Nebraska State Tax Refund Status

In the United States, state tax refunds are an important aspect of financial planning and can significantly impact a resident's overall tax liability. Nebraska, like many other states, offers tax refunds to eligible individuals and businesses, providing a much-needed financial boost. This article aims to provide a comprehensive guide to understanding the Nebraska State Tax Refund process, from application to receipt, offering valuable insights and real-world examples to help residents navigate this crucial financial process.

Understanding the Nebraska State Tax Refund Process

The Nebraska Department of Revenue is responsible for administering state taxes and managing the refund process. The state offers refunds to taxpayers who have overpaid their estimated taxes or have excess withholding from their paychecks. The refund process is straightforward and user-friendly, designed to ensure residents receive their refunds promptly and efficiently.

The first step in claiming a refund is to ensure you have filed your Nebraska Individual Income Tax Return correctly. This return, often referred to as Form 1040, is the primary document that determines your tax liability and potential refund. It's crucial to accurately report all sources of income, deductions, and credits to ensure you receive the maximum refund you're entitled to.

Once you've filed your return, the Department of Revenue will process it. This typically takes around 6-8 weeks, although it can vary depending on the complexity of your return and the volume of filings. During this time, the department will review your return for accuracy and ensure you've claimed all eligible deductions and credits.

Eligibility and Requirements

To be eligible for a Nebraska state tax refund, you must have overpaid your taxes for the year. This can occur if your tax liability is lower than the estimated taxes you've paid or if your employer has withheld more taxes than necessary from your paycheck.

Additionally, you must meet certain residency requirements. Nebraska defines residency for tax purposes based on various factors, including physical presence, intent, and economic ties to the state. It's important to understand these residency rules to ensure you're eligible for a refund.

| Eligibility Criteria | Requirements |

|---|---|

| Overpaid Taxes | Your total tax liability must be lower than the amount you've paid or had withheld. |

| Residency | You must be a resident of Nebraska for the tax year in question. Part-year residents may also be eligible under certain conditions. |

| Filing Status | You must file your taxes using the appropriate filing status (single, married filing jointly, etc.) |

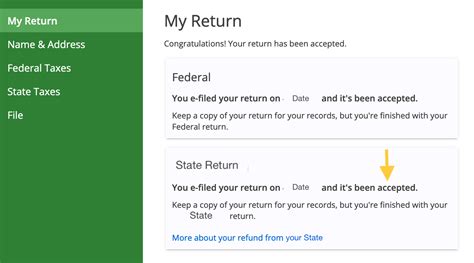

Checking Your Refund Status

After filing your return, you'll likely be eager to know the status of your refund. Nebraska offers a convenient online refund status tool on its Department of Revenue website. This tool allows you to check the progress of your refund using your Social Security Number (SSN) and the amount of your refund.

Here's a step-by-step guide to checking your Nebraska state tax refund status:

- Visit the Nebraska Department of Revenue website and navigate to the "Refund Status" page.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Enter the exact amount of your refund as shown on your tax return.

- Click the "Submit" button to view the status of your refund.

- The tool will display one of the following statuses:

- Pending: Your return is being processed, and your refund is not yet available.

- Approved: Your refund has been approved, and you can expect to receive it soon.

- Sent: Your refund has been sent and is on its way to you.

- Rejected: There may be an issue with your return, and you should contact the Department of Revenue for further information.

It's important to note that the online tool may not reflect the most up-to-date status of your refund, especially during peak filing seasons. If you don't receive an update within the expected timeframe, you can contact the Nebraska Department of Revenue directly for assistance.

Common Issues and How to Resolve Them

While the Nebraska state tax refund process is generally efficient, there may be instances where issues arise. Here are some common problems and how to resolve them:

- Missing or Incorrect Information: If you've provided incorrect or incomplete information on your tax return, it may delay your refund. Double-check your return for accuracy and ensure you've included all necessary documents and forms.

- Identity Verification: In some cases, the Department of Revenue may require additional identity verification to process your refund. This could involve sending in supporting documentation or completing a form. Be sure to respond promptly to any requests for additional information.

- Errors on Your Return: If errors are found on your return, the Department of Revenue will contact you to resolve the issue. Cooperate fully and provide any necessary corrections or supporting documentation.

- Refund Offset: Nebraska may offset your refund to cover outstanding debts, such as unpaid child support or state taxes. If this occurs, you'll receive a notice explaining the offset and your options for resolving the debt.

Receiving Your Refund

Nebraska offers several methods for receiving your state tax refund, allowing you to choose the option that best suits your needs.

