Calculate Reverse Sales Tax

Calculating reverse sales tax is a crucial skill for businesses, especially those operating in jurisdictions with complex tax structures. This article will delve into the process of reversing sales tax calculations, providing a comprehensive guide for professionals in the e-commerce and accounting industries. By the end of this article, you should have a clear understanding of the methods and tools available to accurately calculate reverse sales tax.

Understanding Reverse Sales Tax

Reverse sales tax, also known as un-taxing, is the process of calculating the pre-tax price of a product or service given the post-tax price. This calculation is essential for businesses when processing returns, refunds, or adjustments, ensuring that the correct amount is refunded to customers while complying with tax regulations.

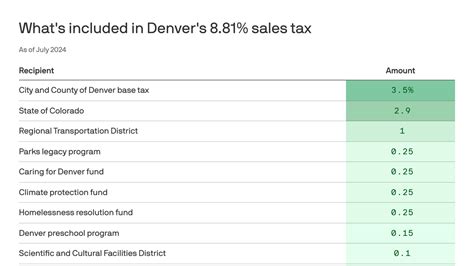

The complexity of reverse sales tax calculations varies depending on the tax jurisdiction. Some regions have a single sales tax rate, while others have multiple rates, tax holidays, or special exemptions. Additionally, the calculation may involve state, local, and even regional taxes, making it a challenging task for businesses to handle manually.

