How Much Is Sales Tax In Florida

In Florida, the sales tax system is a bit unique compared to other states, as it operates with a base state sales tax rate and allows local governments to implement additional taxes. This means that the sales tax rates can vary depending on the specific location within the state. As of my last update in January 2023, here's an overview of the sales tax structure in Florida.

Florida's Sales Tax Structure

The statewide sales tax rate in Florida is currently set at 6%. This base rate is applied uniformly across the state and forms the foundation of the sales tax system. However, it's important to note that this is not the only tax that consumers may encounter when making purchases in Florida.

Local Option Taxes

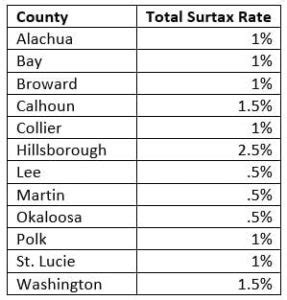

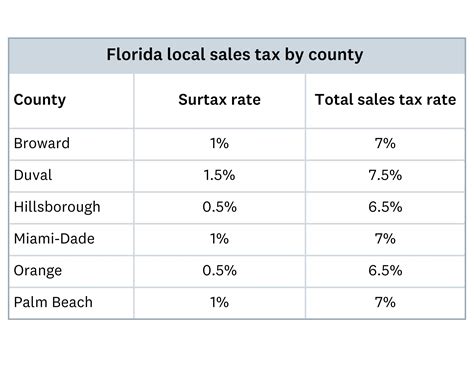

In addition to the statewide sales tax, Florida allows counties and municipalities to impose local option taxes, often referred to as discretionary sales surtaxes. These surtaxes are typically used to fund specific projects or initiatives within the local community. The rate of these surtaxes can vary significantly, ranging from 0% to 1.5% in most counties. However, there are a few counties that have implemented higher rates, with Monroe County leading at 2.5%.

For example, in Miami-Dade County, the local option tax rate is 1.5%, meaning that the total sales tax rate for this county is 7.5% (6% state tax + 1.5% local tax). On the other hand, counties like Gilchrist and Hamilton have no additional local taxes, resulting in the statewide sales tax rate of 6% being applied.

| County | Local Option Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Miami-Dade | 1.5% | 7.5% |

| Gilchrist | 0% | 6% |

| Monroe | 2.5% | 8.5% |

Specialty Taxes and Exemptions

Florida also imposes sales tax on specific categories of goods and services, including rentals, preparation of meals, and hotel and motel accommodations. The sales tax rate for these categories is generally 12%, which includes the state tax rate of 6% and an additional 6% tax that is often referred to as the tourist development tax.

However, it's important to note that there are numerous exemptions and special provisions within the Florida sales tax law. For instance, certain types of food, prescription drugs, and non-prepared grocery items are exempt from sales tax. Additionally, Florida offers various sales tax holidays, during which specific items like school supplies or hurricane preparedness items are exempt from sales tax for a limited time.

Impact on Businesses and Consumers

The varied sales tax rates across Florida can have implications for both businesses and consumers. For businesses, especially those with multiple locations or an online presence, it's crucial to ensure compliance with the correct sales tax rates for each jurisdiction. This often involves maintaining accurate records, utilizing sales tax software, and staying informed about any changes in tax rates or regulations.

For consumers, understanding the sales tax rates in their specific area can be beneficial when making purchasing decisions. It allows them to budget effectively and compare prices accurately, especially when considering online purchases or comparing prices across different counties.

Online Sales and Tax Collection

With the rise of e-commerce, the collection of sales tax on online purchases has become a significant consideration. Florida has implemented laws to ensure that online retailers collect and remit sales tax on purchases made by Florida residents. This includes both marketplace facilitators (companies that facilitate transactions between buyers and third-party sellers) and remote sellers (those with no physical presence in the state but still selling to Florida residents).

To assist businesses with compliance, Florida provides resources and guidelines on sales tax registration, collection, and reporting. The Florida Department of Revenue offers an online platform for businesses to register, file returns, and make payments, making it more convenient to manage sales tax obligations.

Future Implications and Considerations

The sales tax landscape in Florida is subject to ongoing discussions and potential changes. While the current system provides flexibility for local governments to generate revenue for specific projects, it can also lead to complexities for businesses and consumers. There have been proposals to simplify the system, such as the idea of a uniform sales tax rate across the state, which could make tax compliance and comparison shopping easier.

Additionally, the impact of online sales and the evolution of e-commerce continue to shape the sales tax environment. As more purchases shift to online platforms, the collection and enforcement of sales tax become increasingly important for ensuring a level playing field between online and brick-and-mortar retailers. Florida, like many other states, is navigating these challenges and adapting its tax policies to keep pace with the changing retail landscape.

Are there any exceptions or exemptions to the sales tax in Florida?

+

Yes, Florida offers a range of exemptions and special provisions. Certain types of food, prescription drugs, and non-prepared grocery items are exempt from sales tax. Additionally, there are specific sales tax holidays during which designated items are exempt from sales tax.

How do I register for sales tax collection in Florida as a business?

+

Businesses can register for sales tax collection through the Florida Department of Revenue’s website. The process involves completing an online registration form, providing business details, and obtaining a sales tax permit. The department offers resources and guidelines to assist businesses in understanding their sales tax obligations.

What happens if a business fails to collect and remit sales tax in Florida?

+

Businesses that fail to collect and remit sales tax in Florida may face penalties and interest charges. The Florida Department of Revenue has enforcement mechanisms in place to ensure compliance, including audits, assessments, and potential legal action. It’s crucial for businesses to understand their sales tax obligations and stay compliant to avoid these consequences.