Wa Estate Tax

Welcome to a comprehensive guide on the world of Wealth and Estate Tax, a critical aspect of financial planning and management. This expert-level article will delve into the intricacies of this domain, providing valuable insights and practical information for individuals and professionals alike. Wealth and Estate Tax is a complex but crucial topic, as it directly impacts the financial well-being of individuals, families, and businesses, especially when it comes to inheritance and the transfer of assets. As such, understanding the various aspects of this tax is essential for making informed decisions and ensuring compliance with the law.

Understanding Wealth and Estate Tax

Wealth and Estate Tax, often simply referred to as Estate Tax, is a levy imposed by the government on the transfer of an individual’s assets upon their death. It is a critical component of the tax system, serving as a means to redistribute wealth and generate revenue for the state. The concept of Estate Tax is rooted in the idea that wealth should be taxed, just like income, to ensure a more equitable society. It is designed to prevent the concentration of wealth in the hands of a few and to support public services and infrastructure development.

The Estate Tax system is complex and varies greatly depending on the jurisdiction. Each country, and sometimes each state or province within a country, has its own set of rules and regulations governing the taxation of estates. These rules dictate who is liable for the tax, what assets are included in the estate, and the applicable tax rates. Understanding these variations is essential for effective financial planning, especially for individuals with cross-border assets or those who are considering moving assets between jurisdictions.

Key Components of Wealth and Estate Tax

The Estate Tax system is built upon several key components, each of which plays a crucial role in determining the final tax liability. These components include:

- Gross Estate Value: This is the total value of all assets owned by the decedent at the time of their death, including real estate, investments, personal property, and business interests. Certain assets, like life insurance proceeds and some retirement accounts, may be excluded or receive special treatment.

- Deductions and Exemptions: Many jurisdictions allow for certain deductions and exemptions from the gross estate value. These can include expenses related to the administration of the estate, charitable contributions, and, in some cases, an unlimited marital deduction for assets transferred to a surviving spouse.

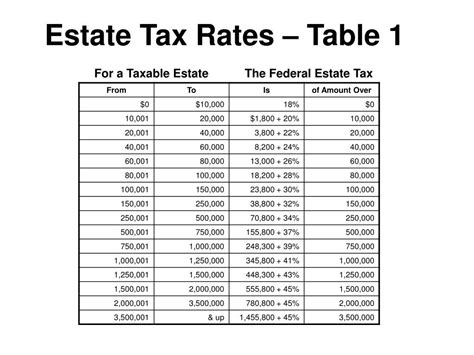

- Applicable Tax Rates: The tax rate applied to the net estate value (gross estate value minus deductions and exemptions) can vary significantly. Some jurisdictions have progressive tax rates, where the rate increases as the estate value increases, while others have a flat rate.

- Tax Liability Calculation: The process of calculating the actual tax liability involves applying the applicable tax rates to the net estate value, taking into account any credits or special provisions that may reduce the tax burden. This can be a complex process, especially for large or complex estates.

Understanding these components is essential for effective Estate Tax planning. By grasping the nuances of each element, individuals and their advisors can develop strategies to minimize the tax burden and ensure that more of the estate is passed on to the intended beneficiaries.

Estate Tax Planning Strategies

Estate Tax planning is a critical aspect of wealth management, especially for high-net-worth individuals and families. Effective planning can help minimize the tax burden, ensuring that more of the estate is preserved for the intended beneficiaries. There are several strategies that can be employed to achieve this goal, each tailored to the specific needs and circumstances of the individual or family.

Gifting Strategies

One of the most common Estate Tax planning strategies involves making gifts during one’s lifetime. This strategy takes advantage of the annual gift tax exclusion, which allows individuals to give away a certain amount of money each year without incurring gift tax. By consistently making gifts, individuals can reduce the size of their estate and, consequently, their potential Estate Tax liability. This strategy is particularly effective when combined with the lifetime gift and estate tax exemption, which allows individuals to gift or bequeath a certain amount of money tax-free over their lifetime.

For instance, consider an individual with a large estate who wants to pass on their wealth to their children. By gifting a portion of their assets each year, they can reduce the overall size of their estate, potentially dropping it below the threshold for Estate Tax. This strategy not only reduces the tax burden but also allows the individual to see the impact of their generosity during their lifetime.

Trusts and Estate Vehicles

Another powerful tool in Estate Tax planning is the use of trusts. Trusts are legal entities that hold assets for the benefit of another person or entity. By establishing a trust, individuals can transfer ownership of their assets while maintaining some level of control. There are various types of trusts, each with its own set of rules and tax implications. For example, a revocable trust allows the grantor (the person creating the trust) to retain control over the assets and make changes to the trust during their lifetime, while an irrevocable trust transfers ownership permanently, often with more favorable tax treatment.