Direct Deposit

Direct deposit is the fastest and most convenient way to receive your refund. When filing your return, you can provide your bank account information to have your refund deposited directly into your account. This method typically takes 7-10 business days from the date your return is approved.

Check by Mail

If you prefer a traditional check, Nebraska will mail your refund to the address on your tax return. This method can take slightly longer, with a processing time of 8-12 weeks from the date of approval. It's important to ensure your mailing address is up-to-date to avoid delays.

Nebraska Refund Card

Nebraska offers a prepaid debit card, known as the Nebraska Refund Card, as an alternative to direct deposit or check. This card allows you to access your refund without needing a bank account. It can be used to make purchases, withdraw cash, or transfer funds to a bank account. The Nebraska Refund Card is a convenient option for those who may not have access to traditional banking services.

Using Your Refund Wisely

Once you've received your Nebraska state tax refund, it's important to use it wisely. Consider the following tips to make the most of your refund:

- Pay Off Debt: Use your refund to pay down high-interest debt, such as credit cards or personal loans. This can help improve your financial health and reduce your overall interest payments.

- Build an Emergency Fund: Consider setting aside a portion of your refund to build an emergency fund. Having a financial cushion can provide peace of mind and help you weather unexpected expenses or financial setbacks.

- Invest in Your Future: Invest your refund in your future by contributing to a retirement account or education fund. This can help you grow your wealth over time and achieve long-term financial goals.

- Save for a Specific Goal: Whether it's a down payment on a home, a dream vacation, or a new car, use your refund to save for a specific goal. Having a clear financial target can motivate you to save and help you achieve your aspirations.

Future Implications and Tax Planning

Understanding your Nebraska state tax refund can also provide valuable insights for future tax planning. By analyzing your refund, you can identify areas where you may be overpaying taxes and adjust your withholding or estimated tax payments accordingly.

For example, if you consistently receive a large refund, you may be withholding too much from your paycheck. Consider adjusting your withholding allowances to have more of your income available throughout the year. On the other hand, if you owe taxes, you may need to increase your withholding or make estimated tax payments to avoid penalties.

Additionally, keeping track of your refund can help you identify potential tax savings opportunities. For instance, if you have significant medical expenses, charitable donations, or education costs, you may be eligible for tax credits or deductions that can reduce your tax liability and increase your refund.

Tax Planning Strategies

- Review Your Withholdings: Periodically review your W-4 form to ensure your withholding allowances are accurate. Consider using the IRS Withholding Calculator to estimate your tax liability and adjust your withholdings accordingly.

- Maximize Deductions and Credits: Research and take advantage of all eligible deductions and credits. This could include deductions for mortgage interest, state and local taxes, or credits for dependent care or education expenses.

- Consider Tax-Advantaged Accounts: Explore tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Individual Retirement Accounts (IRAs), to reduce your taxable income and potentially increase your refund.

- Stay Informed: Keep up-to-date with Nebraska tax laws and regulations. The state may introduce new deductions, credits, or incentives that could benefit you.

Conclusion

Navigating the Nebraska state tax refund process can be a complex but rewarding experience. By understanding the process, checking your refund status, and using your refund wisely, you can maximize your financial benefits and plan for a brighter future. Remember, tax planning is an ongoing process, and staying informed and proactive can help you make the most of your hard-earned money.

How long does it take to receive my Nebraska state tax refund?

+

The processing time for Nebraska state tax refunds can vary. On average, it takes around 6-8 weeks from the date you file your return. However, if you file your return early in the tax season, it may take longer. Direct deposit refunds typically arrive within 7-10 business days, while checks by mail can take up to 12 weeks.

What if I haven’t received my refund after the expected processing time?

+

If you haven’t received your refund after the expected processing time, there could be several reasons. First, ensure that you entered your banking information correctly if you opted for direct deposit. If you filed a paper return, there may be delays in processing. You can check the status of your refund online or contact the Nebraska Department of Revenue for assistance.

Can I track my refund status online?

+

Yes, Nebraska offers an online refund status tool on its Department of Revenue website. You can check your refund status by entering your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and the exact amount of your refund as shown on your tax return.

What if I move during the refund process?

+

If you move during the refund process, it’s important to update your address with the Nebraska Department of Revenue as soon as possible. This ensures that any correspondence or refund checks are sent to the correct address. You can update your address online or by mail.

Are there any penalties for filing late in Nebraska?

+

Yes, Nebraska imposes penalties for late filing. If you fail to file your tax return by the deadline, you may be subject to a late filing penalty of 5% of the tax due for each month or part of a month that your return is late, up to a maximum of 25%. Additionally, you may be charged interest on any unpaid taxes.