Car Sales Tax In New York

When purchasing a car in New York, it's important to understand the sales tax implications to ensure you're fully prepared for the financial commitment. The state of New York imposes a sales tax on the purchase of motor vehicles, which varies depending on the type of vehicle and its value. This tax is a significant factor in the overall cost of owning a car in New York, so let's delve into the specifics to provide a comprehensive understanding of this process.

Understanding New York’s Car Sales Tax

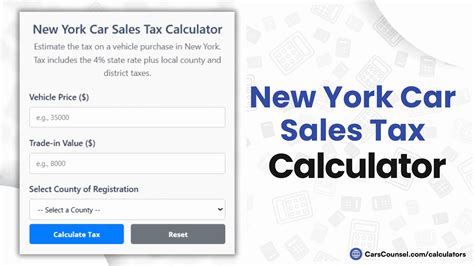

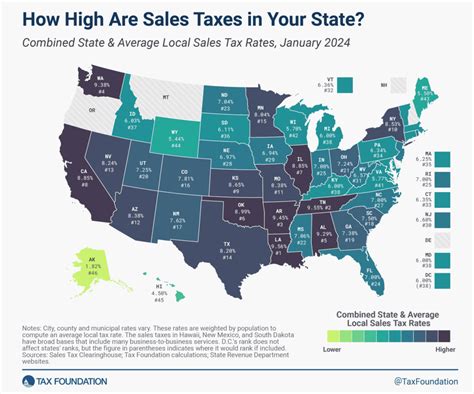

New York’s sales tax on vehicles is a combined state and local tax. This means that the sales tax rate you pay will be determined by the location where you register your vehicle, and it will consist of both the state sales tax rate and any additional local taxes or fees.

The current state sales tax rate for vehicles in New York is 4%. However, it's important to note that there are additional local taxes that can significantly impact the overall sales tax amount. These local taxes can vary greatly depending on the county and municipality where you register your vehicle. For instance, New York City imposes a 5% sales tax on top of the state rate, while other counties may have different rates or additional fees.

Tax Rates by County

To give you a clearer picture, here’s a breakdown of sales tax rates in some of the most populous counties in New York:

| County | Sales Tax Rate |

|---|---|

| New York County (Manhattan) | 8.875% |

| Kings County (Brooklyn) | 8.625% |

| Queens County | 8.625% |

| Bronx County | 8.625% |

| Richmond County (Staten Island) | 8.125% |

| Nassau County | 8.375% |

| Suffolk County | 7.375% |

These rates can change over time, so it's always advisable to check with the New York Department of Taxation and Finance or your local tax office for the most up-to-date information.

Calculating the Sales Tax

To calculate the sales tax on your vehicle purchase, you’ll need to multiply the purchase price by the applicable sales tax rate. For instance, if you’re purchasing a car in Manhattan with a price of $30,000, the sales tax calculation would be:

Purchase Price: $30,000

Sales Tax Rate: 8.875% (State rate of 4% + Manhattan rate of 4.875%)

Sales Tax: $2,662.50 (30,000 x 0.08875)

Therefore, the total cost of the vehicle would be $32,662.50, including sales tax.

Exemptions and Special Cases

While the majority of vehicle purchases in New York are subject to sales tax, there are certain exemptions and special cases to be aware of. These include:

- Leased Vehicles: When leasing a vehicle, you'll typically pay a monthly sales tax based on the lease payments. This is calculated by multiplying the lease payment by the sales tax rate and then dividing by 12 months.

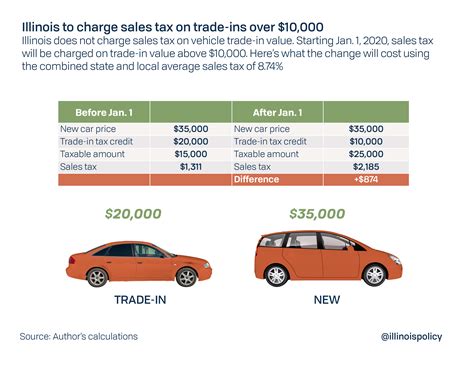

- Trade-Ins: If you're trading in an old vehicle when purchasing a new one, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle.

- Disabled Individuals: New York offers sales tax exemptions for certain adaptive equipment and vehicles purchased by individuals with disabilities. This includes modifications such as hand controls, wheelchair lifts, or other adaptations necessary for operation.

- Military Personnel: Active-duty military personnel stationed in New York may be eligible for a sales tax exemption on the purchase of a vehicle if they meet specific criteria.

Registration and Title Fees

In addition to sales tax, there are other fees associated with registering and titling your vehicle in New York. These fees can vary depending on the type of vehicle and its characteristics.

Registration Fees

Registration fees in New York typically range from 2-25 for most passenger vehicles. However, there are additional fees for certain types of vehicles, such as:

- Motorcycles: $25 registration fee.

- Electric Vehicles: $200 registration fee, which is reduced to $100 for the second and subsequent years.

- Hybrid Vehicles: $150 registration fee.

- Alternative Fuel Vehicles: $200 registration fee.

Title Fees

The cost of titling a vehicle in New York is 50</strong> for most passenger vehicles. This fee covers the initial title and any subsequent title transfers. However, if you're applying for a duplicate title, there's an additional <strong>20 fee.

Conclusion

Purchasing a vehicle in New York comes with a range of costs, including sales tax, registration fees, and title fees. While the sales tax can vary significantly depending on your location, understanding these costs can help you budget effectively for your new vehicle. It’s important to research the specific rates and requirements in your county to ensure a smooth and accurate transaction.

Frequently Asked Questions

Are there any ways to reduce the sales tax on my vehicle purchase in New York?

+

Unfortunately, sales tax rates are set by the state and local governments, so there aren’t many ways to directly reduce the sales tax. However, you may be eligible for certain exemptions or discounts based on your circumstances, such as being a disabled individual or an active-duty military member. It’s worth researching these options and consulting with a tax professional to see if you qualify.

What happens if I purchase a car out of state and bring it to New York?

+

If you purchase a vehicle out of state and bring it to New York, you will typically need to pay the applicable sales tax in New York based on the vehicle’s value. This is known as “use tax” and is designed to ensure that all vehicle purchases are taxed, regardless of where they are made. You should consult with the New York Department of Taxation and Finance to understand the specific requirements and deadlines for paying this tax.

Are there any sales tax holidays for vehicle purchases in New York?

+

New York does not currently have any specific sales tax holidays for vehicle purchases. However, there may be other sales tax holidays throughout the year for various products, so it’s worth checking the New York Department of Taxation and Finance’s website for any upcoming events.

Can I negotiate the sales tax with the dealership?

+

Sales tax is a mandatory tax imposed by the state and local governments, so dealerships do not have the authority to negotiate or waive it. However, you may be able to negotiate the vehicle’s price, which can indirectly reduce the sales tax amount. It’s always worth discussing pricing with the dealership to see if there’s room for negotiation.

How often do sales tax rates change in New York?

+

Sales tax rates in New York can change periodically, typically as a result of legislative decisions or budget considerations. While the state sales tax rate has remained stable at 4% for many years, local tax rates can vary more frequently. It’s a good idea to check with the New York Department of Taxation and Finance or your local tax office for the most up-to-date information before making a significant vehicle purchase.