Do Amish People Pay Taxes

The relationship between the Amish community and taxes is a fascinating aspect of their unique way of life. The Amish, known for their simple living, strong religious beliefs, and resistance to modern technologies, have a distinct approach to taxes that is worth exploring. This article aims to delve into the intricacies of the Amish tax system, shedding light on their obligations, exemptions, and the overall impact on their community.

The Amish Tax Obligations: A Complex Balance

Contrary to popular belief, the Amish are not exempt from all taxes. They, like all U.S. citizens, have certain financial obligations to the government. However, their tax landscape is far from simple, with a mix of federal, state, and local regulations that apply to various aspects of their lives.

Federal Taxes: Income and Social Security

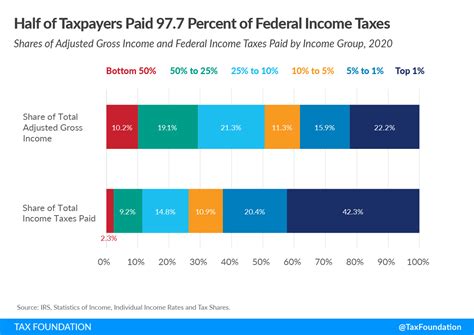

The Amish pay federal income taxes just like any other American citizen. This includes filing annual tax returns and paying taxes on any income earned, whether it’s from farming, small businesses, or other sources. However, the Amish often have lower taxable incomes due to their simple lifestyle and limited use of modern amenities.

One notable aspect is their exemption from Social Security taxes. The Amish have a strong tradition of communal support and believe that government programs like Social Security interfere with their self-sufficiency and religious values. As a result, they are not required to pay into the Social Security system, and they are also not eligible to receive benefits.

| Tax Category | Amish Obligation |

|---|---|

| Federal Income Tax | Payable |

| Social Security Tax | Exempt |

Sales and Property Taxes: A Mixed Bag

Sales taxes are a more complex matter for the Amish. While they often avoid paying sales tax on goods they purchase, this is not due to any legal exemption. Instead, it’s because they frequently buy goods from other Amish businesses or individuals, who may not charge sales tax, or they may barter for goods and services, thus avoiding the need for monetary transactions.

Property taxes, on the other hand, are a significant expense for the Amish. They own substantial amounts of land and property, which are subject to local property taxes. These taxes can be a financial burden, especially for larger Amish communities with many members.

Amish Exemptions and Unique Arrangements

The Amish community has negotiated certain exemptions and arrangements with the government over the years, allowing them to maintain their way of life while still contributing to society.

Military Service and Selective Service

The Amish are known for their strong pacifist beliefs and have historically opposed military service. As a result, they are exempt from military conscription under the Selective Service Act. However, this does not mean they avoid all forms of service. Many Amish men opt for alternative service, such as working in hospitals or providing community service, as a way to contribute during times of national emergency or war.

Health Insurance and Obamacare

The Affordable Care Act (ACA), often referred to as Obamacare, posed a unique challenge for the Amish community. With their strong tradition of communal support and aversion to government interference, many Amish individuals were exempt from the individual mandate to purchase health insurance. However, many Amish communities have their own health care plans, often called “Amish Aid” or “Amish Mutual Aid,” which provide financial support for medical expenses within their community.

The Impact of Taxes on Amish Communities

Taxes play a significant role in shaping the Amish way of life and their interactions with the wider world. While they contribute to the national economy through income taxes, their exemption from certain taxes and government programs allows them to maintain their self-sufficient and community-oriented lifestyle.

Financial Considerations and Business

The Amish approach to taxes influences their business practices. Many Amish businesses, particularly those that cater to the non-Amish market, are structured to minimize tax obligations. This can involve careful accounting, utilizing exemptions, and navigating complex tax laws. Despite these challenges, Amish businesses often thrive, contributing to the local and national economy.

Community Support and Self-Sufficiency

The Amish community’s approach to taxes reinforces their values of communal support and self-sufficiency. By paying taxes when necessary and relying on their community for financial support and healthcare, they maintain a delicate balance between their religious beliefs and civic responsibilities.

Conclusion: A Complex Web of Obligations and Exemptions

The Amish community’s relationship with taxes is a testament to their ability to navigate modern systems while staying true to their traditional values. While they are not exempt from all taxes, they have carved out a niche that allows them to contribute to society while maintaining their unique way of life. As the world becomes more interconnected, the Amish community’s approach to taxes serves as a fascinating study in balancing tradition with civic duty.

FAQ

Do the Amish pay federal income taxes?

+Yes, the Amish pay federal income taxes on their earnings, just like any other U.S. citizen.

Are Amish exempt from all taxes?

+No, the Amish are not exempt from all taxes. They pay federal income taxes and property taxes, among others. However, they are exempt from certain taxes like Social Security and, in some cases, sales taxes.

How do Amish communities manage healthcare costs without Obamacare?

+Many Amish communities have their own health care plans, often called “Amish Aid” or “Amish Mutual Aid,” which provide financial support for medical expenses within their community.