levied on both real and personal property within Manatee County, including residential homes, commercial properties, agricultural lands, and other tangible assets. The revenue generated plays a crucial role in maintaining the county’s financial stability and ensuring the continuous delivery of essential services to its residents.

The property tax system in Manatee County operates under a well-defined framework, with assessments and tax rates determined by the Property Appraiser's Office and the Board of County Commissioners, respectively. This collaborative effort ensures a fair and transparent process, taking into account the unique characteristics of each property and the overall economic climate of the county.

The Assessment Process: A Detailed Breakdown

The property tax assessment process in Manatee County involves a meticulous evaluation of each property’s market value. This value, often referred to as the Just Value, is determined by a combination of factors, including recent sales data, property improvements, and the overall real estate market trends. The Property Appraiser’s Office conducts these assessments annually, ensuring that property values remain up-to-date and reflective of the current market conditions.

To provide a more nuanced understanding, let's consider a hypothetical scenario. Imagine a residential property located in a desirable neighborhood of Manatee County. The Property Appraiser's Office would analyze recent sales of similar properties in the area, taking into account factors such as size, location, and any recent renovations. This data-driven approach ensures that the assessed value is a true reflection of the property's market worth.

| Assessment Category | Description |

|---|---|

| Residential Properties | Includes single-family homes, condominiums, and townhouses. Assessments consider factors like square footage, number of bedrooms, and recent improvements. |

| Commercial Properties | Covers offices, retail spaces, and industrial buildings. Assessments focus on income potential, location, and overall market demand. |

| Agricultural Lands | Evaluated based on their use and productivity. The Property Appraiser's Office considers factors like soil quality, irrigation systems, and the prevailing agricultural trends. |

Once the assessments are complete, property owners receive a Notice of Proposed Property Taxes, outlining the proposed tax amount. This notice serves as an important opportunity for property owners to review the assessment and, if necessary, dispute any inaccuracies.

Exemptions and Discounts: Unlocking Savings

Manatee County offers a range of exemptions and discounts to eligible property owners, providing an opportunity to reduce the overall property tax burden. These incentives are designed to support specific groups and encourage certain types of development, ultimately contributing to the county’s economic growth and social well-being.

- Homestead Exemption: One of the most well-known exemptions, the Homestead Exemption, provides a significant discount on the taxable value of a primary residence. To qualify, property owners must reside in the home and have established it as their permanent residence. This exemption is particularly beneficial for long-term residents, helping them maintain affordability in their homes.

- Senior Exemption: Recognizing the contributions of our senior citizens, Manatee County offers an additional exemption for homeowners aged 65 and above. This exemption further reduces the taxable value of the property, providing much-needed relief to seniors on fixed incomes.

- Agricultural Exemption: To support the county's agricultural sector, properties used for bona fide agricultural purposes are eligible for a reduced assessment. This exemption encourages the preservation of farmland and promotes sustainable agricultural practices.

- Greenbelt Exemption: Aimed at encouraging land conservation, the Greenbelt Exemption provides a reduced assessment for properties that are part of a qualified Greenbelt program. This initiative promotes the preservation of natural habitats and open spaces, contributing to the county's environmental sustainability.

Beyond these exemptions, Manatee County also offers various other discounts and incentives, such as the Disabled Veterans' Discount, Military Discount, and Low-Income Senior Discount. These initiatives demonstrate the county's commitment to supporting its residents and fostering a sense of community.

Understanding Tax Rates and Payment Options

The tax rate in Manatee County is determined by the Board of County Commissioners, taking into account the county’s budgetary needs and the overall economic climate. This rate is expressed as a millage rate, which represents the amount of tax levied per 1,000 of the property's assessed value. For instance, a millage rate of 5 mills would mean that property owners pay 5 in taxes for every $1,000 of their property’s assessed value.

