Canadian Tax Return Due

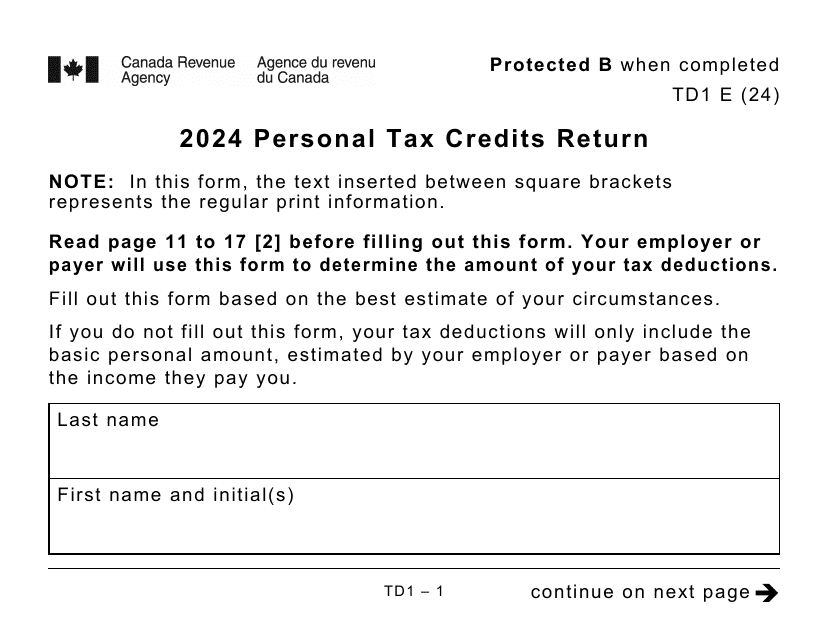

As the end of the tax season approaches, Canadians across the nation are gearing up to file their tax returns. The process of filing taxes can often be daunting, with various deadlines and requirements to navigate. In this comprehensive guide, we will delve into the world of Canadian tax returns, exploring the due dates, the filing process, and offering valuable insights to ensure a smooth and efficient experience.

Understanding the Canadian Tax Return Due Dates

The Canadian tax system operates on a yearly basis, with specific deadlines set by the Canada Revenue Agency (CRA) for individuals and businesses to file their tax returns. It's crucial to stay informed about these due dates to avoid any penalties or missed opportunities.

For the majority of Canadians, the tax return due date falls on April 30 each year. This date marks the final day for individuals to submit their personal tax returns, including any required documentation and forms. However, it's important to note that there are certain exceptions and variations to this deadline, depending on individual circumstances.

Extensions and Special Circumstances

In some cases, individuals may be eligible for an extension to file their tax returns beyond the April 30 deadline. This could apply to individuals who are self-employed, have complex tax situations, or are facing extenuating circumstances beyond their control. It's essential to understand the criteria and requirements for extensions, as they can provide much-needed flexibility in unique situations.

For instance, individuals who are self-employed and require more time to gather business-related information may qualify for an extension. Similarly, those facing unforeseen challenges, such as natural disasters or medical emergencies, may be granted additional time to file their returns. It's advisable to consult with a tax professional or reach out to the CRA to determine your eligibility and navigate the extension process effectively.

Corporate Tax Return Deadlines

While individuals have a set deadline of April 30, the landscape is slightly different for corporations. Corporate tax returns typically have a June 15 deadline, allowing businesses additional time to compile and submit their financial information. However, it's crucial for corporations to remain vigilant and start the process well in advance to avoid any last-minute rush.

Additionally, it's worth noting that the June 15 deadline is applicable to most corporations, but there may be variations based on the specific type of corporation and its legal structure. For instance, publicly traded corporations may have different filing requirements and deadlines. It's imperative for businesses to stay informed about their specific obligations and consult with tax experts to ensure compliance.

| Tax Return Type | Due Date |

|---|---|

| Individual Tax Returns | April 30 |

| Corporate Tax Returns | June 15 |

The Canadian Tax Filing Process: A Step-by-Step Guide

Filing a Canadian tax return can be a complex process, but breaking it down into manageable steps can make it more approachable. Here's a comprehensive guide to help you navigate the tax filing journey.

