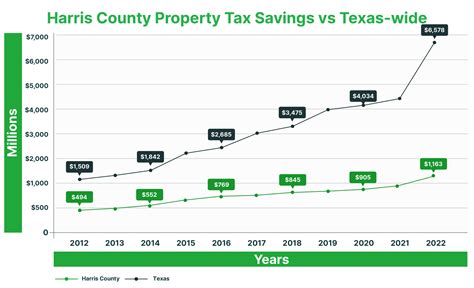

Harris County Property Taxes

Harris County, located in the heart of Texas, is renowned for its vibrant cities, diverse communities, and thriving economy. One aspect that often captures the attention of residents and prospective homebuyers is the topic of property taxes. Property taxes in Harris County play a significant role in funding essential services and infrastructure, making it an important consideration for both homeowners and investors.

Understanding Harris County Property Taxes

Harris County’s property tax system is a complex yet crucial mechanism that supports the county’s operations and development. These taxes are levied on both residential and commercial properties, contributing to the overall tax base of the county. The revenue generated from property taxes is utilized to finance a wide range of services, including public education, law enforcement, fire protection, road maintenance, and various municipal projects.

The property tax rate in Harris County is determined by the taxing jurisdictions within the county, which include the county itself, cities, school districts, and special districts. Each of these entities sets its own tax rate, which, when combined, form the overall effective tax rate for a specific property.

Factors Influencing Property Taxes

Several factors come into play when determining the property tax liability for a homeowner or business owner in Harris County. Here’s a breakdown of the key elements that impact property taxes:

- Property Value: The assessed value of a property is a significant determinant of the tax bill. The Harris County Appraisal District (HCAD) is responsible for appraising properties annually. The appraised value, combined with the tax rate, forms the basis for calculating property taxes.

- Tax Rate: As mentioned earlier, the tax rate is set by the various taxing jurisdictions. It is expressed as a percentage of the property's assessed value. Tax rates can vary significantly between different areas within Harris County, leading to variations in tax liabilities.

- Taxing Jurisdictions: Harris County comprises multiple taxing entities, each with its own responsibilities and funding needs. These entities include the county government, cities like Houston, school districts such as Houston ISD, and special districts for specific purposes like flood control or utility services.

- Exemptions and Discounts: Harris County offers various exemptions and discounts to eligible property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and exemptions for elderly or disabled individuals. Understanding the eligibility criteria for these exemptions can significantly impact a property owner's tax liability.

- Tax Calculation: The process of calculating property taxes involves multiplying the appraised value of the property by the tax rate. However, it's important to note that the appraised value is not always equal to the market value of the property. HCAD employs professional appraisers who consider various factors, such as recent sales data and property characteristics, to determine the assessed value.

Property Tax Rates and Assessment

The tax rates in Harris County can vary significantly depending on the location and the type of property. For instance, residential properties in the city of Houston may have different tax rates compared to those in unincorporated areas of the county. Similarly, commercial properties, such as office buildings or retail spaces, often face higher tax rates due to their unique valuation and the services they require.

Harris County's tax assessment process is carried out by the HCAD, which employs a team of trained appraisers. These appraisers conduct physical inspections, analyze market data, and consider factors like location, size, improvements, and recent sales to determine the fair market value of each property. The assessed value is then subject to review and protest by property owners, ensuring a transparent and fair assessment process.

| Taxing Entity | Tax Rate (Effective Rate per $100 of Value) |

|---|---|

| Harris County | 0.3665 |

| City of Houston | 0.5662 |

| Houston ISD | 1.2829 |

| Harris County Flood Control District | 0.0667 |

| Total Effective Tax Rate | 2.2823 |

The table above provides an example of the effective tax rates for a property located in Houston, including the rates set by the county, city, school district, and special district. It's important to note that these rates are subject to change annually and may vary based on the specific location and property type.

Payment Options and Deadlines

Harris County offers several payment options for property taxes, providing flexibility to taxpayers. Property owners can choose to pay their taxes in full by the deadline or opt for installment plans, allowing them to spread the payment over multiple months. The county also provides online payment platforms and accepts various payment methods, including credit cards, e-checks, and wire transfers.

The payment deadline for property taxes is typically in January or February, with specific dates varying each year. It's essential for property owners to stay updated on the payment schedule to avoid penalties and interest charges. Late payments can result in additional fees, so timely payment is crucial to maintaining a good standing with the county.

The Impact of Property Taxes on the Community

Property taxes in Harris County play a vital role in shaping the community’s development and well-being. The revenue generated from these taxes is a significant source of funding for essential services, infrastructure projects, and public facilities. It supports the local economy, contributes to job creation, and enhances the overall quality of life for residents.

Harris County's property tax system also promotes accountability and transparency. The county's taxing entities are held accountable for their spending, and residents have the opportunity to engage in the budgeting process through public hearings and community input. This engagement ensures that tax revenues are allocated efficiently and effectively, addressing the needs and priorities of the community.

Conclusion

Harris County’s property tax system is a complex yet essential mechanism that funds the county’s operations and development. Understanding the factors influencing property taxes, such as property value, tax rates, and exemptions, is crucial for property owners. The HCAD’s assessment process ensures fairness and transparency, while the county’s payment options provide flexibility to taxpayers.

Property taxes in Harris County are an investment in the community's future, supporting essential services, infrastructure, and public facilities. By contributing to the tax base, residents and businesses play a vital role in shaping the county's growth and prosperity. As Harris County continues to thrive, its property tax system remains a key pillar in sustaining its vibrant communities and dynamic economy.

What is the average property tax rate in Harris County?

+The average property tax rate in Harris County varies depending on the location and property type. However, the effective tax rate for a residential property in the county can range from approximately 2% to 3% of the property’s assessed value. It’s important to note that this rate can change annually, and individual properties may have different rates based on their specific circumstances.

How can I estimate my property taxes in Harris County?

+To estimate your property taxes in Harris County, you can use the HCAD’s online property tax calculator. This tool allows you to input your property’s assessed value and the applicable tax rates to get an estimate of your tax liability. Keep in mind that this is an estimate and may not reflect any exemptions or discounts you may be eligible for.

What happens if I don’t pay my property taxes on time in Harris County?

+If you fail to pay your property taxes by the deadline in Harris County, you may incur penalties and interest charges. The county typically imposes a penalty of up to 6% of the unpaid taxes, and interest accrues at a rate of 1% per month. It’s crucial to stay informed about the payment deadlines and make timely payments to avoid these additional costs.

Are there any exemptions or discounts available for property taxes in Harris County?

+Yes, Harris County offers several exemptions and discounts to eligible property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and exemptions for elderly or disabled individuals. Additionally, the county provides veterans’ exemptions and discounts for certain types of properties, such as agricultural lands. It’s important to research and understand the eligibility criteria for these exemptions to maximize your tax savings.

How can I appeal my property assessment in Harris County if I believe it’s inaccurate?

+If you disagree with your property assessment in Harris County, you have the right to file a protest with the HCAD. The protest process allows you to present evidence and argue for a lower valuation. It’s crucial to follow the protest timeline and submit the required documentation to ensure a successful appeal. The HCAD provides resources and guidance on their website to assist property owners through the protest process.