To provide an illustrative example, let's consider a residential property with an assessed value of $250,000. If the millage rate is set at 5 mills, the annual property tax would amount to $1,250 ($250,000 x 0.005). However, this calculation is just the beginning, as the final tax amount can be impacted by various factors, including exemptions and any applicable special assessments.

Manatee County offers a range of convenient payment options to property owners. These include online payments, which can be made through the county's secure payment portal, as well as traditional methods such as mail-in payments and in-person transactions at designated locations. Additionally, the county provides a convenient Tax Payment Plan for those who prefer to spread their payments across multiple installments.

The Impact of Special Assessments

In certain cases, property owners in Manatee County may be subject to special assessments, which are additional charges levied to fund specific projects or services that benefit a particular area or group of properties. These assessments are typically used to finance infrastructure improvements, such as road repairs, stormwater management, or utility upgrades.

For instance, a special assessment might be imposed on properties within a specific neighborhood to fund the installation of a new stormwater drainage system. While these assessments can add to the overall property tax burden, they are essential for maintaining and enhancing the community's infrastructure and can significantly improve the quality of life for residents.

Future Implications and Long-Term Planning

The Manatee Property Tax system is dynamic and responsive to the evolving needs of the county. As the population grows and the economy evolves, the revenue generated from property taxes plays an increasingly crucial role in funding essential services and infrastructure projects. Understanding the potential long-term implications of property tax policies is essential for both property owners and local policymakers.

One key consideration is the impact of property tax policies on the county's overall economic health. While property taxes are a vital source of revenue, excessive taxation can potentially hinder economic growth by making the county less attractive for businesses and new residents. Striking the right balance between revenue generation and maintaining a competitive business environment is a delicate task that requires careful consideration of various factors, including the county's economic climate, growth prospects, and the availability of alternative revenue sources.

For property owners, long-term planning is crucial to navigate the potential fluctuations in property tax rates and assessments. By staying informed about the county's fiscal policies, property owners can make strategic decisions regarding property improvements, investment opportunities, and financial planning. Understanding the potential for future exemptions, discounts, and incentives can also help property owners optimize their tax liabilities and make more informed choices.

Furthermore, the Manatee Property Tax system's responsiveness to the changing needs of the community is a key strength. As the county continues to grow and evolve, the tax system can adapt to support new infrastructure projects, encourage sustainable development, and provide essential services to a diverse population. This dynamic nature ensures that the property tax system remains a vital tool for fostering the county's economic prosperity and social well-being.

What is the timeline for property tax assessments in Manatee County?

+

Property assessments in Manatee County are conducted annually, typically completed by April 1st of each year. Property owners receive a Notice of Proposed Property Taxes, which outlines the proposed tax amount and provides an opportunity to dispute any inaccuracies.

How can I appeal my property tax assessment if I believe it is inaccurate?

+

If you believe your property tax assessment is inaccurate, you have the right to appeal. The process typically involves submitting a formal written protest to the Property Appraiser’s Office within a specified timeframe. It is advisable to gather supporting evidence, such as recent sales data or professional appraisals, to strengthen your case.

Are there any tax relief programs for low-income homeowners in Manatee County?

+

Yes, Manatee County offers the Low-Income Senior Discount, which provides a reduction in property taxes for eligible low-income seniors. This discount aims to support seniors who may face financial challenges in maintaining their homes. To qualify, seniors must meet certain income criteria and own their primary residence.

Can I pay my property taxes online in Manatee County?

+

Absolutely! Manatee County offers a convenient online payment option through its secure payment portal. This allows property owners to make payments quickly and securely from the comfort of their homes. The online system also provides real-time updates on payment status and account information.

What happens if I fail to pay my property taxes on time in Manatee County?

+

Late payment of property taxes can result in penalties and interest charges. It is important to stay on top of your payment due dates to avoid additional financial burdens. If you encounter financial difficulties, it is advisable to contact the Tax Collector’s Office to explore potential payment plans or other assistance options.