Gathering the Necessary Documents

Before diving into the filing process, it's crucial to assemble all the relevant documents and information. This step ensures a smoother and more efficient filing experience. Here's a checklist of key documents you'll need:

- T4 Slips: These slips provide crucial information about your employment income, including your earnings, deductions, and tax withholdings. Ensure you have all T4 slips from your employers for the tax year.

- T5 Slips: T5 slips detail your interest, investment, and other income sources. Collect these slips from banks, investment firms, and other financial institutions.

- RRSP Contributions: Keep track of your Registered Retirement Savings Plan (RRSP) contributions throughout the year. You'll need this information to claim deductions and maximize your tax benefits.

- Receipts and Expenses: If you have eligible expenses related to your employment, business, or medical care, gather all the necessary receipts and documentation to support your claims.

- Previous Year's Tax Return: Having your previous tax return handy can be beneficial for reference and to ensure accuracy in the current filing.

Choosing Your Filing Method

In today's digital age, the CRA offers various methods to file your tax return, catering to different preferences and comfort levels with technology. Here are the primary options available:

- NETFILE: NETFILE is a popular online filing option that allows individuals to submit their tax returns electronically. It's a user-friendly and secure platform, suitable for those comfortable with basic computer skills. NETFILE supports a range of tax software and web applications, making the process efficient and convenient.

- AUTOMATED TAX FILING (AUTOFIL): AUTOFIL is an automated filing option that utilizes your financial institution's data to pre-populate your tax return. This method is ideal for individuals with straightforward tax situations, as it simplifies the process by leveraging the information already available in your financial records.

- PAPER TAX RETURN: For those who prefer a more traditional approach or have complex tax scenarios, the paper tax return option is available. This involves completing the necessary forms manually and mailing them to the CRA. While it may be more time-consuming, it provides a tangible record of your tax filing.

Completing Your Tax Return

Once you've gathered your documents and chosen your filing method, it's time to tackle the tax return itself. Whether you opt for NETFILE, AUTOFIL, or the paper method, ensure you have a clear understanding of the forms and requirements specific to your situation.

Start by reviewing the instructions and guidelines provided by the CRA for your chosen filing method. Double-check the accuracy of your personal information, income details, deductions, and credits. Take the time to carefully consider any eligible deductions and credits that may apply to your circumstances, as these can significantly impact your tax liability or refund.

If you're using tax software or an online filing platform, these tools often guide you through the process, asking relevant questions and providing assistance along the way. Ensure you take advantage of the built-in calculations and error-checking features to minimize the risk of mistakes.

Review and Submit

Before finalizing and submitting your tax return, it's crucial to perform a thorough review. Check for any errors, omissions, or discrepancies. Double-check the math, ensure all relevant forms and schedules are included, and verify that your personal information is accurate.

If you're filing online, take advantage of the preview feature to review your return before submission. This step allows you to spot any potential issues and make necessary adjustments. Once you're satisfied with your tax return, proceed with the final submission, following the instructions provided by your chosen filing method.

Remember, accuracy is paramount when it comes to tax returns. Even a small mistake can lead to delays, additional scrutiny, or penalties. Take the time to ensure your return is complete and correct to avoid any unnecessary complications.

Maximizing Your Tax Refund: Strategies and Tips

Filing your tax return isn't just about meeting the deadline; it's also an opportunity to maximize your refund or minimize your tax liability. Here are some strategies and tips to help you make the most of your tax return:

RRSP Contributions

One of the most effective ways to reduce your taxable income and potentially increase your refund is by contributing to a Registered Retirement Savings Plan (RRSP). RRSP contributions are tax-deductible, meaning they can lower your taxable income and potentially result in a larger refund.

Consider maximizing your RRSP contributions within the allowed limits. The CRA provides annual contribution room, which accumulates over time if not fully utilized. By making regular contributions and taking advantage of this room, you can not only save for your retirement but also potentially reduce your tax burden.

Tuition and Education Credits

If you or your dependents are pursuing post-secondary education, you may be eligible for tuition and education credits. These credits can help reduce your taxable income and provide a refund or a reduction in your tax liability.