Additionally, certain types of trusts, such as grantor retained annuity trusts (GRATs) and life insurance trusts, can be particularly effective in reducing Estate Tax liability. GRATs allow the grantor to retain an annuity payment for a set period, after which the remaining assets in the trust pass to the beneficiaries free of Estate Tax. Life insurance trusts, on the other hand, can be used to hold life insurance policies, with the proceeds passing to the beneficiaries tax-free upon the grantor's death.

Charitable Giving

Charitable giving is not only a noble endeavor but also a powerful tool in Estate Tax planning. Many jurisdictions offer tax incentives for charitable donations, either during one’s lifetime or as part of an estate plan. By making charitable contributions, individuals can reduce their taxable estate while supporting causes that are important to them. This strategy is particularly effective when combined with other planning tools, such as trusts, to maximize the tax benefits.

For example, an individual with a substantial art collection might consider donating a portion of their collection to a museum or art foundation. This not only reduces their Estate Tax liability but also ensures that their collection is preserved and shared with the public. Additionally, the individual may receive a tax deduction for the fair market value of the donated artwork, further reducing their tax burden.

The Role of Professional Advisors

Navigating the complex world of Wealth and Estate Tax can be daunting, even for the most financially savvy individuals. This is where professional advisors, such as tax attorneys, certified public accountants (CPAs), and financial planners, play a crucial role. These professionals have the expertise and experience to guide individuals through the intricacies of Estate Tax planning, ensuring compliance with the law and optimizing the tax burden.

Tax Attorneys

Tax attorneys are legal professionals who specialize in tax law. They can provide valuable guidance on the legal aspects of Estate Tax planning, ensuring that all strategies employed are within the bounds of the law. Tax attorneys can help draft legal documents, such as wills and trusts, and provide advice on complex tax issues, such as the treatment of specific assets or the application of tax treaties.

Certified Public Accountants (CPAs)

CPAs are financial professionals who are licensed to provide a range of accounting services, including tax preparation and planning. They can assist with the preparation of tax returns, both during one’s lifetime and as part of the estate administration process. CPAs can also provide valuable advice on the tax implications of various financial decisions, helping individuals make informed choices that align with their financial goals.

Financial Planners

Financial planners are professionals who specialize in helping individuals manage their financial resources. They can provide a comprehensive overview of an individual’s financial situation, including their estate planning needs. Financial planners can assist with the coordination of various Estate Tax planning strategies, ensuring that all elements work together seamlessly. They can also provide ongoing support, helping individuals adjust their plans as their financial circumstances change.

The role of these professional advisors is critical in ensuring that Estate Tax planning is effective and compliant. By working together, these professionals can develop a comprehensive plan that minimizes tax liability, maximizes the value of the estate, and ensures that the individual's wishes are carried out.

Case Studies: Real-World Estate Tax Planning

To illustrate the concepts and strategies discussed, let’s explore a few real-world case studies of Estate Tax planning. These examples will demonstrate how the various components of Estate Tax planning come together to achieve specific goals and minimize tax liability.

Case Study 1: The Smith Family

The Smith family is a wealthy family with a substantial real estate portfolio. The family patriarch, Mr. Smith, is nearing the end of his life and wants to ensure that his estate is passed on to his children with minimal tax burden. Mr. Smith works with his team of advisors, including a tax attorney, a CPA, and a financial planner, to develop a comprehensive Estate Tax plan.

The plan involves a combination of strategies. First, Mr. Smith establishes a revocable trust, transferring ownership of his real estate assets into the trust. This allows him to maintain control over the assets during his lifetime while reducing the value of his taxable estate. Additionally, Mr. Smith takes advantage of the annual gift tax exclusion, gifting a portion of his assets to his children each year, further reducing the size of his estate.

The plan also includes a charitable giving component. Mr. Smith is passionate about environmental conservation and decides to donate a portion of his estate to a conservation foundation. This not only aligns with his personal values but also reduces his taxable estate, providing significant tax savings.

Through these strategies, Mr. Smith is able to preserve more of his wealth for his children, while also supporting a cause that is important to him. The comprehensive Estate Tax plan developed by his team of advisors ensures that his wishes are carried out and that his family's financial future is secure.

Case Study 2: The Johnson Corporation

The Johnson Corporation is a family-owned business with a long history. The company’s founder, Mr. Johnson, is concerned about the potential Estate Tax liability that could arise upon his death. He wants to ensure that the business remains viable and can continue to thrive under the leadership of his children.

Mr. Johnson works with his advisors to develop a strategy that involves a combination of business succession planning and Estate Tax planning. The plan includes the establishment of a grantor retained annuity trust (GRAT), into which Mr. Johnson transfers a portion of his shares in the company. This reduces the value of his taxable estate while also providing an annuity income for a set period.

Additionally, Mr. Johnson sets up a life insurance trust, which owns a substantial life insurance policy on his life. The proceeds of this policy will pass to the trust upon his death, providing liquidity to the estate and ensuring that the business can continue to operate without disruption. The life insurance trust is designed to hold the policy outside of Mr. Johnson's taxable estate, minimizing the Estate Tax liability.