The Process of Reverse Sales Tax Calculation

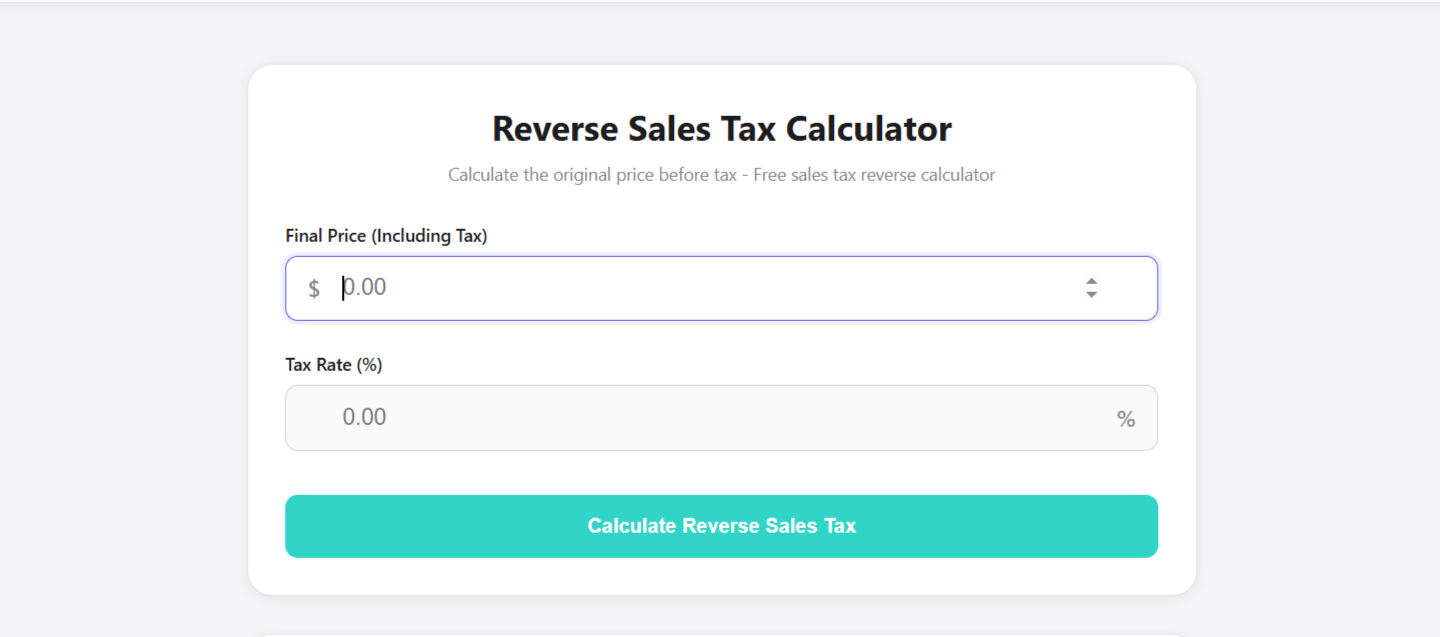

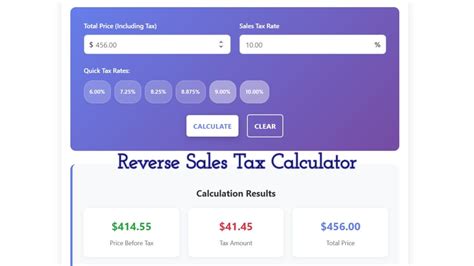

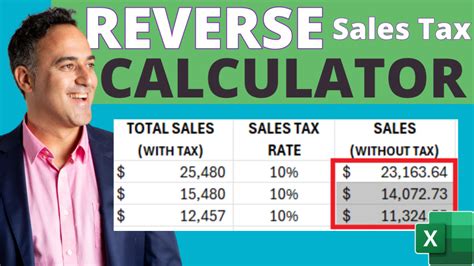

To calculate reverse sales tax accurately, one must understand the basic formula: Pre-Tax Price = Post-Tax Price / (1 + Tax Rate). This formula considers the tax rate as a decimal, so a 10% tax rate would be represented as 0.10.

For example, if a product priced at $100 has a 7% sales tax applied, the post-tax price would be $107. To calculate the pre-tax price, we apply the formula: $107 / (1 + 0.07) = $100. This confirms that the pre-tax price was indeed $100.

Handling Multiple Tax Rates

In regions with multiple tax rates, the calculation becomes more complex. The basic formula remains the same, but the tax rate must be adjusted to account for all applicable taxes. For instance, if a product is subject to a 5% state tax and a 2% local tax, the tax rate used in the formula would be 0.07 (5% + 2%).

| Tax Type | Rate |

|---|---|

| State Tax | 5% |

| Local Tax | 2% |

| Total Tax Rate | 7% |

Dealing with Rounding Errors

Reverse sales tax calculations can sometimes lead to rounding errors, especially when dealing with multiple tax rates or complex tax structures. To mitigate this, businesses can employ advanced tax calculation tools or software that account for these discrepancies, ensuring accurate and compliant tax calculations.

Common Challenges and Solutions

Reverse sales tax calculations can be challenging, especially for businesses operating in multiple jurisdictions or dealing with dynamic tax structures. Here are some common challenges and their solutions:

Handling Tax Holidays and Exemptions

Tax holidays and exemptions can complicate reverse sales tax calculations. To address this, businesses can maintain a database of applicable tax rates and exemptions, updating it regularly to account for changes in tax regulations. This ensures that the correct tax rates are applied during calculations.

Managing Rounding Differences

Rounding differences can occur when dealing with fractional tax rates or when converting between currencies. To tackle this issue, businesses can employ rounding methods that ensure consistency across calculations. For instance, rounding to the nearest whole number or using a specific decimal place can help maintain accuracy.

Addressing Tax Rate Changes

Tax rates can change frequently, and keeping up with these changes is crucial for accurate reverse sales tax calculations. Businesses can automate the process by integrating their systems with tax rate databases or APIs that provide real-time tax rate updates. This ensures that the latest tax rates are used in calculations.

The Importance of Accurate Reverse Sales Tax Calculations

Accurate reverse sales tax calculations are essential for several reasons. Firstly, they ensure that customers receive the correct refund amounts, building trust and maintaining a positive brand image. Secondly, accurate calculations help businesses comply with tax regulations, avoiding potential penalties or legal issues.

Furthermore, accurate reverse sales tax calculations contribute to a business's overall financial health. By correctly accounting for tax refunds and adjustments, businesses can maintain precise financial records, aiding in financial planning and decision-making.

Conclusion

Calculating reverse sales tax is a critical skill for businesses, especially in the e-commerce and accounting sectors. By understanding the process and employing the right tools, businesses can ensure accurate and compliant tax calculations. Whether dealing with single or multiple tax rates, advanced tax calculation software can streamline the process, saving time and reducing the risk of errors.

As tax regulations continue to evolve, staying updated with the latest changes and employing efficient calculation methods will be key to maintaining financial accuracy and compliance.

What is the best way to handle reverse sales tax calculations for businesses with multiple tax rates and jurisdictions?

+For businesses operating in multiple tax jurisdictions with varying rates, using a centralized tax calculation system or software is recommended. These tools can automatically apply the correct tax rates based on the customer’s location, ensuring accuracy and compliance.

How can businesses stay updated with the latest tax rate changes to ensure accurate calculations?

+Businesses can integrate their systems with tax rate databases or APIs that provide real-time updates on tax rate changes. This ensures that the latest rates are used in calculations, reducing the risk of errors.

What are some best practices for handling rounding errors in reverse sales tax calculations?

+To manage rounding errors, businesses can implement consistent rounding methods across their calculations. This could involve rounding to the nearest whole number or a specific decimal place, ensuring accuracy and consistency.