Sales Tax For Milwaukee Wi

Understanding the intricacies of sales tax is crucial, especially when navigating the business landscape in a specific region. This article aims to provide a comprehensive guide to sales tax in Milwaukee, Wisconsin, covering the essential details that businesses and individuals should know.

Sales Tax Basics in Milwaukee

Sales tax is a vital component of the tax system in Milwaukee, contributing significantly to the revenue generated for local and state governments. It is a consumption tax, meaning it is applied to the sale of goods and certain services, with the primary purpose of funding essential public services and infrastructure.

In Milwaukee, sales tax is administered by the Wisconsin Department of Revenue, which sets the rules and regulations for tax compliance. The city's sales tax rate is a combination of state, county, and municipal taxes, each with its own unique rate and purpose.

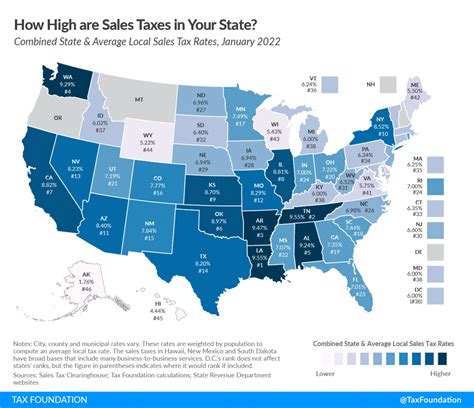

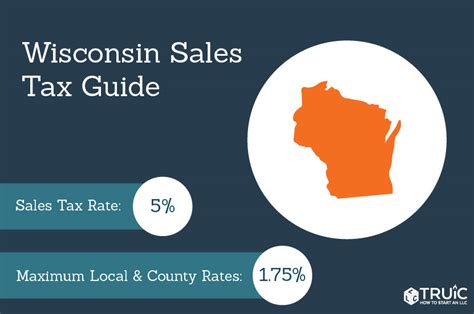

As of [current date], the total sales tax rate in Milwaukee is 5.5%, which includes a state tax rate of 5%, a county tax rate of 0.5%, and a municipal tax rate of 0%. This rate is applicable to most retail transactions, but there are specific exemptions and rules for certain goods and services.

Key Components of Milwaukee’s Sales Tax

The sales tax system in Milwaukee consists of several key components that contribute to the overall tax rate:

- State Sales Tax: The state of Wisconsin imposes a general sales tax rate of 5%, which applies to most tangible personal property and certain services. This tax is collected by businesses and remitted to the state on a regular basis.

- County Sales Tax: Milwaukee County adds an additional 0.5% to the state sales tax, bringing the total county-wide tax to 5.5%. This tax is used to fund specific county projects and initiatives.

- Municipal Sales Tax: Milwaukee itself does not currently levy a municipal sales tax. However, this can vary across Wisconsin, with some cities and municipalities imposing their own additional tax rates.

It's important to note that sales tax rates can change periodically, so it's essential to stay updated with the latest regulations. The Wisconsin Department of Revenue provides regular updates and resources to help businesses and individuals understand the current tax landscape.

Sales Tax Exemptions and Special Cases

While the standard sales tax rate applies to most retail transactions, there are specific exemptions and special cases to be aware of in Milwaukee:

- Food and Groceries: Certain food items, such as unprepared food and non-alcoholic beverages, are exempt from sales tax in Wisconsin. This exemption extends to most grocery store purchases, providing some relief for consumers' daily necessities.

- Prescription Drugs: Sales tax is not applicable to the sale of prescription drugs, ensuring that essential medical needs are not burdened by additional costs.

- Manufacturing: The sale of manufacturing equipment and supplies is exempt from sales tax, encouraging investment in the state's manufacturing sector.

- Resale: Items purchased for resale are not subject to sales tax, as the tax will be collected at the point of final sale to the consumer. This exemption applies to many businesses, from retailers to wholesalers.

- Services: Some services, such as professional services like legal and medical advice, are not taxable. However, it's important to note that this exemption does not apply to all services, and the rules can be complex.

