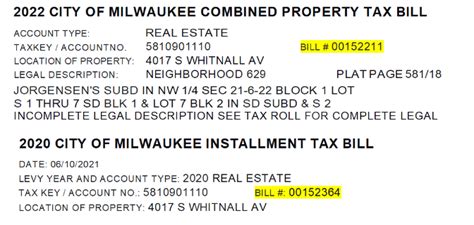

Milwaukee County Tax Bill

Understanding Your Milwaukee County Tax Bill: A Comprehensive Guide

If you own property in Milwaukee County, Wisconsin, it's essential to have a clear understanding of your tax obligations and how they are calculated. The Milwaukee County tax bill is a crucial document that outlines the amount of property tax owed by homeowners and businesses. This guide aims to demystify the process, providing an in-depth analysis of the factors influencing your tax bill and offering insights into how you can navigate this essential financial aspect of property ownership.

Decoding the Milwaukee County Tax Bill

The Milwaukee County tax bill is a detailed statement that outlines the taxes levied on your property. It is issued annually by the Milwaukee County Treasurer’s Office and is based on the assessed value of your property and the tax rates set by various taxing authorities.

Key Components of the Tax Bill

- Property Assessment: This section details the assessed value of your property. It is determined by the Milwaukee County Assessor’s Office and is based on factors like property size, location, improvements, and recent sales of comparable properties.

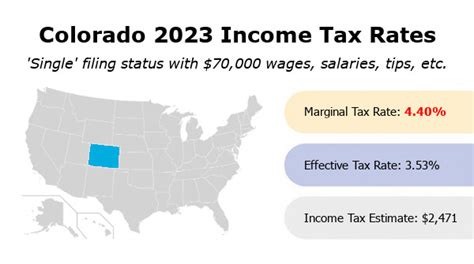

- Tax Rates: Tax rates are set by different taxing authorities, including the County, School Districts, and municipalities. These rates are applied to the assessed value of your property to calculate the total tax due.

- Taxable Value: The taxable value is the assessed value minus any applicable exemptions or deductions. It is the base for calculating your tax liability.

- Tax Amount: This is the total amount of tax you owe for the year. It is calculated by multiplying the taxable value by the applicable tax rates.

- Payment Options: The tax bill also provides information on payment due dates and accepted payment methods. Milwaukee County offers various payment options, including online payments, direct debit, and in-person payments at designated locations.

Understanding the Assessment Process

The assessment process in Milwaukee County is an essential factor in determining your tax bill. Assessments are conducted to ensure that property values are fair and accurate. The County Assessor’s Office employs various methods to assess property values, including:

- Market Analysis: This involves studying recent property sales to determine the fair market value of similar properties in your area.

- Cost Approach: The assessor estimates the cost of rebuilding your property, minus depreciation, to arrive at its current value.

- Income Approach: This method is applicable to income-producing properties, where the assessor estimates the property's value based on its income potential.

- Physical Inspection: In some cases, the assessor may conduct a physical inspection of your property to verify its condition and any recent improvements.

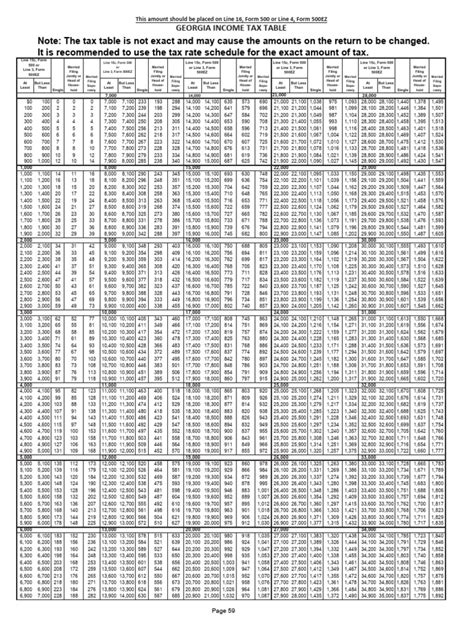

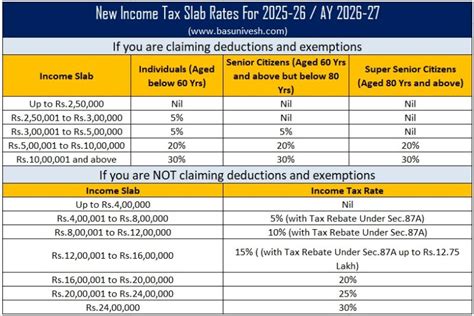

Tax Rate Structure

The tax rate structure in Milwaukee County is complex, as it involves multiple taxing authorities. The County, School Districts, and municipalities all have their own tax rates, which are combined to form the overall tax rate applied to your property.

