Calculate Taxes Washington State

In the vibrant state of Washington, understanding the intricacies of its tax system is crucial for both individuals and businesses. The tax landscape in Washington is characterized by a unique blend of sales and excise taxes, property taxes, and various other levies, making it essential to navigate with precision. This article aims to provide an in-depth analysis of the tax structure in Washington State, offering a comprehensive guide to calculating taxes and exploring the key considerations for taxpayers.

Understanding Washington’s Tax Landscape

Washington State operates under a unique tax regime, differing significantly from many other states in the US. Notably, it stands out as one of the few states without a personal income tax. Instead, the state relies heavily on a robust sales tax system and a variety of other taxes to generate revenue.

The tax system in Washington is administered by the Washington State Department of Revenue (DOR), which is responsible for collecting and distributing taxes across various state and local government entities. The DOR ensures compliance with state tax laws and provides resources and guidance to taxpayers.

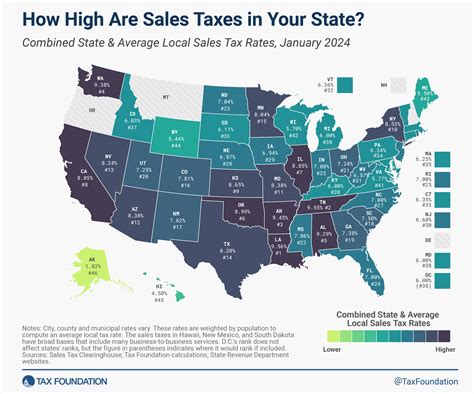

Sales and Use Taxes

The cornerstone of Washington’s tax structure is its sales and use tax system. As of [most recent data], the state sales tax rate stands at 6.5%, applicable to the sale of tangible personal property and certain services. However, it’s important to note that local jurisdictions can add additional sales tax rates, resulting in a combined sales tax rate that varies across the state.

Washington also imposes a use tax, which is essentially a sales tax applied to purchases made outside the state but used within Washington. This ensures that taxpayers are not circumventing sales tax obligations by making out-of-state purchases. The use tax rate mirrors the state sales tax rate.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

| Local Sales Tax | Varies by Jurisdiction |

| Use Tax | 6.5% |

Business and Occupation (B&O) Tax

Washington’s Business and Occupation (B&O) tax is a gross receipts tax, applying to the income or gross proceeds of businesses operating within the state. It is a unique tax structure that aims to capture a broad base of business activities.

The B&O tax is not a traditional income tax but rather a tax on the privilege of doing business in Washington. It is levied on various business activities, including retail sales, manufacturing, and service businesses. The tax rates vary depending on the type of business activity and can range from 0.471% to 1.5% of the business's gross income.

| Business Activity | Tax Rate |

|---|---|

| Retail Sales | 0.471% |

| Manufacturing | 0.484% |

| Service Businesses | 1.5% |

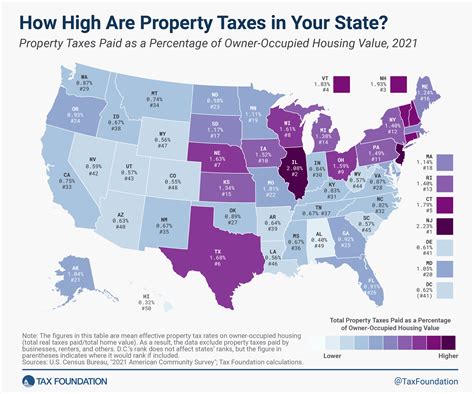

Property Taxes

Property taxes are a significant source of revenue for local governments in Washington. These taxes are primarily levied on real estate properties, including land and buildings. The property tax rate is determined by the assessed value of the property and the tax levy set by local jurisdictions, such as counties and cities.

Washington's property tax system is notable for its Property Tax Exemption Program, which offers exemptions for certain types of properties, including those owned by seniors, disabled individuals, and qualifying organizations. These exemptions can significantly reduce the property tax burden for eligible taxpayers.

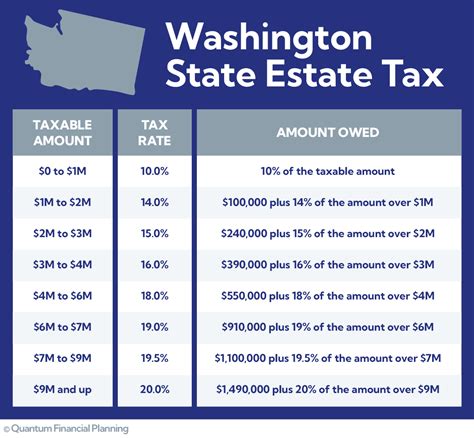

Other Taxes and Levies

In addition to the above, Washington State imposes a range of other taxes and levies, each designed to address specific revenue needs. These include:

- Excise Taxes: Washington levies excise taxes on specific goods and activities, such as gasoline, tobacco products, and motor vehicle sales.

- Public Utility Taxes: These taxes are imposed on the sale of public utility services, including electricity, natural gas, and telecommunications.

- Real Estate Excise Tax: This tax is applied to the sale or transfer of real estate property within the state.

- Timber Taxes: Washington has a unique timber tax system, imposing taxes on the harvest of timber from private and public lands.

