Suffolk County Ny Sales Tax

Welcome to our in-depth exploration of the sales tax landscape in Suffolk County, New York. As one of the most populous counties in the state, Suffolk County plays a vital role in the economic framework of New York. With a diverse range of businesses and a thriving consumer base, understanding the sales tax regulations in this region is crucial for both businesses and consumers alike.

In this comprehensive guide, we will delve into the specifics of Suffolk County's sales tax, shedding light on its rates, applicability, and unique characteristics. By the end of this article, you'll have a thorough understanding of how sales tax operates in this county and its implications for your financial decisions.

Understanding Sales Tax in Suffolk County

Sales tax is a critical component of the tax system in Suffolk County, serving as a primary source of revenue for local and state governments. It is a tax levied on the sale of goods and services, and its purpose is to generate funds for essential public services, infrastructure development, and various governmental programs.

In Suffolk County, sales tax is applied to most retail transactions, including the sale of tangible personal property, certain services, and even some digital products. The tax rate is expressed as a percentage of the total sale price, and it can vary depending on several factors, including the type of goods or services, the location of the sale, and any applicable exemptions or discounts.

One of the unique aspects of sales tax in Suffolk County is its multi-tiered structure. This means that the tax rate can differ based on the specific category of goods or services being purchased. For instance, certain essential items like groceries may be subject to a lower tax rate, while luxury goods might be taxed at a higher rate. This approach ensures that the tax burden is distributed fairly and that essential items remain more affordable for consumers.

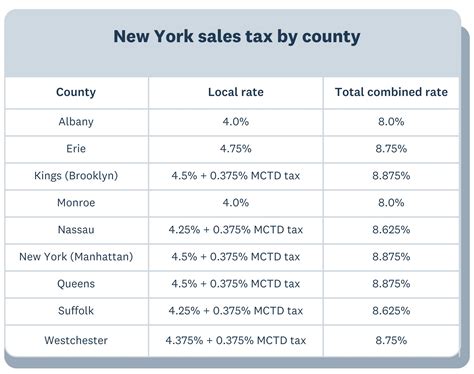

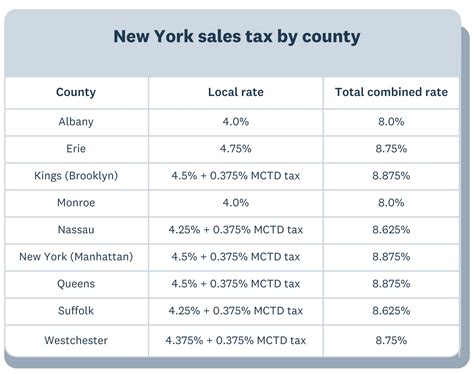

The Current Sales Tax Rates in Suffolk County

As of our latest update, the sales tax rate in Suffolk County stands at 8.625%, which includes both the state and local sales tax components. This rate is applicable to most general merchandise sales within the county.

| Tax Type | Rate |

|---|---|

| New York State Sales Tax | 4% |

| Suffolk County Local Sales Tax | 4.625% |

| Total Sales Tax Rate | 8.625% |

It's important to note that the local sales tax rate in Suffolk County is not uniform across the entire county. Certain jurisdictions within the county may have additional local sales taxes, resulting in slightly higher rates. These variations are typically due to specific initiatives or projects funded by the additional tax revenue.

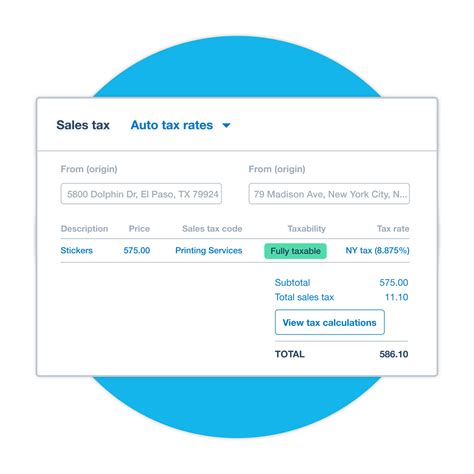

How Sales Tax is Calculated and Applied

The calculation of sales tax is relatively straightforward. The tax is typically added to the purchase price of an item or service after any applicable discounts or promotions have been applied. For instance, if you purchase an item priced at $100, and the sales tax rate is 8.625%, the tax amount would be calculated as follows:

\[ \begin{equation*} 100 \text{ (price)} \cdot 0.08625 \text{ (tax rate)} = 8.63 \text{ (tax amount)} \end{equation*} \]

So, the total amount you would pay for the item is $108.63, including the sales tax.

