St Clair County Property Tax

St. Clair County, located in the southeastern part of Michigan, has a unique property tax system that is an important aspect of its local government's revenue stream. Property taxes play a significant role in funding various services and infrastructure projects in the county. This article aims to provide an in-depth exploration of the St. Clair County property tax system, its workings, and its impact on residents and businesses.

Understanding St. Clair County Property Tax

The property tax system in St. Clair County is based on the assessment of real estate properties, including residential, commercial, and industrial properties. This assessment is conducted by the St. Clair County Equalization Department, which ensures that all properties are valued fairly and consistently. The assessed value of a property is then used as the basis for calculating property taxes.

The property tax rate in St. Clair County is set annually by the St. Clair County Board of Commissioners, taking into consideration the budgetary needs of the county and its various municipalities. This rate is applied to the assessed value of each property to determine the property tax liability.

Assessment Process

The assessment process in St. Clair County involves a comprehensive evaluation of each property. The Equalization Department conducts physical inspections, reviews sales data, and considers various factors such as location, size, age, and condition of the property. These assessments are crucial in ensuring that property owners are taxed fairly and in accordance with the value of their real estate.

Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate. The appeal process provides an opportunity for property owners to present evidence and arguments to support their case. An independent review board then considers these appeals and makes final determinations.

| Assessment Period | Appeal Deadline |

|---|---|

| Annual Assessments | 30 days after notice of assessment |

| Special Assessments (e.g., new construction) | 35 days after notice |

Property Tax Calculation

Once the assessed value of a property is determined and any appeals have been resolved, the property tax liability can be calculated. The formula used is:

Property Tax = Assessed Value x Tax Rate

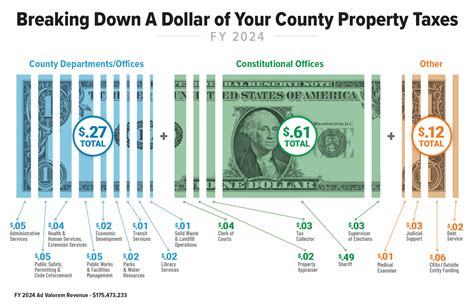

The tax rate is expressed as a percentage and is typically a combination of rates set by various taxing authorities, including the county, local municipalities, school districts, and special districts. These rates are approved through public budgeting processes and are designed to fund specific services and projects.

| Taxing Authority | 2023 Tax Rate |

|---|---|

| St. Clair County | 1.05% |

| Local Municipality (Example: Port Huron) | 1.20% |

| School District (Example: Marysville Public Schools) | 2.15% |

| Special District (Example: Library District) | 0.30% |

Payment Options and Due Dates

Property taxes in St. Clair County are typically due in two installments. The first installment is due in summer, usually around July, while the second installment is due in winter, around February. Property owners have the option to pay their taxes online, by mail, or in person at the St. Clair County Treasurer’s Office.

Late payments incur penalties and interest, which are added to the outstanding tax amount. It is important for property owners to stay informed about payment due dates to avoid any unnecessary financial burdens.

Impact on Residents and Businesses

The property tax system in St. Clair County has a significant impact on both residents and businesses. Property taxes are a major source of revenue for the county and its municipalities, funding essential services such as:

- Public safety (police, fire departments)

- Road maintenance and infrastructure projects

- Education (public schools, community colleges)

- Healthcare facilities and social services

- Parks and recreational amenities

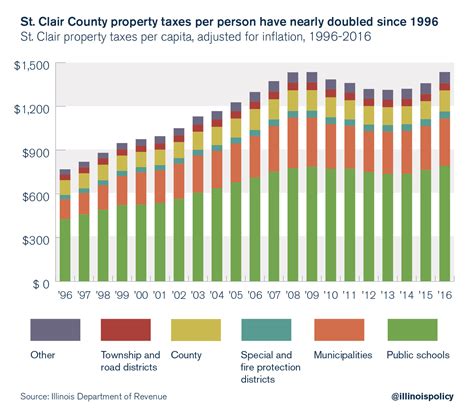

For residents, property taxes directly influence their cost of living and the quality of services they receive. Higher property taxes can lead to improved infrastructure and better public services, but they also represent a significant expense for homeowners. Property tax bills can vary significantly depending on the assessed value of the property and the tax rates set by different taxing authorities.

Businesses, on the other hand, are also subject to property taxes on their commercial properties. These taxes contribute to the overall economic development of the county and support the business-friendly environment. However, businesses may face challenges when it comes to managing their property tax liabilities, especially if they own multiple properties or have large-scale operations.

Strategies for Property Tax Management

Both residents and businesses can employ certain strategies to manage their property tax obligations effectively:

- Understanding Assessments: Property owners should stay informed about the assessment process and ensure their property is valued accurately. Regular inspections and maintenance can help maintain property values and avoid unnecessary increases in assessments.

- Appealing Assessments: If a property owner believes their assessment is incorrect, they should consider appealing. This process can lead to a reduction in property taxes if the appeal is successful.

- Payment Plans: For those who struggle to pay their property taxes in full, payment plans can be an option. The St. Clair County Treasurer's Office offers installment plans to help property owners manage their tax liabilities.

- Tax Exemptions: Certain properties may be eligible for tax exemptions or reductions. Examples include senior citizen exemptions, veteran exemptions, and exemptions for nonprofit organizations. Property owners should explore these options to reduce their tax burden.

Future Outlook and Developments

The St. Clair County property tax system is continuously evolving to meet the changing needs of the community. As the county experiences population growth and economic development, the demand for services and infrastructure projects increases. This, in turn, may lead to adjustments in property tax rates and assessment practices.

In recent years, there has been a growing emphasis on transparency and accountability in the property tax system. The St. Clair County government has taken steps to improve communication with property owners, providing clear information about assessments, tax rates, and payment options. This transparency aims to foster trust and understanding among residents and businesses.

Potential Reforms and Initiatives

Looking ahead, there are several potential reforms and initiatives that could shape the future of the St. Clair County property tax system:

- Assessed Value Reform: Discussions are ongoing about reforming the assessed value system to ensure it remains fair and accurate. Proposals include regular revaluations and updates to the assessment methodology.

- Tax Rate Stability: The county may explore strategies to provide greater stability in tax rates, especially for commercial properties, to promote business growth and investment.

- Online Services: Further development of online platforms and tools can enhance the efficiency of the property tax system, making it easier for property owners to access information, pay taxes, and manage their accounts.

- Community Engagement: Engaging with the community through public forums and educational initiatives can help improve understanding of the property tax system and foster collaboration between residents, businesses, and government.

How often are properties assessed in St. Clair County?

+Properties in St. Clair County are typically assessed annually. However, special assessments may be conducted for new construction or significant improvements to existing properties.

Can I dispute my property assessment if I disagree with the value assigned to my property?

+Yes, property owners have the right to appeal their assessments. The appeal process involves submitting evidence and arguments to an independent review board. If the appeal is successful, the assessed value may be adjusted.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes incurs penalties and interest. If taxes remain unpaid, the county may place a tax lien on the property, which could lead to foreclosure proceedings.

Are there any tax exemptions or reductions available for property owners in St. Clair County?

+Yes, St. Clair County offers various tax exemptions and reductions, including senior citizen exemptions, veteran exemptions, and exemptions for nonprofit organizations. Property owners should consult with the county’s tax office to determine their eligibility.