Tax Percent In Michigan

In the state of Michigan, taxes play a significant role in shaping the economic landscape and contributing to various public services and infrastructure. The tax system in Michigan is composed of various types of taxes, including income tax, sales tax, property tax, and others, each with its own set of rates and regulations. Understanding the tax structure is crucial for individuals and businesses operating within the state, as it directly impacts their financial obligations and planning.

Income Tax in Michigan

The income tax system in Michigan operates on a marginal bracket system, where the tax rate increases as income levels rise. As of the latest available information, Michigan’s income tax rates range from 4.25% to 4.60%, depending on the taxpayer’s income bracket. These rates are applied to taxable income, which includes wages, salaries, and other forms of earned income. It’s important to note that Michigan does not tax dividend or interest income, setting it apart from many other states.

For instance, consider a hypothetical scenario where an individual, we'll call them Jane, resides in Michigan and earns an annual income of $50,000. Based on Michigan's income tax brackets, Jane's income would fall within the 4.25% tax bracket. This means that she would pay a tax rate of 4.25% on her taxable income, which could significantly impact her financial planning and budget.

Tax Brackets and Rates

Michigan’s income tax brackets are structured to ensure fairness and progressivity. Here’s a simplified breakdown of the tax brackets and their respective rates (as of the most recent information):

| Tax Bracket (Income Range) | Tax Rate |

|---|---|

| $0 - $20,000 | 4.25% |

| $20,001 - $50,000 | 4.25% |

| $50,001 - $100,000 | 4.25% |

| $100,001 - $500,000 | 4.60% |

| $500,001 and above | 4.60% |

Sales Tax in Michigan

In addition to income tax, Michigan imposes a sales tax on the purchase of goods and certain services. The general sales tax rate in Michigan is 6%, which is applied to most retail transactions. However, it’s worth noting that certain items, such as groceries and medications, are exempt from sales tax, providing some relief for essential purchases.

For businesses operating in Michigan, understanding the sales tax regulations is crucial for accurate tax collection and compliance. The sales tax rate may also vary depending on the local jurisdiction, with some cities and counties imposing additional local sales taxes. This variation in rates can impact a business's pricing strategy and financial planning.

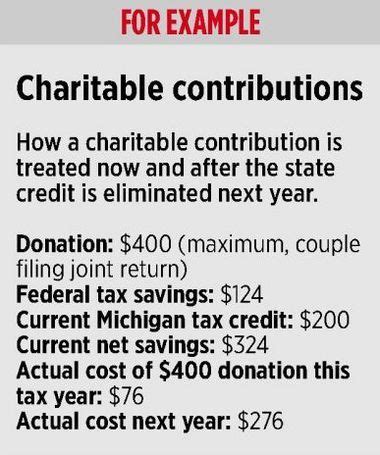

Sales Tax Exemptions and Considerations

Michigan’s sales tax system includes a range of exemptions and considerations. For instance, certain goods, such as prescription drugs, over-the-counter medications, and medical devices, are exempt from sales tax, providing a financial benefit to those who rely on these essential items. Additionally, some services, like legal and accounting services, are also exempt from sales tax, offering a tax advantage to businesses in these industries.

It's essential for consumers and businesses alike to be aware of these exemptions and considerations to ensure accurate tax compliance and to take advantage of any applicable tax benefits.

Property Tax in Michigan

Another significant tax in Michigan is the property tax, which is levied on real estate and tangible personal property. Property taxes are a critical source of revenue for local governments and are used to fund public services like schools, fire departments, and local infrastructure. The property tax rate in Michigan varies by jurisdiction and can range from around 1% to 4% of the property’s assessed value.

For homeowners in Michigan, understanding the property tax system is crucial. The tax rate and assessment process can significantly impact the financial obligations associated with homeownership. It's essential to stay informed about local property tax rates and any changes that may occur, as these can affect an individual's overall financial planning and budget.