Sales tax is usually included in the displayed price of goods and services, making it transparent to consumers. However, it's always a good practice to confirm the final price, including tax, before making a purchase.

Exemptions and Special Considerations

While most sales in Suffolk County are subject to the standard sales tax rate, there are certain categories of goods and services that are exempt or have special tax considerations. These exemptions can significantly impact the overall tax burden for specific industries and consumers.

- Food and Groceries: Certain food items, including unprepared groceries and non-prepared food products, are exempt from sales tax in Suffolk County. This exemption helps make essential food items more affordable for residents.

- Prescription Drugs: Sales of prescription drugs are also exempt from sales tax. This exemption aims to reduce the financial burden on individuals who require medication for their health.

- Clothing and Footwear: In a unique provision, clothing and footwear purchases under a certain price threshold are exempt from sales tax. This threshold is currently set at $110, meaning items costing $110 or less are tax-free.

- Custom Software: Sales of custom software are subject to a reduced sales tax rate of 1%, which encourages businesses to invest in technology and supports the local tech industry.

- E-books and Digital Publications: Digital publications, such as e-books and online magazines, are taxed at a reduced rate of 1%, making digital content more affordable for consumers.

These exemptions and special tax rates demonstrate Suffolk County's commitment to supporting various sectors of the economy and making essential goods and services more accessible to its residents.

Compliance and Reporting for Businesses

For businesses operating in Suffolk County, understanding and adhering to sales tax regulations is crucial. Compliance ensures that businesses meet their tax obligations and maintain a positive relationship with the local government and their customers.

Registration and Permits

Any business engaged in taxable sales in Suffolk County must register with the New York State Department of Taxation and Finance to obtain a Seller’s Permit. This permit authorizes the business to collect and remit sales tax on behalf of the government.

The registration process typically involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. Once registered, the business receives a unique identification number, which must be displayed on all sales tax-related documentation.

Sales Tax Collection and Remittance

Businesses are responsible for collecting sales tax from customers at the point of sale. This involves calculating the applicable tax rate, adding it to the purchase price, and clearly displaying the tax amount on the customer’s receipt.

The collected sales tax must then be remitted to the state on a regular basis, typically monthly or quarterly. The due dates and filing requirements are determined by the business's annual sales volume and the number of employees. Businesses can register for an online account with the Department of Taxation and Finance to facilitate the remittance process.

It's important for businesses to maintain accurate records of sales and the corresponding sales tax collected. These records are essential for audit purposes and ensure compliance with tax regulations.

Sales Tax Audits and Penalties

The Department of Taxation and Finance has the authority to conduct audits of businesses to ensure compliance with sales tax regulations. These audits can be random or targeted, depending on various factors such as the business’s size, sales volume, and industry.

During an audit, the department may review the business's sales records, tax returns, and other financial documents to verify the accuracy of the reported sales tax. If discrepancies are found, the business may be subject to penalties, interest, and even criminal charges in severe cases of non-compliance.

To avoid penalties and maintain a good standing with the tax authorities, businesses should maintain meticulous records, understand the applicable tax rates, and stay updated with any changes in sales tax regulations.

Impact on Consumer Behavior

The sales tax rate in Suffolk County can significantly influence consumer behavior and spending habits. Understanding how sales tax affects consumers can help businesses strategize their pricing and marketing approaches to optimize sales.

Price Sensitivity and Tax-Inclusive Pricing

Consumers are often sensitive to price changes, especially when it comes to sales tax. A higher sales tax rate can make certain items or services seem more expensive, potentially discouraging purchases. On the other hand, a lower tax rate or tax-inclusive pricing strategies can make goods appear more affordable, encouraging consumers to spend.

Businesses can mitigate the impact of sales tax by adopting tax-inclusive pricing, where the sales tax is already factored into the displayed price. This approach simplifies the purchasing decision for consumers and reduces the perceived impact of the tax.

Sales Tax Holidays

In an effort to boost consumer spending and support certain industries, Suffolk County, along with other counties in New York, sometimes offers sales tax holidays. During these designated periods, specific categories of goods, such as clothing or school supplies, are exempt from sales tax.

Sales tax holidays can create a sense of urgency among consumers, encouraging them to make purchases during the tax-free period. Businesses often leverage these holidays to promote sales and attract customers with special offers and discounts.

Online Shopping and Sales Tax

With the rise of e-commerce, online shopping has become a significant aspect of consumer behavior. In Suffolk County, online retailers are generally required to collect and remit sales tax just like brick-and-mortar stores. However, the enforcement of sales tax on online purchases can be more complex, especially for out-of-state retailers.

