Hawaii Sales Tax Calculator

Welcome to the comprehensive guide on understanding and calculating sales tax in the beautiful state of Hawaii. Hawaii, known for its breathtaking natural beauty and vibrant culture, has a unique sales tax system that we will delve into. In this article, we will explore the ins and out of Hawaii's sales tax, providing you with all the information you need to navigate the tax landscape with ease. From the basics of sales tax to specific rates and exemptions, we've got you covered.

Understanding Hawaii's Sales Tax

Hawaii's sales tax is a consumption tax imposed on the sale of goods and certain services within the state. It is a crucial revenue source for the state government, contributing to essential public services and infrastructure development. Unlike many other states, Hawaii has a unified state-level sales tax, with no additional local or city-specific taxes, making the tax system relatively straightforward.

The sales tax rate in Hawaii is 4%, which is applied to most tangible personal property and certain services. This base rate is consistent across the state, ensuring uniformity in tax payments. However, it's important to note that there are certain goods and services that are exempt from sales tax, and we will discuss these exemptions in detail later in this article.

Hawaii's sales tax is administered by the Department of Taxation, which ensures compliance and provides resources for businesses and consumers to understand their tax obligations. The department's website offers a wealth of information, including tax guides, registration processes, and tax rate details, making it an invaluable resource for anyone dealing with sales tax in Hawaii.

Taxable Items and Services

In Hawaii, a wide range of goods and services are subject to the state's sales tax. Here are some of the key categories:

- Tangible Personal Property: This includes items like clothing, electronics, furniture, and appliances. Basically, any physical item that is purchased for personal use is taxable.

- Groceries: Most food items, including snacks, beverages, and non-alcoholic beverages, are taxable in Hawaii. However, there are exemptions for certain staple foods, which we will explore in the exemptions section.

- Restaurant Meals: Dining out in Hawaii is subject to sales tax. This includes meals at restaurants, cafes, and other food establishments.

- Services: Certain services, such as repairs, maintenance, and professional services, are also taxable. This includes everything from car repairs to haircuts and even some online services.

- Rental Property: Renting residential or commercial property in Hawaii is subject to sales tax, making it an important consideration for both landlords and tenants.

Sales Tax Exemptions in Hawaii

While Hawaii's sales tax applies to a broad range of goods and services, there are certain items and scenarios where sales tax is not imposed. Understanding these exemptions is crucial for both businesses and consumers to ensure accurate tax calculations.

Here are some key exemptions to be aware of:

- Prescription Medications: Sales tax does not apply to the sale of prescription drugs. This exemption extends to both the medication itself and the dispensing fee charged by pharmacies.

- Medical Devices: Certain medical devices, such as wheelchairs, crutches, and other assistive equipment, are exempt from sales tax. This exemption aims to ensure equal access to essential medical aids.

- Groceries: While most food items are taxable, there are exemptions for staple foods like bread, milk, eggs, and certain fresh produce. These exemptions recognize the importance of affordable access to essential groceries.

- Educational Materials: Books, newspapers, magazines, and other educational resources are exempt from sales tax. This encourages learning and supports the educational sector.

- Nonprofit Organizations: Sales to nonprofit organizations, such as charitable institutions and religious groups, are often exempt from sales tax. This exemption varies based on the specific nonprofit's activities and tax-exempt status.

Calculating Sales Tax in Hawaii

Calculating sales tax in Hawaii is a straightforward process once you understand the basic principles. Here's a step-by-step guide to help you determine the sales tax on any taxable purchase:

- Identify Taxable Items: Begin by identifying the items or services that are subject to sales tax. Refer to the taxable items section for guidance on what is and isn't taxable.

- Determine the Pre-Tax Price: Calculate the total price of the taxable items before tax. This is the amount you will use to calculate the sales tax.

- Apply the Sales Tax Rate: Multiply the pre-tax price by the sales tax rate of 4%. This will give you the amount of sales tax applicable to your purchase.