Keep track of your tuition fees, textbooks, and other eligible education expenses. When filing your tax return, ensure you claim these credits to maximize your refund. Additionally, consider carrying forward any unused credits to future tax years, as they can be applied against future income and provide ongoing tax benefits.

Medical Expense Deductions

Certain medical expenses can be deducted to reduce your taxable income. These deductions include eligible healthcare costs, such as prescription medications, medical devices, and certain procedures. Keep a record of your medical expenses throughout the year, including receipts and proof of payment.

When filing your tax return, calculate your eligible medical expenses and claim the deduction. This can help lower your taxable income and potentially result in a larger refund. It's important to note that there are thresholds and limitations to medical expense deductions, so consult the CRA guidelines or seek professional advice to ensure you're claiming the appropriate amount.

Charitable Donations

Making charitable donations is not only a noble act but also a tax-efficient strategy. Charitable donations can be claimed as a tax credit, reducing your taxable income and potentially increasing your refund.

Keep track of your donations throughout the year, including the names of the registered charities and the amounts donated. When filing your tax return, ensure you claim these donations and attach the necessary receipts. The CRA provides a schedule for charitable donations, making it easier to calculate and claim the appropriate credit.

Future Implications and Planning

Filing your tax return isn't just a yearly obligation; it's an opportunity to assess your financial situation and plan for the future. By understanding your tax obligations and exploring potential deductions and credits, you can make informed decisions to optimize your financial well-being.

Reviewing Your Financial Goals

Take the time to review your financial goals and assess how your tax return fits into your overall financial plan. Consider the following aspects:

- Are you on track with your savings goals, such as retirement planning or purchasing a home?

- Have you maximized your RRSP contributions to take advantage of tax-deductible savings?

- Are there any investments or financial strategies you can explore to further optimize your tax situation in the future?

Optimizing Your Tax Strategy

Use the insights gained from your tax return to refine and optimize your tax strategy for the upcoming year. Consider the following actions:

- Review your income sources and explore ways to minimize taxable income, such as through tax-efficient investments or business deductions.

- Stay informed about any changes in tax laws or regulations that may impact your tax obligations or potential deductions.

- Consider seeking professional advice from a tax advisor or accountant to develop a comprehensive tax planning strategy tailored to your specific circumstances.

Planning for Future Tax Returns

Filing your tax return is not a standalone event but rather a continuous process. Use the lessons learned from this year's filing to streamline future tax seasons. Here are some tips for future tax planning:

- Keep detailed records of your income, expenses, and deductions throughout the year to simplify the filing process.

- Stay organized by using a tax-specific filing system or digital tools to track your financial information.

- Explore tax software or accounting tools that can automate certain aspects of your tax filing, making future returns more efficient.

FAQs

Can I file my tax return before the due date?

+Yes, you can file your tax return before the due date. In fact, many individuals choose to file their returns early to receive their refunds sooner. However, ensure you have all the necessary information and documents to avoid any errors or delays.

What happens if I miss the tax return due date?

+Missing the tax return due date can result in penalties and interest charges. The CRA may impose late-filing penalties, and you may also be charged interest on any outstanding taxes. It’s crucial to file your return as soon as possible to minimize these consequences.

How can I calculate my tax refund or liability?

+The calculation of your tax refund or liability depends on various factors, including your income, deductions, and credits. Using tax software or consulting a tax professional can provide accurate estimates. Additionally, the CRA’s online tools and calculators can assist in estimating your refund or liability.

Are there any tax benefits for families with children?

+Yes, the Canadian tax system offers several tax benefits for families with children. These include the Canada Child Benefit (CCB), which provides monthly payments to eligible families, as well as various tax credits and deductions related to childcare expenses and family-specific situations. It’s important to review these benefits and ensure you claim them when filing your tax return.

Can I e-file my tax return if I’m self-employed?

+Yes, self-employed individuals can e-file their tax returns using NETFILE or other online filing options. However, it’s important to ensure you have all the necessary business-related information and documentation to accurately complete your return. Consulting a tax professional can provide valuable guidance for self-employed individuals.