Sales Tax In La Ca

Sales tax is an essential aspect of doing business and making purchases in any region, and it plays a significant role in the state of California. Understanding the sales tax system is crucial for both businesses and consumers to ensure compliance and avoid legal issues. This comprehensive guide will delve into the intricacies of sales tax in La Cañada Flintridge, California, commonly known as La Ca, providing valuable insights and information for all stakeholders.

Sales Tax in La Ca: An Overview

La Ca, a picturesque city in Los Angeles County, California, has its own unique sales tax structure that contributes to the state’s overall tax revenue. Sales tax in California is a combined tax, which means it consists of both state and local tax rates. This means that when you make a purchase in La Ca, you are not only contributing to the state’s revenue but also supporting the city’s local infrastructure and services.

The sales tax rate in La Ca is subject to various factors, including the type of product or service being purchased, the location of the sale, and any applicable exemptions or special rates. It is a complex system designed to generate revenue while also ensuring fairness and compliance with state and local regulations.

State and Local Sales Tax Rates

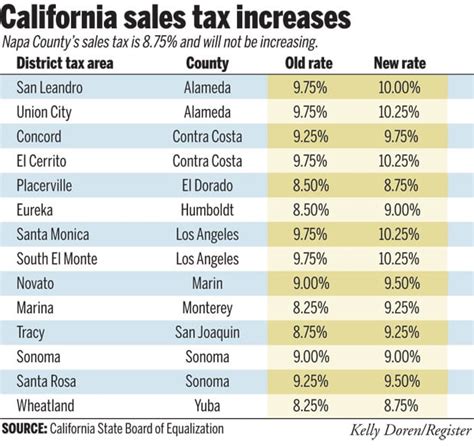

California’s state sales tax rate is a fixed percentage applied uniformly across the state. As of the latest information, the state sales tax rate stands at 7.25%. This rate is mandated by the California State Board of Equalization and is applicable to most retail sales, including goods and some services.

However, the story doesn't end there. La Ca, like many other cities in California, imposes an additional local sales tax on top of the state rate. This local tax is used to fund essential city services, infrastructure projects, and community initiatives. The local sales tax rate in La Ca is currently set at 1.5%, bringing the total sales tax rate in the city to 8.75%.

It's important to note that while the state sales tax rate remains consistent across California, local sales tax rates can vary significantly from one city to another. This is because each city has the authority to determine its own local sales tax rate based on its unique needs and financial requirements.

| Tax Type | Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| La Ca Local Sales Tax | 1.5 |

| Total Sales Tax in La Ca | 8.75 |

Sales Taxable Items and Exemptions

Not all goods and services are subject to the same sales tax rates in La Ca. California’s sales tax system differentiates between various categories of items, applying different rates or even providing exemptions for certain products and services.

Taxable Items

The majority of tangible personal property purchased for consumption or use is subject to sales tax in La Ca. This includes everyday items like groceries, clothing, electronics, and furniture. Additionally, many services, such as auto repairs, haircuts, and legal services, are also taxable.

For example, if you purchase a new smartphone in La Ca, you will be charged the full sales tax rate of 8.75%. However, certain items, like unprepared food items or prescription medications, may be exempt from sales tax or subject to a lower rate.

Exemptions and Special Rates

California’s sales tax system offers exemptions and special rates for specific items to promote certain economic or social goals. For instance, many food items, including produce, dairy, and bread, are exempt from sales tax. This exemption is designed to make essential food items more affordable for consumers.

Furthermore, certain types of businesses, such as nonprofit organizations or government entities, may be eligible for tax-exempt status. This means that when they make purchases for their operations, they are not required to pay sales tax. These exemptions are crucial for ensuring that essential services and charitable activities are not unduly burdened by tax obligations.

Sales Tax Collection and Compliance

Sales tax collection is a critical responsibility for businesses operating in La Ca. It is essential for businesses to understand their obligations and ensure compliance with the law to avoid penalties and legal consequences.

Registration and Permits

Any business selling taxable goods or services in La Ca is required to register with the California Department of Tax and Fee Administration (CDTFA). This registration process ensures that businesses are properly identified and tracked for tax purposes.

Once registered, businesses are issued a Seller's Permit, which authorizes them to collect and remit sales tax on behalf of the state and local government. This permit must be displayed at the business premises and renewed periodically to maintain compliance.

Tax Collection and Remittance

Businesses in La Ca are responsible for collecting sales tax from customers at the point of sale. This tax is then held in trust until it is remitted to the appropriate tax authorities. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly filings.

Accurate record-keeping is crucial for sales tax compliance. Businesses must maintain detailed records of all sales transactions, including the date, amount, and applicable tax rate. These records are essential for preparing tax returns and ensuring accurate reporting.

