Pa Homeowners Tax Rebate

The concept of tax rebates and incentives is an intriguing aspect of property ownership, especially when it comes to homeowners in Pennsylvania. This state, known for its rich history and diverse landscapes, offers a unique set of benefits to its residents. In this article, we delve into the specifics of the Pa Homeowners Tax Rebate, exploring its purpose, eligibility criteria, and the potential financial benefits it brings to homeowners across the Keystone State.

Unveiling the Pa Homeowners Tax Rebate

The Pa Homeowners Tax Rebate program is a significant initiative designed to provide financial relief to eligible Pennsylvania homeowners. It serves as a testament to the state's commitment to supporting its residents and fostering a sense of community. This rebate program has been a topic of interest for many, as it offers a potential reduction in the overall tax burden for homeowners.

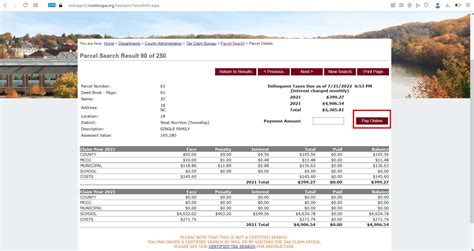

Diving deeper, the Pa Homeowners Tax Rebate is not a one-size-fits-all approach. It considers various factors, including the homeowner's income, the assessed value of their property, and even the local tax rates. This tailored approach ensures that the rebate is distributed fairly and benefits those who need it the most.

Eligibility Criteria: Who Qualifies for the Rebate?

Understanding the eligibility criteria is crucial for homeowners looking to take advantage of this program. The Pa Homeowners Tax Rebate is primarily aimed at homeowners with moderate to lower incomes. The income threshold varies based on the number of people in the household and the specific county where the property is located.

For instance, a single-person household in Philadelphia might have a different income limit compared to a family of four in a rural county. This variation ensures that the rebate reaches those who are most likely to benefit from it financially.

| County | Income Limit (Single-Person Household) |

|---|---|

| Philadelphia | $35,000 |

| Allegheny | $32,000 |

| Erie | $28,000 |

Additionally, the program takes into account the assessed value of the property. Properties with higher assessments may have a lower chance of qualifying for the full rebate, as the program aims to provide assistance to those with more modest homes.

Application Process: A Step-by-Step Guide

Applying for the Pa Homeowners Tax Rebate is a straightforward process. Homeowners can typically access the necessary forms online or obtain them from their local tax office. The application usually requires basic information about the homeowner, their income, and the property details.

- Gather the required documents: Income statements, property tax bills, and proof of residency are typically needed.

- Fill out the application form: Ensure all information is accurate and complete.

- Submit the application: This can be done online, by mail, or in person at designated locations.

- Wait for processing: The timeframe for approval varies, but homeowners can expect a response within a few weeks.

It's important to note that the application process may vary slightly between counties, so homeowners should check with their local authorities for any specific requirements.

The Impact: Financial Benefits for Homeowners

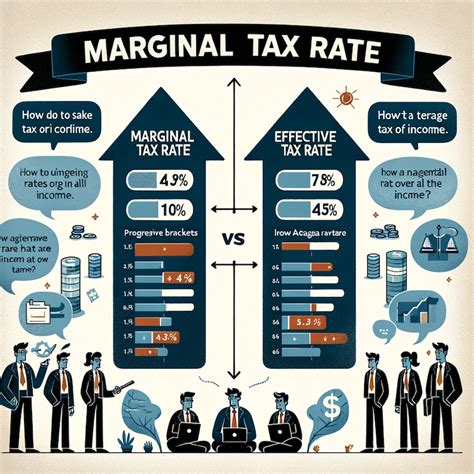

The Pa Homeowners Tax Rebate can provide a significant financial boost to eligible homeowners. Depending on their income and property value, homeowners can receive a rebate that directly reduces their property tax liability. This rebate is often a fixed amount, ensuring a predictable financial benefit.

| Income Bracket | Rebate Amount |

|---|---|

| Low-Income ($20,000 - $30,000) | $300 |

| Moderate-Income ($30,001 - $40,000) | $200 |

| Above Moderate-Income ($40,001 and above) | No Rebate |

For homeowners with tight budgets, this rebate can make a substantial difference. It can help cover essential expenses, provide financial stability, or even serve as a savings boost.

Beyond the Rebate: Other Tax Benefits for Homeowners

While the Pa Homeowners Tax Rebate is a notable program, it's not the only tax benefit available to Pennsylvania homeowners. The state offers a range of other incentives and deductions that can further reduce the tax burden.

- Homestead Exemption: This exemption reduces the assessed value of a homeowner's property, leading to lower property taxes.

- Senior Citizen Tax Relief: Older homeowners may qualify for additional tax relief based on their age and income.

- Property Tax Deduction: Homeowners can deduct a portion of their property taxes from their state income tax, providing further savings.

These additional benefits showcase Pennsylvania's dedication to supporting its homeowners and ensuring that property ownership remains an achievable goal.

The Future of Tax Relief in Pennsylvania

As the state continues to evolve, so too does its approach to tax relief. The Pa Homeowners Tax Rebate program is a dynamic initiative, with potential for growth and adaptation. With changing economic landscapes and evolving housing markets, the program may see adjustments to ensure it remains effective and accessible.

Looking ahead, there is a possibility of expanded eligibility criteria, increased rebate amounts, or the introduction of new incentives. The state's commitment to its residents and the housing market is evident in its willingness to explore and implement such changes.

Potential Impacts and Challenges

While the Pa Homeowners Tax Rebate program brings numerous benefits, it also presents certain challenges. The program's success relies on accurate income reporting and fair assessments, which can be complex to manage on a large scale. Additionally, ensuring that the rebate reaches those who need it most while maintaining financial stability for the state is a delicate balance.

However, with proper administration and ongoing evaluation, these challenges can be addressed, allowing the program to thrive and continue benefiting Pennsylvania's homeowners.

A Community-Centric Approach

At its core, the Pa Homeowners Tax Rebate program embodies a community-centric approach. It recognizes the importance of homeownership and aims to make it more accessible and affordable. By providing financial relief, the state fosters a sense of belonging and stability within its communities.

This initiative not only benefits individual homeowners but also contributes to the overall economic well-being of the state. It encourages long-term residency, promotes community development, and strengthens the social fabric of Pennsylvania.

FAQs

Can I apply for the Pa Homeowners Tax Rebate if I rent my property?

+

No, the Pa Homeowners Tax Rebate is exclusively for homeowners. Renters may explore other tax benefits, but this specific rebate is designed for property owners.

Are there any income restrictions for the rebate, even if I own a modest home?

+

Yes, income restrictions apply to ensure the rebate reaches those who need it most. The income limits vary based on county and household size.

Can I receive the rebate if I’m a first-time homeowner, or is it only for established homeowners?

+

The Pa Homeowners Tax Rebate is available to all eligible homeowners, regardless of whether they are first-time buyers or established homeowners.