Property Tax Assessment and Appeals

The property tax assessment process in Michigan involves determining the taxable value of a property, which is then used to calculate the tax amount. This assessment is typically conducted by local tax assessors, who consider factors like the property’s location, size, and recent sales data. Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair.

The process of appealing a property tax assessment involves a review by the local tax board, which may result in a change to the assessed value. It's important for property owners to understand their rights and the appeal process, as it can lead to significant savings on their property tax obligations.

Other Taxes in Michigan

Beyond income, sales, and property taxes, Michigan imposes various other taxes to fund specific programs and services. These include:

- Intangibles Tax: Michigan imposes a tax on the transfer of certain intangible assets, such as stocks and bonds, at a rate of 0.35%.

- Use Tax: The use tax is applied to out-of-state purchases of goods and services that would be subject to sales tax if purchased within Michigan. This ensures fairness in the tax system, preventing individuals from avoiding sales tax by making purchases out of state.

- Real Estate Transfer Tax: A tax is levied on the transfer of real estate, typically paid by the seller, to fund local governments and specific programs.

- Fuel Taxes: Michigan imposes taxes on the sale of gasoline and diesel fuel, which are used to fund transportation infrastructure and maintenance.

Understanding these additional taxes is crucial for both individuals and businesses, as they can impact financial planning and compliance obligations.

Impact of Taxes on Michigan’s Economy

The tax system in Michigan plays a pivotal role in shaping the state’s economic landscape. Taxes provide the revenue necessary to fund public services, infrastructure development, and various programs that benefit Michigan’s residents and businesses. The tax structure, including the rates and regulations, can influence economic growth, business investment, and individual financial decisions.

For instance, a competitive tax structure can attract businesses and investors to the state, fostering economic growth and job creation. On the other hand, a tax system that is perceived as burdensome or complex may discourage investment and hinder economic development. Therefore, Michigan's tax policies are a key factor in the state's overall economic competitiveness and its ability to attract and retain businesses and residents.

Tax Incentives and Economic Development

To promote economic growth and attract businesses, Michigan offers various tax incentives and programs. These include tax credits, grants, and other financial incentives aimed at supporting specific industries, encouraging investment, and creating jobs. For example, the Michigan Strategic Fund provides tax incentives to businesses that create new jobs or make significant investments in the state.

These tax incentives can be a powerful tool for economic development, encouraging businesses to choose Michigan as their location for operations and expansion. By offering competitive tax structures and incentives, Michigan can position itself as an attractive destination for businesses, fostering economic growth and prosperity.

Conclusion

Michigan’s tax system is a complex yet essential component of the state’s economy. From income and sales taxes to property and other specialized taxes, the tax structure impacts individuals, businesses, and the overall economic landscape. Understanding Michigan’s tax system is crucial for accurate financial planning, compliance, and taking advantage of any applicable tax benefits.

Staying informed about tax rates, regulations, and any changes to the tax system is essential for making informed financial decisions and contributing to Michigan's thriving economy. Whether you're an individual taxpayer, a business owner, or a resident, understanding Michigan's tax system is a key aspect of navigating the state's economic environment.

What is the current income tax rate in Michigan for the highest tax bracket?

+As of the most recent information, the highest income tax rate in Michigan is 4.60%, which applies to taxable income above $500,000.

Are there any sales tax holidays in Michigan?

+Yes, Michigan does occasionally have sales tax holidays, typically for back-to-school shopping or other specific events. These holidays provide a temporary exemption from sales tax on certain purchases.

How often do property tax assessments occur in Michigan?

+Property tax assessments in Michigan are typically conducted every year, but the exact timing may vary by jurisdiction. It’s important for property owners to stay informed about the assessment schedule in their area.

Are there any tax incentives for renewable energy projects in Michigan?

+Yes, Michigan offers various tax incentives and grants for renewable energy projects, including tax credits and exemptions. These incentives are designed to encourage the development of clean energy sources and promote sustainability.