How Much Tax Title License Texas

In the great state of Texas, understanding the intricacies of taxes, title fees, and licensing costs is essential for both residents and newcomers. These expenses are integral components of vehicle ownership and are governed by specific laws and regulations. Let's delve into the details, offering a comprehensive guide to help you navigate these financial obligations with ease.

Taxes on Vehicles in Texas

Texas levies taxes on vehicles based on their value and other factors. These taxes contribute significantly to the state’s revenue and are an essential part of vehicle ownership. Here’s a breakdown of the key aspects:

Vehicle Sales Tax

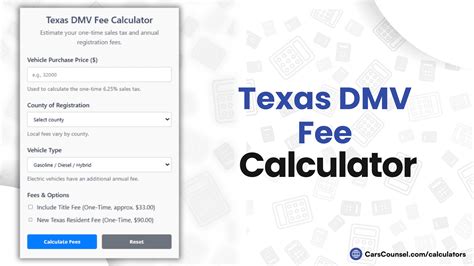

When purchasing a new or used vehicle in Texas, you are required to pay a sales tax. The standard sales tax rate is 6.25%, but this can vary depending on the local county and city where the purchase is made. Some areas have additional local sales tax rates, which can increase the total tax liability. For instance, in Houston, the combined sales tax rate is 8.25%, while in Austin, it is 8.25%.

It's important to note that the sales tax is calculated based on the purchase price of the vehicle. This means that the higher the vehicle's cost, the more tax you will pay. To illustrate, if you buy a car for $30,000 in an area with an 8.25% sales tax rate, the sales tax amount would be $2,475 (8.25% of $30,000). This tax is typically included in the overall price of the vehicle at the dealership, making it a straightforward process for buyers.

Annual Ad Valorem Tax

In addition to the sales tax, Texas residents must pay an annual ad valorem tax on their vehicles. This tax is based on the vehicle’s value and is usually billed by the county tax assessor-collector’s office. The vehicle’s value is determined by the National Automobile Dealers Association (NADA) guide, and the tax rate can vary depending on the county and school district where the vehicle is registered.

The ad valorem tax is generally calculated as a percentage of the vehicle's value. For example, if your vehicle is valued at $20,000 and the tax rate in your county is 1.5%, the annual ad valorem tax would be $300 (1.5% of $20,000). This tax is typically due once a year and is often paid when renewing your vehicle registration.

| Tax Type | Rate/Calculation |

|---|---|

| Sales Tax | 6.25% (Standard) to 8.25% (in some areas) of the purchase price |

| Ad Valorem Tax | Varies by county; percentage of vehicle value as determined by NADA guide |

Title Fees and Licensing Costs

When it comes to title fees and licensing costs in Texas, the charges can vary based on several factors, including the type of vehicle, its age, and the specific services required. Here’s an overview to help you understand these expenses:

Vehicle Title Fees

A vehicle title is a legal document that establishes ownership. In Texas, the title fee for a standard vehicle is $33. However, there are additional fees for specific scenarios:

- New Vehicle Purchase: If you are purchasing a new vehicle, the title fee is $33 plus a processing fee of $12, totaling $45.

- Used Vehicle Purchase: For used vehicles, the title fee is $33 plus a title transfer fee of $25, resulting in a total of $58.

- Vehicle Title Replacement: If you need to replace a lost or damaged title, there is a replacement fee of $21, in addition to a processing fee of $12, making it a total of $33.

Vehicle Registration Fees

Vehicle registration is a crucial step in establishing your vehicle’s legal status on Texas roads. The registration fee varies based on the vehicle’s weight and type:

- Passenger Vehicles: For vehicles with a gross weight of 6,000 pounds or less, the registration fee is $54.

- Commercial Vehicles: If your vehicle has a gross weight exceeding 6,000 pounds, the registration fee is calculated based on the vehicle's weight and type, ranging from $72 to $195.

Driver’s License Fees

Obtaining a driver’s license in Texas involves various fees, depending on the type of license and the services required:

- Standard Driver's License: The standard fee for a Class C driver's license is $25, valid for 6 years.

- Commercial Driver's License (CDL): For a commercial driver's license, the initial fee is $65, and renewal fees vary based on the license type, ranging from $30 to $65.

- Identification Card: An identification card has a fee of $11, valid for 6 years.

| Service | Fee |

|---|---|

| Vehicle Title (Standard) | $33 |

| Vehicle Registration (Passenger) | $54 |

| Driver's License (Class C) | $25 |

Understanding the Impact and Planning

Taxes, title fees, and licensing costs are an integral part of vehicle ownership in Texas. By understanding these expenses and planning accordingly, you can ensure a smooth process and maintain compliance with the state’s regulations. Remember, staying informed about these financial obligations is crucial for responsible vehicle ownership and can help you budget effectively.

Conclusion: A Comprehensive Guide

In conclusion, this guide has provided an in-depth look at the tax, title, and license expenses associated with vehicle ownership in Texas. From understanding the varying sales tax rates to navigating the intricacies of ad valorem taxes, title fees, and licensing costs, we’ve covered it all. By familiarizing yourself with these financial obligations, you can navigate the process with confidence and ensure you’re meeting your legal responsibilities as a vehicle owner in the Lone Star State.

How often do I need to renew my vehicle registration in Texas?

+Vehicle registration in Texas must be renewed annually. The renewal period typically starts 90 days before the expiration date of your current registration and ends 30 days after the expiration date. It’s important to renew on time to avoid late fees and maintain legal compliance.

Are there any tax exemptions for vehicles in Texas?

+Yes, Texas offers certain tax exemptions for specific types of vehicles. For example, disabled veterans may be eligible for a partial or full exemption from the ad valorem tax. Additionally, some electric and hybrid vehicles may qualify for a sales tax exemption. It’s advisable to check with the Texas Comptroller’s office or your local tax assessor-collector’s office for detailed information on exemptions.

Can I transfer my out-of-state vehicle registration to Texas?

+Absolutely! If you move to Texas with an out-of-state vehicle, you have 90 days to register it in Texas. This process involves applying for a Texas title and registration, paying the applicable fees, and providing the necessary documentation. It’s recommended to visit your local TxDMV office or their website for specific instructions and requirements.