Ct State Tax Rate

The state of Connecticut, or Connecticut, is known for its diverse landscape, ranging from coastal towns to rural areas and vibrant cities. Along with its natural beauty and rich history, understanding the tax structure is essential for both residents and businesses. This article delves into the intricacies of the Connecticut state tax rate, shedding light on its composition, variations, and implications.

Understanding the Connecticut State Tax Structure

Connecticut’s tax system is designed to fund essential state services, including education, infrastructure, and social programs. It comprises various taxes, with the state income tax being a significant contributor to the state’s revenue. Here’s a breakdown of the key components of the Connecticut tax structure:

State Income Tax

The Connecticut income tax is progressive, meaning the tax rate increases as income rises. As of [most recent data available], the state income tax rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 3.07% |

| $10,001 - $50,000 | 5.00% |

| $50,001 - $100,000 | 5.50% |

| $100,001 - $200,000 | 6.70% |

| $200,001 - $250,000 | 6.90% |

| $250,001 and above | 6.99% |

These rates are applicable to both individual and joint filers, and they are subject to change based on legislative decisions. The income tax forms a substantial part of the state's revenue, contributing to various public services.

Sales and Use Tax

Connecticut also imposes a sales and use tax on the retail sale, rental, and purchase of most goods and certain services. The general sales tax rate is 6.35%, which is added to the price of eligible items at the point of sale. However, certain essential items like groceries, prescription drugs, and clothing are exempt from this tax, making them more affordable for residents.

Additionally, the state offers a use tax for purchases made outside Connecticut but used within the state. This tax ensures that residents pay the equivalent of sales tax on items purchased elsewhere, maintaining fairness in the tax system.

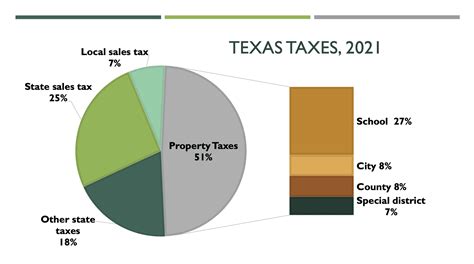

Property Tax

Property taxes in Connecticut are primarily a local responsibility, with each town setting its own tax rate. The state government provides some guidance and oversight, but the specific rates and assessment methods can vary significantly between municipalities. Property taxes fund local services like schools, fire departments, and public works projects.

Implications and Variations

The Connecticut state tax structure has several implications for residents and businesses:

- Progressive Income Tax: The progressive nature of the income tax means that higher-income earners contribute a larger share of their income to state revenue. This can encourage economic growth and provide funding for essential services.

- Sales Tax Exemptions: The exemptions for essential items under the sales tax can make daily living more affordable for residents, particularly those on lower incomes.

- Local Control over Property Taxes: The variation in property tax rates between towns allows for local control and decision-making. However, it can also lead to disparities in tax burdens and services across the state.

- Use Tax Fairness: The use tax ensures that residents pay their fair share, regardless of where they make their purchases, promoting equity in the tax system.

Conclusion

Connecticut’s tax structure is designed to balance the needs of the state and its residents. The progressive income tax, sales and use taxes, and local control over property taxes contribute to a complex yet essential system. Understanding these taxes is crucial for individuals and businesses operating in the state, as it impacts their financial planning and contributions to the community.

What is the current sales tax rate in Connecticut?

+As of the latest update, the general sales tax rate in Connecticut is 6.35%. This rate is applicable to most goods and certain services purchased within the state.

Are there any tax incentives for businesses in Connecticut?

+Yes, Connecticut offers various tax incentives to attract and support businesses. These incentives include tax credits, grants, and exemptions for specific industries and initiatives. It’s recommended to consult the Connecticut Economic Resource Center for detailed information on these incentives.

How often are Connecticut’s tax rates reviewed and updated?

+The tax rates in Connecticut are typically reviewed and adjusted on an annual basis, often as part of the state’s budgeting process. However, emergency situations or special circumstances may lead to mid-year adjustments as well. Staying informed through official state channels is crucial for businesses and residents.

Can residents claim deductions or credits on their state income tax returns?

+Absolutely! Connecticut residents can take advantage of various deductions and credits on their state income tax returns. These include deductions for medical expenses, property taxes, and certain charitable contributions. Additionally, credits are available for education expenses and certain income thresholds. It’s advisable to consult a tax professional or refer to the Connecticut Department of Revenue Services website for the most up-to-date information on deductions and credits.