These exemptions and special cases highlight the nuances of sales tax law in Milwaukee. It's crucial for businesses to understand these regulations to ensure proper tax compliance and avoid any penalties or legal issues.

Compliance and Filing Requirements

Compliance with sales tax regulations is a critical aspect of doing business in Milwaukee. Here are some key considerations for businesses regarding compliance and filing:

- Registration: All businesses selling taxable goods or services in Milwaukee must register with the Wisconsin Department of Revenue to obtain a sales tax permit. This permit allows businesses to collect and remit sales tax.

- Tax Collection: Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is typically calculated based on the total purchase amount and the applicable tax rate.

- Filing Frequency: The frequency of sales tax filings depends on the business's sales volume. Businesses with higher sales may be required to file and remit sales tax more frequently (e.g., monthly or quarterly), while those with lower sales may file annually.

- Record-Keeping: Proper record-keeping is essential for sales tax compliance. Businesses must maintain records of all sales transactions, including the tax collected, to ensure accurate reporting and auditing.

- Late Filing and Penalties: Failure to file sales tax returns or remit taxes on time can result in penalties and interest charges. It's crucial to stay on top of filing deadlines to avoid these additional costs and potential legal consequences.

The Wisconsin Department of Revenue provides resources and guidance to help businesses navigate the compliance process, including online tools for registration, filing, and payment.

Impact on Businesses and Consumers

Sales tax has a direct impact on both businesses and consumers in Milwaukee. For businesses, sales tax can affect pricing strategies, profit margins, and cash flow. It’s important for businesses to consider the tax implications when setting prices and budgeting for operations.

For consumers, sales tax adds to the cost of goods and services, influencing purchasing decisions and overall spending power. Understanding the sales tax rate can help consumers budget effectively and plan their spending accordingly.

Additionally, sales tax revenue contributes significantly to the funding of public services and infrastructure in Milwaukee. It supports essential services like education, healthcare, and public safety, ensuring the city's overall well-being and economic vitality.

Future Considerations and Trends

The sales tax landscape is subject to change, and businesses and individuals should stay informed about potential developments. Here are some key future considerations for sales tax in Milwaukee:

- Tax Rate Changes: While the current sales tax rate in Milwaukee is stable, it's possible that future economic conditions or legislative decisions could lead to rate adjustments. Staying updated on any proposed changes is essential for accurate tax planning.

- Online Sales Tax: With the growth of e-commerce, the collection and remittance of sales tax on online sales is an evolving area of tax law. Businesses selling online should stay informed about the latest regulations to ensure compliance.

- Tax Policy Reforms: There may be ongoing discussions and proposals for tax policy reforms at the state and local levels. These reforms could impact sales tax rates, exemptions, and overall tax structures, so staying engaged with local politics and tax news is beneficial.

By staying informed about these future considerations, businesses and individuals can adapt their tax strategies and ensure continued compliance with Milwaukee's sales tax regulations.

Conclusion

Understanding and complying with sales tax regulations is a crucial aspect of doing business in Milwaukee, Wisconsin. From the standard sales tax rate to the various exemptions and special cases, businesses and individuals must navigate a complex tax landscape. By staying informed and compliant, businesses can contribute to the local economy and ensure the continued funding of essential public services.

How often do I need to file sales tax returns in Milwaukee?

+The filing frequency depends on your business’s sales volume. Generally, businesses with higher sales must file more frequently (e.g., monthly or quarterly), while those with lower sales may file annually. It’s best to consult the Wisconsin Department of Revenue for specific guidelines based on your business’s circumstances.

Are there any sales tax holidays in Wisconsin?

+Yes, Wisconsin does have sales tax holidays, typically occurring during certain weekends or specific days. These holidays provide an exemption from sales tax for certain items, often including back-to-school supplies, clothing, and energy-efficient appliances. Check the Wisconsin Department of Revenue’s website for the latest information on sales tax holidays.

How do I calculate sales tax for my business in Milwaukee?

+To calculate sales tax, you multiply the taxable amount of the sale by the applicable tax rate. For example, if the taxable amount is 100 and the total sales tax rate is 5.5%, the sales tax due would be 5.50. It’s important to ensure that you are applying the correct tax rate based on the specific location of the sale.