| Taxing Authority | Tax Rate (per $1,000 of Assessed Value) |

|---|---|

| Milwaukee County | 5.25 |

| School District | 12.75 |

| Municipality | 4.50 |

| Total Tax Rate | 22.50 |

In the above example, if your property has an assessed value of $200,000, the tax calculation would be as follows:

- Taxable Value: $200,000

- Tax Amount: $200,000 x 0.0225 = $4,500

Appealing Your Property Assessment

If you believe your property assessment is inaccurate or unfair, you have the right to appeal. The Milwaukee County Board of Review is responsible for reviewing assessment appeals and making necessary adjustments. Here’s a step-by-step guide to the appeal process:

- Obtain the Appeal Form: You can download the appeal form from the Milwaukee County website or request a copy from the Assessor's Office.

- Complete the Form: Provide all the required information, including your property details, reasons for the appeal, and any supporting documentation.

- Submit the Appeal: The appeal must be submitted within a specified timeframe, typically 30 days from the date of the assessment notice.

- Hearing: If your appeal is accepted, you will be invited to a hearing before the Board of Review. Prepare your case and be ready to present your evidence.

- Decision: The Board of Review will issue a decision, either upholding or adjusting your property assessment. You will receive a written notice of the decision.

Tips for a Successful Appeal

- Gather supporting evidence, such as recent sales of comparable properties, to demonstrate that your property’s assessed value is higher than the market value.

- Be prepared to explain any unique circumstances or recent changes to your property that may have impacted its value.

- Consider seeking professional advice from a tax consultant or attorney who specializes in property tax appeals.

Managing Your Tax Liability

Understanding your tax bill is the first step towards managing your tax liability effectively. Here are some strategies to consider:

Tax Exemptions and Deductions

Milwaukee County offers various exemptions and deductions that can reduce your taxable value and, consequently, your tax bill. Some common exemptions include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for this exemption, which reduces the taxable value by up to $37,500.

- Veterans' Exemption: Eligible veterans and their spouses may qualify for a property tax exemption.

- Senior Citizen Exemption: Property owners aged 65 or older may be eligible for a reduced tax assessment.

Payment Plans and Discounts

Milwaukee County offers several payment options and discounts to help property owners manage their tax obligations:

- Early Payment Discount: You can receive a discount on your tax bill if you pay in full by a certain date, typically before the due date.

- Installment Plans: If you prefer to pay in installments, you can set up a payment plan with the Treasurer's Office.

- Electronic Payments: Paying your taxes online or through electronic methods often comes with convenience and potential discounts.

Financial Planning

Effective financial planning can help you budget for your tax obligations. Consider the following tips:

- Set aside funds specifically for property taxes in your monthly budget.

- Review your tax bill annually and plan for any potential increases in tax rates or assessments.

- Explore tax strategies with a financial advisor to optimize your tax liability and overall financial health.

Conclusion

Understanding your Milwaukee County tax bill is crucial for responsible property ownership. By familiarizing yourself with the assessment process, tax rates, and available exemptions, you can manage your tax liability effectively. Remember, staying informed and proactive can make a significant difference in your financial planning and overall experience as a property owner in Milwaukee County.

When are Milwaukee County property taxes due?

+Property taxes in Milwaukee County are due in two installments. The first installment is typically due in January, and the second installment is due in July. However, the exact due dates may vary slightly from year to year, so it’s advisable to check the official Milwaukee County Treasurer’s Office website for the most accurate information.

Can I appeal my property assessment if I disagree with it?

+Yes, you have the right to appeal your property assessment if you believe it is inaccurate or unfair. The appeal process involves submitting a formal request to the Milwaukee County Board of Review, providing supporting evidence, and attending a hearing if your appeal is accepted. It’s important to act promptly, as there are specific deadlines for filing an appeal.

Are there any exemptions or deductions available to reduce my tax liability?

+Milwaukee County offers various exemptions and deductions to eligible property owners. These include the Homestead Exemption, Veterans’ Exemption, and Senior Citizen Exemption. Each exemption has specific criteria, so it’s important to review the eligibility requirements and apply for the ones that apply to your situation.

What payment options are available for paying my property taxes?

+Milwaukee County provides several payment options for property taxes. You can pay in full by the due date to take advantage of any early payment discounts. Alternatively, you can set up an installment plan with the Treasurer’s Office to spread out your payments over time. Online payments, direct debit, and in-person payments at designated locations are also accepted.

How can I stay informed about changes in tax rates or assessment processes?

+Staying informed is crucial to understanding your tax obligations. The Milwaukee County Treasurer’s Office and Assessor’s Office websites are excellent resources for up-to-date information on tax rates, assessment processes, and any changes or updates. Additionally, local news outlets and community newsletters often cover relevant tax-related topics.