Calculating Taxes in Washington

Calculating taxes in Washington requires a meticulous approach due to the state’s diverse tax structure. Here’s a step-by-step guide to help you navigate the process:

Sales and Use Tax Calculation

- Identify the Taxable Transaction: Determine whether the transaction is subject to sales tax. This includes the sale of tangible personal property and certain services.

- Determine the Tax Rate: The state sales tax rate is 6.5%, but it’s crucial to consider local sales tax rates, which can add to the overall tax burden.

- Calculate the Tax Amount: Multiply the taxable amount (the price of the item or service) by the applicable tax rate. For instance, if an item costs 100 and the total tax rate is 10% (state + local), the tax amount would be 10.

Business and Occupation (B&O) Tax Calculation

- Identify Taxable Activities: Determine which business activities are subject to the B&O tax. This could include retail sales, manufacturing, or service-related activities.

- Determine the Tax Rate: Refer to the B&O tax rates table (provided above) to identify the applicable tax rate for your specific business activity.

- Calculate the Tax Amount: Multiply the business’s gross income or gross proceeds from the taxable activity by the applicable tax rate. For example, if a retail business has a gross income of 500,000 and the tax rate is 0.471%, the B&O tax amount would be 2,355.

Property Tax Calculation

- Assess the Property Value: Obtain the assessed value of the property from the local assessor’s office. This value is typically based on a combination of the property’s market value and a predetermined assessment ratio.

- Determine the Tax Rate: The tax rate is set by the local jurisdiction and is often expressed as a mill rate (mills per 1,000 of assessed value). Convert this rate to a decimal to calculate the tax amount.</li> <li><strong>Calculate the Tax Amount</strong>: Multiply the assessed value of the property by the tax rate (converted to a decimal). For instance, if the assessed value is 200,000 and the tax rate is 10 mills (0.01 per 1,000), the tax amount would be $2,000.

Considerations and Tips for Taxpayers

Navigating Washington’s tax landscape requires a keen understanding of the state’s unique tax structure. Here are some key considerations and tips for taxpayers:

Exemptions and Deductions

Washington offers a range of exemptions and deductions to reduce the tax burden for eligible taxpayers. These include:

- Sales tax exemptions for certain goods, such as food, prescription drugs, and medical devices.

- Property tax exemptions for seniors, disabled individuals, and qualifying organizations.

- Deductions for business expenses, such as advertising, employee compensation, and certain taxes paid.

Compliance and Reporting

Ensuring compliance with Washington’s tax laws is crucial to avoid penalties and interest. Here are some key compliance considerations:

- Register for tax accounts with the DOR for all applicable taxes, including sales and use tax, B&O tax, and property tax.

- Maintain accurate records of sales, purchases, and business activities to facilitate accurate tax reporting.

- File tax returns on time and make timely tax payments to avoid late fees and penalties.

Tax Planning and Strategies

Effective tax planning can help minimize tax liabilities and maximize deductions. Consider these strategies:

- Utilize sales tax exemptions and special rates for specific goods and services.

- Explore the possibility of qualifying for property tax exemptions or reduced rates.

- Optimize business activities to take advantage of lower B&O tax rates for specific industries.

- Consult with tax professionals to ensure compliance and explore tax-saving opportunities.

Tax Software and Tools

Utilizing tax software and tools can simplify the tax calculation and filing process. Consider the following options:

- Sales tax calculators and software to automate sales tax calculations, especially for businesses with complex sales structures.

- Property tax assessment tools to estimate property values and tax liabilities.

- B&O tax calculators to assist in determining the applicable tax rate and calculating the tax amount.

- Tax preparation software to streamline the tax return filing process.

Conclusion: Navigating Washington’s Tax System

Washington’s tax system, while complex, offers a unique approach to revenue generation. By understanding the various taxes and levies, taxpayers can navigate the system with confidence. Whether it’s calculating sales and use taxes, understanding the B&O tax, or managing property taxes, a strategic approach can ensure compliance and minimize tax burdens.

As with any tax system, staying informed and seeking professional advice is essential. The Washington State Department of Revenue provides extensive resources and guidance to taxpayers, ensuring a smooth tax journey for individuals and businesses alike. By leveraging the information and tools available, taxpayers can effectively manage their tax obligations and contribute to the vibrant economy of Washington State.

What is the sales tax rate in Washington State?

+The state sales tax rate in Washington is 6.5%. However, it’s important to note that local jurisdictions can add additional sales tax rates, resulting in a combined sales tax rate that varies across the state.

How is the Business and Occupation (B&O) tax calculated in Washington?

+The B&O tax is calculated based on the gross income or gross proceeds of a business’s taxable activities. The tax rates vary depending on the type of business activity, ranging from 0.471% to 1.5% of the business’s gross income.

Are there any property tax exemptions in Washington State?

+Yes, Washington offers property tax exemptions for seniors, disabled individuals, and qualifying organizations. These exemptions can significantly reduce the property tax burden for eligible taxpayers.

What are some tips for effective tax planning in Washington?

+Some tips for effective tax planning in Washington include utilizing sales tax exemptions and special rates, exploring property tax exemptions, optimizing business activities for lower B&O tax rates, and consulting with tax professionals to ensure compliance and explore tax-saving opportunities.