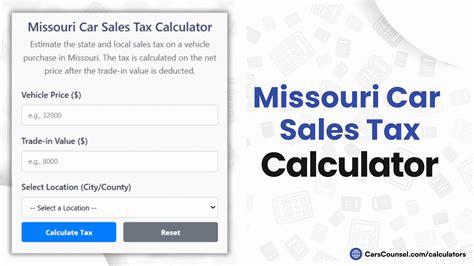

Missouri Car Sales Tax Calculator

Welcome to the comprehensive guide on understanding and calculating car sales tax in the state of Missouri. This article aims to provide an in-depth analysis of the tax structure, rates, and factors that influence the final sales tax amount for vehicle purchases. By delving into the specifics of Missouri's tax laws and regulations, we will empower you with the knowledge to make informed decisions when buying a car in this state.

Understanding Missouri’s Car Sales Tax Structure

Missouri, like many other states, imposes a sales tax on the purchase of motor vehicles. This tax is applied at both the state and local levels, resulting in a combined sales tax rate that varies across the state. The state of Missouri has a uniform sales tax rate, but local jurisdictions, such as cities and counties, have the authority to levy additional taxes, creating a complex tax landscape.

The sales tax on cars in Missouri is calculated based on the purchase price of the vehicle. This includes the base price, any optional features or upgrades, and any applicable dealer fees. The tax is applied as a percentage of the total purchase price, making it essential to understand the exact calculation method to ensure accuracy.

State Sales Tax Rate

The state of Missouri has a consistent sales tax rate for motor vehicles, currently set at 4.225%. This rate is applicable statewide and forms the foundation for calculating the sales tax on a car purchase. It’s important to note that this rate is subject to change, so staying updated with the latest tax regulations is crucial.

Local Sales Tax Rates

In addition to the state sales tax, Missouri allows local jurisdictions to impose their own sales taxes. These local taxes can vary significantly, with some areas having higher rates than others. For instance, the city of St. Louis has a local sales tax rate of 3.25%, while the surrounding St. Louis County has a rate of 1.25%. These local rates are added to the state rate, resulting in a combined sales tax that can differ depending on the location of the vehicle purchase.

| Local Jurisdiction | Sales Tax Rate |

|---|---|

| City of St. Louis | 3.25% |

| St. Louis County | 1.25% |

| Kansas City | 1.5% |

| Jackson County | 1.5% |

| Jefferson City | 2.5% |

| Columbia | 2% |

Calculating Car Sales Tax in Missouri

Calculating the sales tax on a car purchase in Missouri involves a straightforward process. By breaking down the steps, we can ensure an accurate assessment of the tax liability.

Step 1: Determine the Purchase Price

The first step is to establish the total purchase price of the vehicle. This includes the base price, any additional options, and any dealer fees. For instance, if you’re purchasing a car with a base price of 30,000</strong> and have added <strong>2,000 worth of upgrades, the total purchase price would be $32,000.

Step 2: Calculate the State Sales Tax

Apply the state sales tax rate of 4.225% to the total purchase price. In our example, the state sales tax would be 1,347</strong> (<strong>32,000 x 0.04225).

Step 3: Determine the Local Sales Tax Rate

Identify the specific local sales tax rate for the city or county where the purchase is made. Let’s assume the local sales tax rate is 2.5% for our example.

Step 4: Calculate the Local Sales Tax

Apply the local sales tax rate to the total purchase price. In our case, the local sales tax would be 800</strong> (<strong>32,000 x 0.025).

Step 5: Combine State and Local Sales Tax

Add the state and local sales taxes together to find the total sales tax liability. In our example, the total sales tax would be 2,147</strong> (<strong>1,347 + $800).

Step 6: Add Sales Tax to Purchase Price

Finally, add the total sales tax to the original purchase price to determine the final cost of the vehicle. In our example, the total cost would be 34,147</strong> (<strong>32,000 + $2,147).

Factors Influencing Car Sales Tax in Missouri

Several factors can impact the sales tax liability when purchasing a car in Missouri. Understanding these factors can help buyers anticipate their tax obligations and make more informed financial decisions.

Vehicle Purchase Price

The most significant factor influencing sales tax is the purchase price of the vehicle. As the price increases, so does the sales tax liability. It’s essential to consider the impact of any additional options or upgrades on the final price, as these can substantially affect the tax amount.

Local Sales Tax Rates

As mentioned earlier, local sales tax rates can vary across Missouri. Buyers should be aware of the specific rate applicable to their chosen purchase location. This variation can result in significant differences in the final sales tax liability, even for vehicles with identical purchase prices.

Exemptions and Incentives

Missouri offers certain exemptions and incentives that can reduce the sales tax burden for specific vehicle purchases. For example, the state provides a 75% sales tax exemption for vehicles used for agricultural purposes. Additionally, there are incentives for electric and hybrid vehicles, with partial sales tax refunds available. It’s crucial to research and understand these exemptions and incentives to maximize potential savings.

Trade-Ins and Rebates

The sales tax calculation can be affected by trade-ins and rebates. If a buyer trades in an old vehicle, the sales tax may be calculated based on the difference between the purchase price and the trade-in value. Similarly, rebates or discounts offered by dealerships or manufacturers can reduce the taxable amount, leading to a lower sales tax liability.

Are there any online tools to calculate Missouri car sales tax accurately?

+Yes, there are several online sales tax calculators available that can assist with calculating Missouri car sales tax. These calculators often consider factors like purchase price, location, and applicable exemptions. However, it's important to verify the accuracy of these tools and cross-reference their results with official sources.

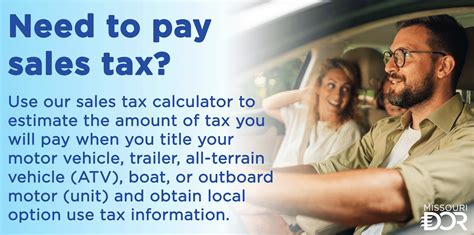

What happens if I purchase a car from a private seller in Missouri?

+When purchasing a car from a private seller, you are still responsible for paying the applicable sales tax. The process may involve registering the vehicle and paying the tax at your local county assessor's office or through the Missouri Department of Revenue. It's essential to understand the specific requirements and deadlines to avoid penalties.

Are there any ways to reduce my car sales tax liability in Missouri?

+Yes, there are strategies to minimize your sales tax liability. These include researching and taking advantage of available exemptions and incentives, negotiating the purchase price, and considering trade-ins or rebates. It's crucial to understand the specific rules and requirements for each strategy to ensure compliance.

Conclusion

Understanding the car sales tax structure and calculation in Missouri is essential for making informed vehicle purchases. By familiarizing yourself with the state and local sales tax rates, factors influencing tax liability, and potential exemptions, you can navigate the tax landscape with confidence. Remember to stay updated with the latest tax regulations and consult official sources or tax professionals for precise and accurate information.