Japan Tax Rate

Understanding the tax system of a country is crucial, especially for businesses and individuals looking to navigate their financial obligations. Japan, known for its vibrant economy and unique culture, has a tax system that plays a significant role in its economic landscape. In this comprehensive guide, we delve into the intricacies of Japan's tax rates, exploring the various types of taxes, their applicable rates, and how they impact individuals and businesses.

The Landscape of Japan’s Tax System

Japan’s tax system is designed to support the country’s economic growth and development, while also providing a stable revenue stream for the government. It encompasses a range of taxes, each with its own purpose and rate structure. Understanding these taxes is essential for anyone doing business in Japan or for individuals seeking to comply with their tax obligations.

Corporate Taxes: A Pillar of Japan’s Economy

Corporate taxes form a significant portion of Japan’s tax revenue. The corporate tax rate in Japan is generally 30%, which includes the national corporate tax rate of 23.2% and the local corporate tax rate of 6.8%. This rate is applicable to the profits of corporations, including domestic and foreign companies operating in Japan. It is important to note that there are additional surcharges and local taxes that can increase the effective tax rate.

For example, a corporation with a net income of ¥100 million would face a corporate tax liability of approximately ¥30 million. This calculation considers the basic tax rate and assumes no deductions or tax incentives are applicable. It's worth mentioning that Japan has been actively working to make its corporate tax system more competitive, which has led to a gradual reduction in the corporate tax rate over the years.

| Tax Component | Rate |

|---|---|

| National Corporate Tax | 23.2% |

| Local Corporate Tax | 6.8% |

| Effective Corporate Tax Rate | 30% |

Individual Income Taxes: Balancing Equity and Efficiency

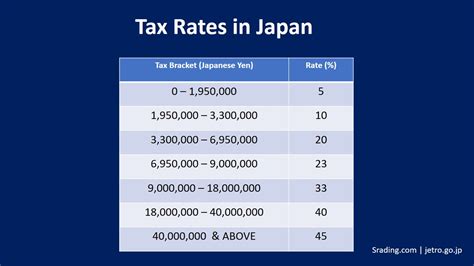

Individual income taxes in Japan follow a progressive tax system, meaning the tax rate increases as income levels rise. The tax rates are divided into seven brackets, with the highest marginal tax rate of 45% applying to incomes above ¥40 million. This rate structure aims to promote income equality while encouraging economic growth.

Let's take a closer look at the individual income tax brackets for the fiscal year 2023:

| Income Bracket (in ¥) | Tax Rate |

|---|---|

| Up to ¥1.95 million | 5% |

| From ¥1.95 million to ¥3.3 million | 10% |

| From ¥3.3 million to ¥6.95 million | 20% |

| From ¥6.95 million to ¥9 million | 22% |

| From ¥9 million to ¥18 million | 23% |

| From ¥18 million to ¥40 million | 33% |

| Above ¥40 million | 45% |

These rates are subject to change, and residents may also be eligible for various deductions and credits, which can significantly impact their overall tax liability. It's important for individuals to stay informed about the latest tax regulations and seek professional advice to ensure they maximize their tax benefits.

Consumption Tax: A Key Revenue Source

Japan’s consumption tax, also known as consumption tax rate or value-added tax (VAT), is another critical component of the country’s tax system. As of 2023, the standard consumption tax rate stands at 10%, which is applied to most goods and services. This tax is collected at each stage of the supply chain and ultimately passed on to the final consumer.

The consumption tax has undergone significant changes in recent years. In October 2019, the rate was increased from 8% to 10%, marking a notable shift in Japan's tax policy. This increase aimed to bolster the country's fiscal health and support social welfare programs. It's worth noting that there are certain items, such as fresh food and medical services, that are exempt from the consumption tax.

Tax Strategies and Compliance in Japan

Navigating Japan’s tax system requires careful planning and a thorough understanding of the applicable regulations. Businesses and individuals can employ various strategies to optimize their tax obligations, such as:

- Utilizing tax incentives and deductions offered by the government to reduce tax liabilities.

- Structuring business operations to take advantage of Japan's tax treaties with other countries, which can help minimize double taxation.

- Implementing effective tax planning strategies to ensure compliance and avoid penalties.

- Seeking professional advice from tax experts who specialize in Japanese tax laws to ensure accurate filing and potential tax savings.

Compliance with Japan's tax regulations is essential to avoid legal issues and maintain a positive business reputation. The National Tax Agency of Japan provides extensive resources and guidelines to help taxpayers understand their obligations and ensure accurate reporting.

Conclusion

Japan’s tax system, with its various tax rates and structures, plays a pivotal role in the country’s economic framework. Understanding these rates is crucial for businesses and individuals operating in Japan. By staying informed about the latest tax regulations and implementing effective tax strategies, taxpayers can navigate the system successfully and contribute to Japan’s thriving economy.

What is the corporate tax rate for foreign companies operating in Japan?

+The corporate tax rate for foreign companies operating in Japan is generally the same as for domestic companies, at 30%. However, there may be additional considerations for foreign entities, such as withholding taxes and transfer pricing rules.

Are there any tax incentives for startups in Japan?

+Yes, Japan offers various tax incentives for startups and small businesses to encourage innovation and economic growth. These incentives include tax credits, reduced tax rates, and tax exemptions for certain expenses. It’s advisable to consult with tax professionals to understand the specific incentives applicable to your business.

How does Japan’s consumption tax impact international e-commerce businesses?

+International e-commerce businesses selling goods to customers in Japan are required to register for consumption tax if their annual sales to Japan exceed a certain threshold. They must collect and remit the consumption tax on each sale. It’s crucial for these businesses to understand the registration process and their tax obligations to avoid penalties.