Consumers should be aware that even if a retailer does not collect sales tax at the time of purchase, they may still be responsible for paying use tax on their online purchases. Use tax is essentially the sales tax equivalent for items purchased from out-of-state retailers or from other jurisdictions with lower tax rates.

Future Trends and Implications

The sales tax landscape in Suffolk County is subject to ongoing changes and developments. Staying informed about these trends is crucial for both businesses and consumers to adapt their strategies and financial planning accordingly.

Potential Tax Rate Changes

Sales tax rates are not static and can be adjusted over time. Local governments may propose changes to the sales tax rate to address budgetary concerns or fund specific initiatives. While these changes are typically proposed with public input, they can significantly impact the financial landscape of the county.

Businesses and consumers should stay updated on any proposed tax rate changes and their potential implications. This awareness allows for better financial planning and strategic adjustments to pricing and purchasing decisions.

Advancements in Sales Tax Technology

The use of technology in sales tax management is evolving rapidly. Advanced software and platforms can automate various aspects of sales tax compliance, from calculating tax rates to filing returns. These tools can significantly reduce the administrative burden on businesses and improve accuracy in tax calculations.

Businesses should consider investing in such technologies to streamline their sales tax processes and reduce the risk of errors. Consumers, on the other hand, can benefit from these advancements through more transparent and consistent tax calculations at the point of sale.

Expansion of Sales Tax Base

As e-commerce continues to grow, there is a trend towards expanding the sales tax base to include more online transactions. This could mean that a wider range of online retailers, even those based outside Suffolk County, may be required to collect and remit sales tax on purchases made by county residents.

While this expansion aims to ensure a fair tax burden and generate additional revenue, it also presents challenges for online retailers and consumers alike. Businesses may need to adapt their sales tax compliance strategies, while consumers may face slightly higher prices for online purchases.

Tax Incentives and Economic Development

Local governments often use tax incentives as a tool to attract businesses and promote economic development. In Suffolk County, we may see the implementation of tax breaks or incentives for specific industries or projects. These incentives can take various forms, such as reduced sales tax rates, tax credits, or tax exemptions for a defined period.

Businesses should stay informed about these incentives, as they can significantly impact their bottom line and investment decisions. Consumers, on the other hand, may benefit indirectly from these incentives through the creation of new jobs and improved local infrastructure.

Conclusion

Understanding the sales tax landscape in Suffolk County is a critical aspect of financial literacy and business strategy. From the multi-tiered tax structure to the various exemptions and special considerations, the county’s sales tax system is designed to support its diverse economy and resident base.

For businesses, compliance with sales tax regulations is essential for legal and financial reasons. Staying updated on tax rates, exemptions, and compliance requirements ensures a positive relationship with the government and consumers. Adopting modern sales tax management tools can further streamline the compliance process.

Consumers, on the other hand, should be aware of the impact of sales tax on their purchasing decisions. Understanding the tax rates, exemptions, and potential savings opportunities can help them make informed choices and optimize their spending. Additionally, staying informed about sales tax holidays and online shopping regulations ensures they are compliant with their tax obligations.

As Suffolk County continues to evolve and adapt to economic changes, staying informed about sales tax trends and developments is crucial. Whether it's potential rate changes, advancements in tax technology, or tax incentives, being aware of these factors allows for better financial planning and strategic decision-making.

In conclusion, Suffolk County's sales tax system is a vital component of its economic framework, and understanding its intricacies is a valuable asset for both businesses and consumers.

What is the current sales tax rate in Suffolk County, NY?

+As of our latest update, the total sales tax rate in Suffolk County is 8.625%, which includes both the state and local sales tax components.

Are there any sales tax exemptions in Suffolk County?

+Yes, Suffolk County offers exemptions for certain goods and services. This includes food and groceries, prescription drugs, clothing and footwear under $110, custom software, and digital publications.

How often do businesses need to remit sales tax in Suffolk County?

+Businesses typically remit sales tax on a monthly or quarterly basis, depending on their sales volume and number of employees. They can register for an online account with the Department of Taxation and Finance to facilitate the remittance process.

What happens if a business fails to collect or remit sales tax correctly in Suffolk County?

+Businesses that fail to comply with sales tax regulations may face penalties, interest charges, and even criminal charges in severe cases. It is crucial for businesses to maintain accurate records and understand their tax obligations to avoid these consequences.

Are there any online resources for businesses to learn more about sales tax compliance in Suffolk County?

+Yes, the New York State Department of Taxation and Finance provides comprehensive resources and guidelines for businesses. Their website offers detailed information on registration, tax rates, exemptions, and compliance requirements. It is an excellent starting point for businesses to ensure they are up-to-date with the latest regulations.