By implementing this comprehensive plan, Mr. Johnson is able to preserve the financial health of his business while also minimizing the tax burden on his estate. This ensures that the company can continue to thrive under the leadership of his children, carrying on the Johnson legacy.

Future Implications and Trends in Estate Tax

The world of Wealth and Estate Tax is constantly evolving, with new laws, regulations, and court rulings shaping the landscape. Staying informed about these changes is essential for effective Estate Tax planning. Here are some key future implications and trends to watch:

Increasing Complexity

As the tax system becomes more complex, Estate Tax planning will require even greater expertise and specialization. The introduction of new tax laws and the interpretation of existing laws by the courts will create a dynamic and challenging environment for professionals in this field. Advisors will need to stay abreast of these changes to provide the most up-to-date and effective guidance to their clients.

Technological Advances

The rise of digital technologies and blockchain-based solutions is already transforming the world of finance, and Estate Tax planning is no exception. New technologies will offer more efficient and secure ways of managing and transferring assets, which could have significant implications for Estate Tax planning. For example, smart contracts and digital asset management systems could streamline the process of transferring assets, making it more efficient and reducing the risk of errors.

Changing Demographics

The aging population and the rise of intergenerational wealth transfer will continue to shape the Estate Tax landscape. As more individuals live longer and accumulate wealth over multiple generations, the need for effective Estate Tax planning will become even more critical. Advisors will need to adapt their strategies to meet the unique needs of these clients, ensuring that their wealth is preserved and transferred efficiently.

Global Tax Harmonization

With the increasing globalization of the economy, there is a growing trend toward harmonizing tax systems across borders. This could have significant implications for Estate Tax planning, especially for individuals with cross-border assets. As countries work to simplify and standardize their tax systems, advisors will need to stay informed about these changes to provide accurate and effective guidance to their clients.

In conclusion, the world of Wealth and Estate Tax is a complex and dynamic field, requiring expertise and specialized knowledge. By understanding the key components of Estate Tax, implementing effective planning strategies, and working with professional advisors, individuals can navigate this complex landscape with confidence. As the field continues to evolve, staying informed about the latest trends and developments will be essential for effective financial planning and management.

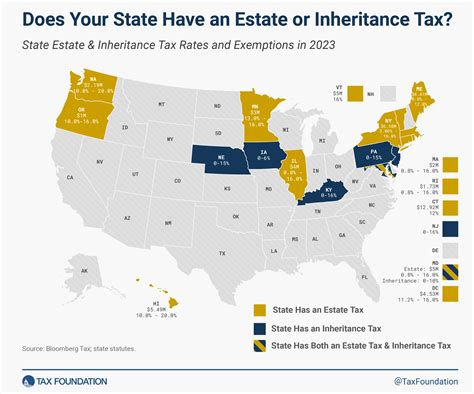

What is the difference between Estate Tax and Inheritance Tax?

+Estate Tax and Inheritance Tax are related but distinct concepts. Estate Tax is levied on the transfer of an individual’s assets upon their death, and it is typically paid by the estate itself before assets are distributed to beneficiaries. Inheritance Tax, on the other hand, is a tax on the receipt of assets by the beneficiaries. It is paid by the beneficiaries themselves and is often based on the value of the assets they receive. Not all jurisdictions have both Estate Tax and Inheritance Tax, and the specific rules and rates can vary significantly.

Are there any exceptions or exemptions from Estate Tax?

+Yes, there are several exceptions and exemptions from Estate Tax. These can vary by jurisdiction, but common exemptions include the unlimited marital deduction (allowing an unlimited transfer of assets to a surviving spouse), the charitable deduction (for gifts to qualified charities), and the lifetime gift and estate tax exemption (which allows individuals to gift or bequeath a certain amount of money tax-free over their lifetime). It’s important to consult with a tax professional to understand the specific exemptions and exceptions that apply in your jurisdiction.

How can I minimize my Estate Tax liability?

+There are several strategies you can employ to minimize your Estate Tax liability. These include making gifts during your lifetime to take advantage of the annual gift tax exclusion and the lifetime gift and estate tax exemption, establishing trusts (such as revocable or irrevocable trusts) to transfer ownership of assets while maintaining control, and making charitable donations, which often receive favorable tax treatment. Working with a team of professional advisors, including tax attorneys, CPAs, and financial planners, can help you develop a comprehensive Estate Tax plan tailored to your specific needs and circumstances.

What is the role of a tax attorney in Estate Tax planning?

+A tax attorney plays a critical role in Estate Tax planning by providing legal expertise and guidance. They can help ensure that all Estate Tax planning strategies are within the bounds of the law, draft legal documents such as wills and trusts, and provide advice on complex tax issues. Tax attorneys are particularly valuable in situations where there are significant assets, complex family structures, or cross-border considerations.