- Add the Sales Tax to the Pre-Tax Price: To get the total amount you need to pay, add the calculated sales tax to the pre-tax price. This final amount includes both the cost of the items and the sales tax.

Let's illustrate this with an example. Suppose you purchase a new laptop for $1,200 and it is subject to sales tax. Here's how you would calculate the sales tax:

| Pre-Tax Price | $1,200 |

|---|---|

| Sales Tax Rate | 4% |

| Sales Tax Amount | $48 |

| Total Amount (including tax) | $1,248 |

In this example, you would pay a sales tax of $48 on your laptop purchase, making the total amount due $1,248.

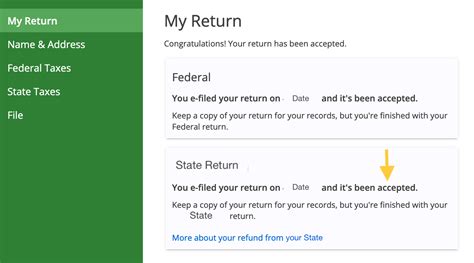

Sales Tax Registration and Compliance

If you are a business owner operating in Hawaii, understanding your sales tax registration and compliance obligations is crucial. Here's a brief overview of what you need to know:

Sales Tax Registration

All businesses selling taxable goods or services in Hawaii are required to register with the Department of Taxation. This process ensures that businesses can collect and remit sales tax accurately. The registration process involves completing the necessary forms and providing relevant business information.

Sales Tax Compliance

Once registered, businesses must comply with sales tax regulations. This includes:

- Collecting sales tax from customers at the point of sale.

- Remitting the collected sales tax to the Department of Taxation on a regular basis (usually quarterly or monthly, depending on your business's tax liability).

- Maintaining accurate records of sales transactions, including the calculation of sales tax.

- Issuing sales tax receipts to customers, clearly displaying the sales tax amount.

Failure to comply with sales tax regulations can result in penalties and interest charges. It's important to stay informed and up-to-date with your sales tax obligations to avoid any legal complications.

Future of Sales Tax in Hawaii

The sales tax landscape is constantly evolving, and Hawaii is no exception. While the current sales tax rate and structure provide a stable tax environment, there are ongoing discussions and proposals that could shape the future of sales tax in the state.

One notable trend is the potential expansion of sales tax to include more services. Currently, certain services are taxable, but there is a growing movement to broaden the tax base to include additional service sectors. This could impact businesses and consumers alike, as it may result in a wider range of services being subject to sales tax.

Additionally, with the increasing popularity of online shopping, there is a focus on ensuring fair taxation for e-commerce transactions. Hawaii, like many other states, is exploring ways to effectively tax online sales, which could impact both in-state and out-of-state businesses.

As technology advances and consumer behavior evolves, Hawaii's sales tax system will likely adapt to stay current and relevant. Staying informed about these potential changes is crucial for businesses and consumers to navigate the evolving tax landscape.

Frequently Asked Questions

Are there any sales tax holidays in Hawaii?

+Hawaii does not currently have sales tax holidays, which are periods where certain items are exempt from sales tax. However, there are ongoing discussions about implementing such holidays to encourage consumer spending and support specific industries.

How often do businesses need to remit sales tax in Hawaii?

+The frequency of sales tax remittance depends on a business’s tax liability. Generally, businesses with higher sales tax collections are required to remit tax more frequently. Most businesses remit sales tax on a quarterly basis, but monthly remittance may be required for those with higher tax obligations.

Are there any special considerations for tourists visiting Hawaii?

+Tourists visiting Hawaii are subject to the same sales tax rates as residents. However, there may be certain exemptions or tax benefits available for specific tourist-related purchases, such as accommodations or tour packages. It’s advisable for tourists to stay informed about these potential benefits.

How does Hawaii’s sales tax compare to other states?

+Hawaii’s sales tax rate of 4% is relatively low compared to many other states. However, it’s important to consider that Hawaii has no local or city-specific sales taxes, which can add up in other states. Additionally, the exemptions and tax structure vary greatly between states, so direct comparisons can be challenging.