California Sales Tax Palo Alto

Welcome to our comprehensive guide on understanding and navigating the complexities of sales tax in Palo Alto, California. As one of the thriving hubs in Silicon Valley, Palo Alto boasts a vibrant business landscape, making it essential for businesses and consumers alike to grasp the nuances of sales tax regulations in this region.

Unraveling the California Sales Tax Landscape

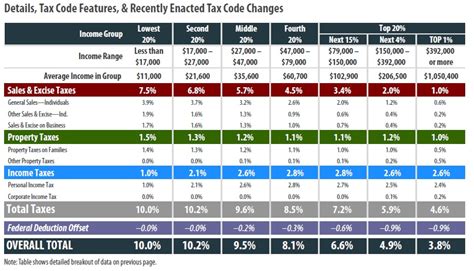

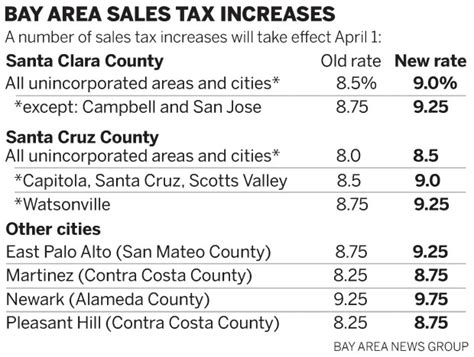

California, known for its diverse economy and bustling markets, has a sales tax system that varies across cities and counties. This variation is influenced by the state’s dynamic business environment and the unique needs of each locality. Palo Alto, situated in the heart of Santa Clara County, stands out as a significant economic center with its own set of sales tax rules.

Sales tax in California is a vital revenue source for the state, counties, and cities, often used to fund essential services and infrastructure projects. The state sales tax rate is set at 7.25%, but local jurisdictions have the authority to levy additional taxes, which can significantly impact the total sales tax rate consumers pay.

Sales Tax Rates in Palo Alto: A Detailed Breakdown

Palo Alto, a city brimming with innovation and technological advancements, has its own unique sales tax rate, which is layered on top of the state sales tax. As of the latest data, the city of Palo Alto imposes a local sales tax rate of 0.75%, bringing the total sales tax rate in the city to 8.00%. This rate is consistent across various products and services, including retail goods, restaurant meals, and certain services.

However, it's important to note that this rate can vary for specific categories of goods and services. For instance, the sale of certain electronics might be subject to additional taxes, bringing the effective rate slightly higher. Additionally, certain exemptions and discounts may apply for specific items, such as food products, making the tax rate effectively lower for these categories.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Palo Alto City | 0.75% |

| Santa Clara County | 0.50% |

| Total Effective Rate in Palo Alto | 8.00% |

How Sales Tax Rates Impact Businesses and Consumers

The cumulative sales tax rate in Palo Alto has significant implications for both businesses and consumers. For businesses, it represents a substantial overhead cost that must be carefully managed to maintain profitability. Many businesses in Palo Alto incorporate sales tax into their pricing strategies, either by absorbing the cost or passing it on to consumers.

From a consumer perspective, the sales tax rate directly affects purchasing power and can influence buying decisions. Consumers in Palo Alto need to be aware of the total sales tax rate to make informed choices about their purchases, especially when comparing prices with other regions or online.

Sales Tax Compliance and Filing Requirements

Understanding and complying with sales tax regulations is crucial for businesses operating in Palo Alto. The California Board of Equalization (BOE) is the primary authority responsible for overseeing sales tax collection and compliance. Businesses are required to register with the BOE, obtain a seller’s permit, and remit sales tax on a regular basis, typically monthly or quarterly.

Sales tax compliance involves accurately calculating and collecting the appropriate tax rate on each transaction. Businesses must maintain detailed records of sales, including the tax component, to facilitate smooth compliance and auditing processes. Failure to comply with sales tax regulations can result in penalties and legal repercussions.

Navigating Exemptions and Discounts in Palo Alto

While the sales tax rate in Palo Alto is relatively straightforward, there are certain exemptions and discounts that can impact the total tax liability. These exemptions are designed to promote specific economic sectors or provide relief to certain consumer groups.

Sales Tax Exemptions in Palo Alto

One notable exemption in Palo Alto is the sales tax holiday, which occurs annually. During this period, specific categories of goods, typically school supplies and clothing, are exempt from sales tax. This holiday provides a significant boost to consumer spending and offers a strategic opportunity for businesses to promote sales and attract customers.

Additionally, certain types of goods, such as food items and prescription drugs, are often exempt from sales tax in California. This exemption is designed to reduce the tax burden on essential items and provide relief to consumers.

Discounts and Rebates for Palo Alto Residents

Palo Alto offers various discounts and rebates to its residents, particularly for senior citizens and those with disabilities. These discounts can significantly reduce the sales tax liability for eligible individuals, making it important for residents to be aware of these benefits and how to claim them.

For instance, the Palo Alto Senior Discount Program provides eligible seniors with a discount on their water and sewer bills, which can indirectly reduce their overall tax burden. Similarly, the city offers a Property Tax Relief Program for eligible low-income homeowners, which can provide significant savings and improve their financial well-being.

Future Outlook and Potential Changes in Sales Tax

The sales tax landscape in California, including Palo Alto, is subject to ongoing changes and revisions. These changes can be driven by various factors, such as shifts in the economic climate, political decisions, and technological advancements.

One potential future development is the implementation of a state-wide online sales tax, which would require online retailers to collect and remit sales tax on transactions regardless of their physical location. This change would significantly impact the e-commerce sector and potentially alter the competitive landscape for businesses in Palo Alto.

Additionally, the continued development of the gig economy and the rise of remote work could lead to new tax regulations and challenges. The classification of workers and the allocation of tax liability in these evolving employment models is an area of ongoing discussion and potential legislative change.

Staying Informed and Adapting to Change

For businesses and consumers in Palo Alto, staying informed about sales tax regulations and changes is crucial. This includes regularly monitoring official sources, such as the California Board of Equalization and the Palo Alto City website, for updates and announcements. Additionally, engaging with industry associations and consulting with tax professionals can provide valuable insights and guidance.

By staying proactive and adapting to changing sales tax regulations, businesses can maintain compliance, minimize penalties, and make strategic decisions that benefit their bottom line. Similarly, consumers can make more informed choices about their purchases and take advantage of any available exemptions or discounts.

What is the sales tax rate in Palo Alto, California as of the latest data?

+As of the latest data, the total sales tax rate in Palo Alto is 8.00%, which includes the state sales tax rate of 7.25% and the local sales tax rate of 0.75%.

Are there any sales tax holidays in Palo Alto?

+Yes, Palo Alto observes an annual sales tax holiday, during which certain categories of goods, such as school supplies and clothing, are exempt from sales tax. This holiday typically occurs in August.

What are the sales tax filing requirements for businesses in Palo Alto?

+Businesses in Palo Alto are required to register with the California Board of Equalization (BOE), obtain a seller’s permit, and remit sales tax on a regular basis, typically monthly or quarterly. They must also maintain accurate records of sales transactions for compliance and auditing purposes.

Are there any discounts or rebates available for Palo Alto residents?

+Yes, Palo Alto offers various discounts and rebates to its residents, particularly for senior citizens and those with disabilities. These include discounts on water and sewer bills and property tax relief programs for eligible homeowners.

How can businesses and consumers stay updated on sales tax regulations and changes in Palo Alto?

+Businesses and consumers can stay informed by regularly checking official sources like the California Board of Equalization and the Palo Alto City website for updates and announcements. Additionally, engaging with industry associations and consulting tax professionals can provide valuable insights.