20 20 Tax Resolution

In the intricate world of taxation, finding expert guidance for complex tax issues is paramount. Enter 20 20 Tax Resolution, a renowned firm dedicated to providing comprehensive solutions for individuals and businesses facing tax challenges. With a track record of success and a team of seasoned professionals, they offer a beacon of hope for those navigating the intricate landscape of tax laws and regulations.

Unraveling the Complexity: An Overview of 20 20 Tax Resolution’s Services

20 20 Tax Resolution specializes in offering tailored strategies to resolve a myriad of tax-related concerns. Their expertise spans a wide array of services, ensuring that no matter the complexity of the tax issue, they have the tools and knowledge to provide effective solutions.

Tax Debt Resolution

One of the cornerstone services of 20 20 Tax Resolution is their adept handling of tax debt. They understand the financial strain that tax liabilities can impose, and thus, their team of experts works diligently to negotiate and resolve tax debts. Through strategies such as Offer in Compromise, Installment Agreements, and Currently Not Collectible status, they strive to find the most favorable outcome for their clients, potentially reducing the overall tax burden and providing much-needed financial relief.

| Service | Description |

|---|---|

| Offer in Compromise | A process where taxpayers and the IRS agree on an amount less than the full liability, providing a fresh start for taxpayers. |

| Installment Agreements | Allowing taxpayers to pay their debt in manageable installments over time. |

| Currently Not Collectible | A status granted to taxpayers who cannot afford to pay their tax debt at the moment, providing temporary relief. |

Back Tax Filing

For those who have fallen behind on their tax filing obligations, 20 20 Tax Resolution offers a comprehensive back tax filing service. Their professionals guide clients through the process, ensuring all necessary returns are filed accurately and on time. This service not only helps individuals and businesses avoid penalties and interest but also establishes a clear and compliant tax history.

IRS Audit Representation

Facing an IRS audit can be an intimidating experience. However, with 20 20 Tax Resolution by your side, the process becomes more manageable. Their experienced team provides representation during audits, advocating for their clients’ rights and interests. They ensure that all relevant documentation is presented, and any disputes are resolved fairly, protecting their clients from potential overpayments or penalties.

Penalty Abatement

Taxpayers often incur penalties for various reasons, such as late filing or late payment. 20 20 Tax Resolution specializes in penalty abatement, a process through which they can request the IRS to remove or reduce certain penalties. By reviewing the circumstances leading to the penalty and presenting a compelling case, they strive to alleviate the financial burden associated with these penalties.

Tax Lien and Levy Release

When taxpayers fail to meet their tax obligations, the IRS may place a lien on their property or initiate a levy. These actions can significantly impact an individual’s or business’ financial stability. 20 20 Tax Resolution’s team is well-versed in negotiating the release of tax liens and levies, working to restore their clients’ financial freedom and creditworthiness.

Tax Planning and Strategy

Prevention is often the best cure, and 20 20 Tax Resolution recognizes this. Their tax planning services are designed to help individuals and businesses navigate the complex tax landscape proactively. By providing tailored strategies and advice, they aim to minimize tax liabilities, maximize deductions, and ensure compliance with all applicable tax laws.

A Journey of Success: Case Studies and Client Testimonials

The true testament to the efficacy of 20 20 Tax Resolution’s services lies in the success stories of their clients. Through their diligent work and expertise, they have successfully resolved a multitude of tax issues, providing tangible relief and peace of mind.

Case Study 1: Overcoming a Tax Debt Crisis

John, a small business owner, found himself in a dire situation with an accumulating tax debt. Through the guidance of 20 20 Tax Resolution, he was able to negotiate an Offer in Compromise, reducing his debt by over 50%. This not only saved his business but also provided him with a renewed sense of financial security.

Case Study 2: Navigating a Complex Audit

Sarah, a self-employed professional, faced an IRS audit that threatened to disrupt her business. With the representation of 20 20 Tax Resolution, she navigated the audit process successfully. Their expertise ensured that all relevant information was presented, resulting in a favorable outcome and protecting Sarah’s business interests.

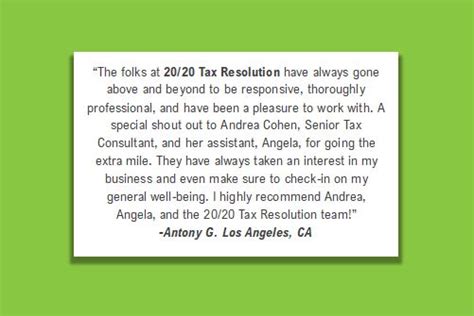

Client Testimonials

“The team at 20 20 Tax Resolution was a lifesaver. They helped me resolve a years-long tax issue, and I couldn’t be more grateful. Their knowledge and dedication made all the difference.”

"I was intimidated by the IRS, but with 20 20 by my side, I felt empowered. They guided me through every step, and now I'm finally free from my tax burdens. Highly recommended!" - Jane S.

The Future of Tax Resolution: Innovations and Advancements

As tax laws and regulations continue to evolve, 20 20 Tax Resolution remains at the forefront, adapting and innovating to provide the most effective solutions. They invest in continuous professional development, ensuring their team stays abreast of the latest tax strategies and technologies.

Digital Solutions for Tax Resolution

In an era of digital transformation, 20 20 Tax Resolution embraces technology to enhance their services. They utilize secure online platforms and digital tools to streamline the resolution process, making it more efficient and accessible for clients. This digital approach not only saves time but also provides a seamless experience, especially for those with busy schedules.

Expanding Services for a Diverse Client Base

Recognizing the diverse needs of their client base, 20 20 Tax Resolution is committed to expanding their services. They aim to cater to a wider range of tax-related concerns, ensuring that no matter the complexity or nature of the issue, they have the expertise and resources to provide tailored solutions.

Conclusion: Navigating Tax Challenges with Confidence

In the intricate world of taxation, finding reliable and expert guidance is crucial. 20 20 Tax Resolution stands as a trusted partner, offering a comprehensive suite of services to resolve tax issues effectively. With their dedication, expertise, and innovative approach, they empower individuals and businesses to navigate the complexities of tax laws with confidence and peace of mind.

How does 20 20 Tax Resolution determine the best course of action for my tax issues?

+Our team conducts a thorough analysis of your unique situation, considering factors such as your financial circumstances, the nature of your tax liability, and your long-term goals. Based on this assessment, we tailor a strategy that best aligns with your needs, ensuring the most favorable outcome.

What sets 20 20 Tax Resolution apart from other tax resolution firms?

+At 20 20 Tax Resolution, we pride ourselves on our personalized approach, extensive industry experience, and commitment to staying at the forefront of tax laws and regulations. Our team’s expertise and dedication to client success set us apart, ensuring we provide the most effective solutions.

Can 20 20 Tax Resolution help with international tax issues?

+Absolutely! Our team has extensive experience handling international tax matters, including cross-border transactions, foreign tax credits, and compliance with international tax laws. We understand the unique challenges associated with global taxation and are well-equipped to provide comprehensive solutions.