Audit and Penalties

The California Department of Tax and Fee Administration conducts regular audits to ensure compliance with sales tax regulations. Audits can be random or targeted based on various factors, such as industry-specific risks or suspicious activity.

If a business is found to be non-compliant with sales tax laws, it may face significant penalties and interest charges. These penalties can be substantial and can even lead to the revocation of the business's Seller's Permit. Therefore, it is crucial for businesses to maintain proper sales tax records and procedures to avoid such consequences.

Sales Tax and E-commerce

The rise of e-commerce has presented unique challenges for sales tax collection and compliance. With online sales, it can be more difficult to determine the applicable tax rate and ensure proper tax collection, especially when selling to customers in different jurisdictions.

Nexus and Sales Tax Obligations

In the context of e-commerce, the concept of “nexus” becomes crucial. Nexus refers to a business’s physical presence or substantial connection to a particular state or jurisdiction. If a business has nexus in La Ca, it is generally required to collect and remit sales tax on sales made to customers in that jurisdiction.

For instance, if an online retailer has a warehouse or fulfillment center in La Ca, it likely has nexus in the city and must collect sales tax on all sales made to La Ca residents. Failure to do so can result in significant tax liabilities and penalties.

Sales Tax Software and Solutions

To simplify the complexities of sales tax collection and compliance, many businesses turn to specialized sales tax software and solutions. These tools can automate tax calculations, ensure accurate rate determination, and assist with tax filing and remittance processes.

Sales tax software can be particularly beneficial for e-commerce businesses, as it can help them keep track of varying tax rates across different jurisdictions and ensure compliance with changing tax laws and regulations.

Future Implications and Trends

The sales tax landscape in La Ca and California as a whole is subject to ongoing changes and developments. As the state and local governments continue to adapt to economic shifts and technological advancements, sales tax regulations may evolve to address new challenges and opportunities.

Potential Changes and Initiatives

One potential area of focus for sales tax reform in La Ca and California is the treatment of online sales. With the rapid growth of e-commerce, there have been calls for a more streamlined and uniform approach to sales tax collection for online transactions. This could involve the adoption of new tax collection models or the implementation of tax collection responsibilities on online marketplaces.

Additionally, as California's economy evolves, the state may consider adjustments to its sales tax rates or the introduction of new tax categories to address emerging industries and economic sectors. These changes could impact the sales tax landscape in La Ca and require businesses to adapt their tax collection and compliance strategies accordingly.

Staying Informed and Adapting

For businesses operating in La Ca, staying informed about sales tax regulations and potential changes is crucial. This includes monitoring local and state tax news, subscribing to relevant newsletters, and participating in industry associations or groups that provide updates on tax matters.

Furthermore, businesses should consider investing in robust tax compliance systems and processes. This may involve engaging tax professionals or utilizing advanced tax software to ensure accurate tax calculations and timely remittances. By staying proactive and adaptable, businesses can navigate the complexities of sales tax in La Ca and minimize the risk of non-compliance.

Conclusion

Understanding and navigating the sales tax system in La Ca is essential for both businesses and consumers. By grasping the nuances of sales tax rates, exemptions, and compliance obligations, individuals and businesses can contribute to the city’s economic well-being while avoiding legal pitfalls.

As the sales tax landscape continues to evolve, staying informed and adaptable will be key for all stakeholders. Whether you're a business owner, a consumer, or a tax professional, keeping abreast of sales tax regulations and changes will ensure you remain compliant and contribute to the vibrant economy of La Ca.

What is the current sales tax rate in La Ca, California?

+

The current sales tax rate in La Ca, California is 8.75%, which includes the state sales tax rate of 7.25% and the local sales tax rate of 1.5%.

Are there any sales tax exemptions in La Ca?

+

Yes, La Ca, like many other areas in California, offers exemptions for certain items such as unprepared food, prescription medications, and purchases made by nonprofit organizations.

How often do businesses need to remit sales tax in La Ca?

+

The frequency of sales tax remittance in La Ca depends on the business’s sales volume. Businesses with higher sales volumes may need to remit sales tax monthly, while those with lower sales may remit quarterly. However, businesses should consult with tax professionals to ensure compliance with the latest regulations.

What happens if a business fails to collect and remit sales tax in La Ca?

+

Failing to collect and remit sales tax in La Ca can result in significant penalties and interest charges. In severe cases, it may lead to the revocation of the business’s Seller’s Permit. Therefore, it is crucial for businesses to understand their sales tax obligations and ensure compliance.

How can businesses stay updated on sales tax regulations in La Ca?

+

Businesses can stay updated on sales tax regulations in La Ca by subscribing to newsletters from the California Department of Tax and Fee Administration, monitoring local tax news, and consulting with tax professionals or industry associations. Additionally, utilizing sales tax software can help businesses stay informed about changing tax rates and requirements.